There are so many game developers struggling just to make a living, and moving from one game to the next, that it may seem crazy to worry about the rare case when a game company has a huge hit. Yet there are dangers inherent in a massive success, and some companies don’t seem to be aware of them.

What can success do that’s harmful The seductive power of a successful game can harm a company’s long-term prospects in a number of ways. The drive to produce new products can decline. Companies often spend wildly or go on massive hiring sprees. Executives can start believing their own press releases and miss danger signs or market signals. Sometimes audience tastes or technology changes rapidly, and a hit product can become a dud with amazing speed.

Of course, a highly successful game throws off massive profits, which is a good thing… isn’t it? Not always. If a game’s success is not sustainable in the long run, early profits may be squandered on expensive luxuries that are not investments in the company’s long-term health. Companies can burn brightly and then fizzle out when tastes change.

A company that’s likely to survive and grow for a long time will usually do so by having more than one reliable hit. Yes, some games can seem to an unstoppable hit — until the success stops, or sometimes just fades away. Take World of Warcraft, for example. That game has been at the top of the MMORPG market for many, many years. At its peak in 2010 the game had 12 million subscribers, but that number is now under 7 million. You can bet that this year’s Warlords of Draenor expansion will boost that number, but it seems very likely that the boost will wear off in a few months (as previous expansion boosts have) and subscriber numbers will go back to a slow and steady decline.

At this point it seems hard to imagine that Blizzard can find a way to revitalize World of Warcraft and once again start growing the subscriber base from year to year. Perhaps fully going to a free-to-play model might do that, but there’s no particular reason to think it might. Has the game somehow become a bad game Not at all. It’s just that the marketplace has changed, and gamers have many more options than before, including many excellent free-to-play MMORPGs. Fortunately Blizzard has other games that are doing well (Diablo III and Hearthstone), and some strong prospects in the works (like Heroes of the Storm).

Valve is a company that is not in any immediate danger, but they’ve had some serious hits in their time. They must have a lot of cash tucked away from the amazing success of Steam, which continues to reach new heights of subscribers (now in the neighborhood of 75 million). The continuing river of cash from Steam has, apparently, reduced the company’s drive to get new games out the door. Where’s the next Half-Life game There’s really no hurry. Besides, DOTA 2 is doing a terrific business.

There is a danger here for Valve. What if Steam starts, well, losing steam? There is competition out there, and it’s good to remember that the overall PC market has been in decline for the last two years (though it’s started growing again, but not in ways that benefit Valve). Valve could not replace its revenue from new games in any short time frame. And just because some products can taper off gradually, giving a company years to adapt, it doesn’t always happen that way. Just ask Blackberry how fast a product can go from #1 in the market to barely selling.

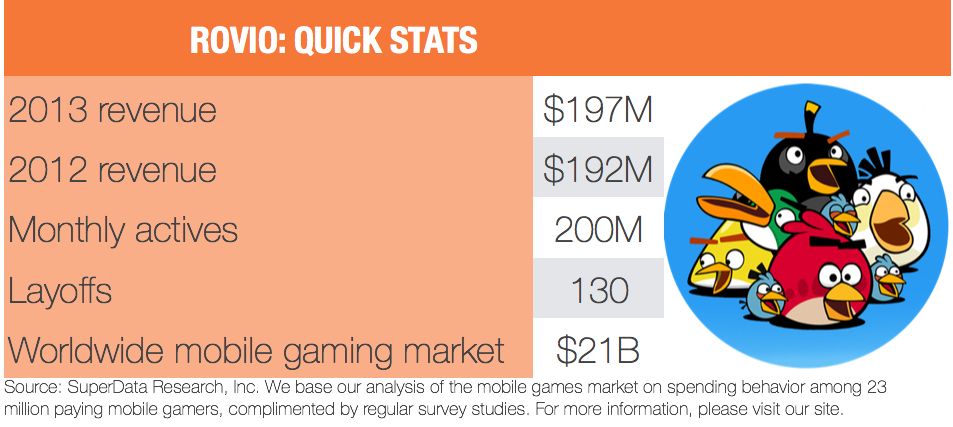

The news today that Rovio is laying off 130 workers clearly shows the danger of a hit product. Rovio created Angry Birds after more than fifty games that never had much success… and then they hit the jackpot. The company expanded rapidly, and made statements about becoming the next Disney or Pixar. A couple of years and many brand extensions later, the fact is that Rovio has yet to produce another hit, and now has to cut back because it staffed up in anticipation of continued growth.

There are companies who have figured out that they must make the transition away from depending on a single hit. Mojang, for instance, where the strategy for founder Markus Persson was to sell the company to Microsoft for $2.5 billion. Wooga has completely revised its product development process to try and come up with a regular supply of titles that perform well, and staffed accordingly. Zynga has essentially torn up its previous list of products in development and is generating a broad slate of titles designed for reliable revenue.

Other companies like Supercell have been slow to staff up in response to major hits, which is a prudent response to the reality that someday the market may turn against you… and there’s no guarantee that future titles will do anywhere near the same business as Clash of Clans.

An example of a successful one-hit wonder is Riot Games. Their League of Legends game is a massive hit, bringing in somewhere close to $1 billion in revenue this year, according to estimates. The team at Riot continues to work hard on the game, with regular releases of new content and the best eSports league in the world. But Riot has yet, in Riot president Marc Merrill’s phrase, “to make the ‘s’ in Riot Games mean something.” The company is entirely dependent on League of Legends for revenue. That’s all well and good while the game is growing rapidly, but at some point they will have reached all the readily addressable market of potential League of Legends players. They may keep that market enthralled for years… or perhaps some technological shift, or a competitor, might make the audience dwindle away.

If Riot waits until the audience begins to fade to start working on another game, that’s too late to keep revenues at the same level. The company may be forced to cut back sharply, or make big acquisitions, or some other dramatic move. A safer strategy to keep revenues up is to invest in some other games, similar or not, and start to see if the company can build up some other franchises. Of course, Riot is backed but the goliath that is Tencent, so there’s plenty of runway ahead – potentially.

At this point, though, it’s fair to wonder if Riot is ever interested in becoming a diversified publisher at all, or whether it will just focus on League of Legends and continue to size itself appropriately to the current state of that game’s fortunes. That’s a perfectly acceptable strategy so long as the investors are happy with it, and Riot’s only investor now is Tencent.

The massive success of Riot is similar to Wargaming, which has catapulted to enormous size on World of Tanks. However, Wargaming has always had plans for more games, and while World of Warplanes is still small in comparison to World of Tanks, it’s growing. The company will be releasing World of Warships soon, and World of Tanks Blitz on mobile seems to be doing quite well. The company doesn’t have a broad array of hits yet, but it’s clearly working on producing a portfolio of successful products.

A one-hit wonder can survive for a long time on its hit, if the company is properly sized. Tetris is still going strong after twenty-five years, but that game isn’t supporting hundreds of employees, either. Nor is Tetris trying to be the basis of a company rivaling Disney. It’s all about properly aligning the company with its goals and its products. Transforming a company from a one-hit wonder into a long-term, sustainable game publisher with a diverse portfolio of products is not an easy task.

The real caution sign here is for investors. Sure, a one-hit wonder may go public after posting astonishing sales figures… but before you buy that stock, think about whether the company has a sustainable strategy for product development that can keep regular moneymakers arriving. Or, at least, that the company isn’t overspending on things that won’t help it create that diverse portfolio.

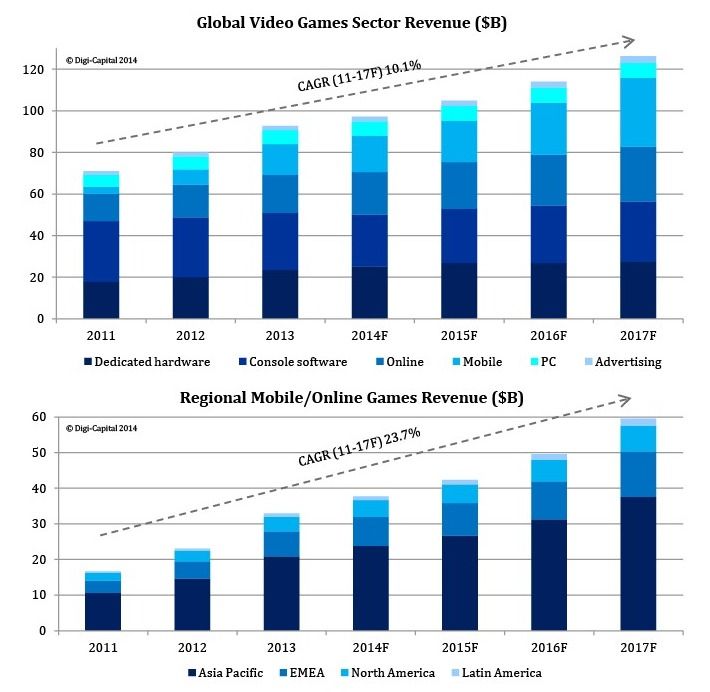

Yes, the games industry is a hit-driven business. But are the top revenue producers for Activision or Electronic Arts the same as when those companies began Not at all. Both companies have several strong, proven brands that generate reliable profits year after year. Both companies are always investing in developing new evergreen brands that can join the pantheon of profitable products. Both EA and Activision know very well that the market is always changing, and to stand still is to lose ground.

Don’t feel bad for the one-hit wonders – they have one more hit than most game developers. Just be wary about investing in them. And if you happen to be in a company that has a hit game, think about what that means for the company’s future before you start spending all that money that’s pouring in.

Cody Bye

Cody Bye

Micheal Bailey

Micheal Bailey