When you want to find out how the console game business is faring, there’s one place you should turn to first: GameStop. GameStop’s market share in the console business is around 35 to 40 percent, which means that what GameStop tells you about console sales is pretty much what’s happening in that market. Paying close attention to GameStop is vital for marketers who want to know what’s happening to the market. GameStop’s most recent earnings call showed a slowdown in sales, but anticipation is high for the quarters ahead.

GameStop’s quarter delivered on earnings per share (at $0.27 per share) but missed on its projected revenue. Total global sales dropped 7.4 percent to $1.63 billion. The big reason fro the drop was the downturn in console hardware and software sales. GameStop “saw declines in hardware of 33.4 percent and in software of 18.2 percent,” said GameStop CFO Rob Lloyd. That led to same-store sales dropping 10.6 percent for the quarter (12.5 percent in the US, 5.9 percent internationally).

“The physical video game business declined again during the quarter with less title count and pre-announced hardware upgrades driving consumer behavior,” said GameStop CEO Paul Raines. “We had anticipated softness in the physical market, but our ability to diversify our revenue and profit stream has allowed us to ride out this cycle successfully.” Essentially, the announcements that both Sony and Microsoft would be seeing new consoles coming out this year not surprisingly caused sales of existing consoles to drop in anticipation of the new hardware.

The more intractable problem for GameStop, which they’ve complained about for years, is the uneven release schedule of major game publishers. When there are strong new releases in a quarter, GameStop does well. When there aren’t new releases, GameStop doesn’t do so well. GameStop also does much better with sales for software that’s being launched. “When we launch games, we typically have 60 percent to 70 percent share during the first week of launch,” Lloyd noted. “Our overall share comes in around 40 percent or so on software. So obviously when a title moves out of that launch phase into what we call the catalog phase, we lose some share.”

GameStop has been changing in order to reduce its reliance on software releases. The company has taken on over 500 AT&T stores as it moves more heavily into what it calls “technology brands,” with notable good results in that area (revenues up 55 percent, contributing 24 percent of total earnings, and strong growth ahead). Beyond that, GameStop is moving heavily into collectibles and licensing, both with its acquisition of ThinkGeek and by cutting its own licensing deals (a Pokémon license for a Snorlax beanbag chair, for instance, which can’t be built fast enough to meet demand).

GameStop is also “creating own reality,” in Raines’ memorable phrase, by working with game studios to publish its own line of games. The first one, Song of the Deep from Insomniac, has been selling well at over 120,000 units so far. “What is interesting is that we have built a complete physical, digital and collectible ecosystem around this intriguing IP working with another great partner at Insomniac games to create a renewable franchise,” noted Raines. GameStop has more games in the pipeline. The thrust of the strategy is clear: “…launching our own IP to take advantage of the gaps in the calendar and the richer margins these games provide,” Raines said.

Good Times Ahead For VR

The prospects for virtual reality (VR) look strong to GameStop. Queried about the prospects for VR this holiday season, GameStop COO Tony Bartel was bullish. “We literally have hundreds of stores that have stations in them, VR stations in them today and in a quarter of our stores we already have had events that have been strong traffic drivers, partnering very closely with Sony, each of our associates are going to be certified in the PlayStation VR,” Bartel explained. “We see tremendous traffic when we run these events in our stores and another element of just how much demand there is, we had the quickest sell-out of preorders in our history the last time we were able to put a PS VR for preorder, we were out literally in five minutes. So there is tremendous demand and in the back half of the year, as people come in, as they talk with our associates they’re incredibly knowledgeable and certified in this, we think it will be a good traffic driver, far beyond the sales that it will generate.”

The latest NPD report underscores GameStop’s information about the drop in hardware and software sales. NPD reported hardware sales for July dropped 30 percent, while software dropped 5 percent. “The lack of strong new releases for the month have resulted with a poorer comp year-on-year, and the top 10 games for July 2016 generated 21 percent fewer dollar sales than they did last year,” said NPD analyst Sam Naji.

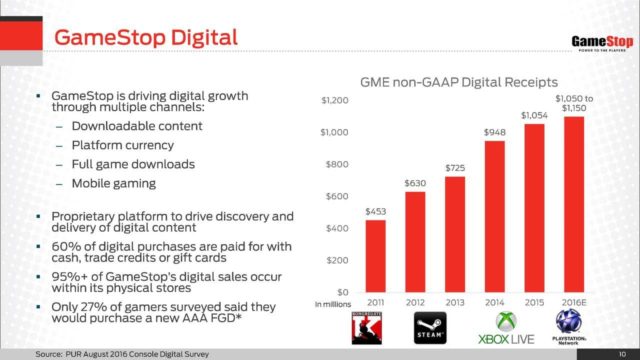

Meanwhile, on the digital side of the industry, sales were up 10 percent in July, according to SuperData, reaching $5.9 billion. Mobile games grew by 16 percent, propelled by the success of Pokémon GO, but digital console games and free-to-play PC games both grew by 11 percent. This divergence between physical game sales and digital game sales is not lost on GameStop, which is why the company is continuing to invest in Kongregate as well as its own game IP.

GameStop’s current revenue mix tells part of the story. New video game hardware was $216.4M (13.3 percent of total); new video game software was $382M (23.4 percent); pre-owned and value video game products $543M (33.3 percent); video game accessories $120M (7.3 percent); digital $36M (2.2 percent); mobile and consumer electronics $203M (13 percent); and collectibles $90M (5.5 percent). GameStop is shifting that mix rapidly with its strong growth in electronics, collectibles, and digital products.

The advent of new hardware is a positive thing for GameStop, primarily due to the company’s ability to give people trade-in credit for old hardware to help the purchase of new hardware. Bartel noted that Xbox One S sales showed that 37 percent of the buyers used trade-in credit to purchase the console, no doubt most of them turning in their old Xbox One to get the shiny new Xbox One S. So GameStop is looking forward to new PlayStation models, as well as PlayStation VR and better availability on Oculus Rift and HTC Vive. When it comes time to buy new hardware, many gamers will choose GameStop because they can use old products to get some money off on the new ones.

GameStop sees a bright future ahead. “If we sit here and think about the decline in physical gaming of almost 40 percent from its peak in 2008 and 2016, our strategy of diversification has paid off and allowing us to reach the high end of our guidance this quarter, on our way to a record net income year that we’re forecasting for this year,” Raines said in his closing remarks. “With all the great virtual reality and console expectations coming, we believe physical gaming will return to growth in 2017. In addition, our new growth businesses of digital, mobile and collectibles make GME a very compelling investment for the future as we grow 3 to 5 percent annually to 2019 as we projected at our Investor Day.”

In other words, it’s good times ahead for games—if you have the right product mix and are well prepared for the changing marketplace ahead.