Pokémon GO, the augmented reality mobile game that took the world by storm, continues to be an incredible success. At one point, the game had more daily active users than Twitter, and the phenomenon shows no signs of slowing down.

The Power Of Pokémon

Nielsen recently used its mobile game tracker to uncover some key insights regarding Pokémon GO’s launch and how it rocketed to the top spot on the Top 10 Mobile Games to Download Next list. During its launch week, most US players (52 percent) who were aware of the game wanted to download it next. Leading up to launch, about 28 percent of active US mobile gamers were aware of Pokémon GO, which is above average for both new and established titles. Of those aware of the game, over 60 percent indicated that they wanted to download the game, and the game resonates strongly with kids between 7-12 and millennials aged 18-24.

Nicole Pike, director of games at Nielsen, discussed the spectacular launch of Pokémon GO with [a]listdaily. When asked if she was surprised about the meteoric success of the game, she replied, “I wouldn’t necessarily say surprised—more impressed. One of the things that really popped up to us in the data is that it’s not typical for mobile games to go to the top of the charts and be ahead of other games in terms of awareness and interest so early. What we see in the mobile category is that it takes a while for awareness of a new game to ramp up, unlike the console industry, where there are months and sometimes years of anticipation for a game. For mobile, a game is announced, then suddenly released, and awareness slowly builds as people start downloading and reviewing it.”

“Pokémon GO was an exception to that,” she continued. “We saw that even before it released—especially in the weeks prior to release—there was really high awareness for the game, not only in terms of a new game, but any game new or established. With that being the case, it only makes sense that when it launched, it would have that advantage that quickly propelled it to the top. Then that cycle continues to self-perpetuate. More people downloading early means more people are recommending early, and the whole cycle becomes faster than average for a mobile game.”

So what contributed the most to the initial awareness of the game? “I think, unlike a lot of mobile games, there was some anticipation from announcements around it coming,” said Pike. “So people knew that it was coming out, and there was that waiting period that really helped. Certainly, there’s the Pokémon franchise. People are already aware of Pokémon, and it resonates very well with millennials. Millennials, being such strong consumers of content and mobile games (at least for now) align nicely with that target.”

Pokémon GO saw tremendous success in its first week, and we asked Pike if a game that rises that quickly can sustain its popularity. “So far, it looks likely,” she said. “Again, what we usually see with a mobile game’s trajectory is that it continues to go up for a while because we have a lot of people who are adopting early and telling other people about it. With buzz being a really big driver for the mobile game category, I think that for the foreseeable future, we’ll see it near the top.” She further notes that it will be interesting to watch the game grows with new content and the engagement balance between experienced and new players.

In addition to having a higher than average awareness and interest percentage at launch, the game quickly became the most liked game on Nielsen’s list of Most Liked titles. “What we saw for the week of July 11—which was the first full week of data we had post launch of Pokémon GO in our mobile game tracking product—was that it was at the top of the list across all mobile games that we track for most watched game,” said Pike. “Number two was Candy Crush Saga, and number three was Candy Crush Soda Saga. In terms of likability, it climbed to the top very quickly.”

However, that’s not to say everyone loved the game. Nielsen’s research also shows that the game had a higher than average number of detractors, with 22 percent of those who were aware stating that they would not download the game. Yet, even the negative buzz might have helped the game grow. “One of the things we’ve seen with our research in mobile gaming is that awareness is highly correlated with the potential of a game,” Pike explained. “In that sense—whether the buzz is positive or negative—the fact that more people are becoming aware of Pokémon GO can help it. Of course, people will still need to make the decision of whether it’s for them or not once they find out about it, but the name and concept are reaching a lot of people early in its lifecycle.”

A High Number Of Spenders

E-Commerce analytics firm, Slice Intelligence, did its own study on Pokémon GO‘s launch week and found that the game made up around 47 percent of the entire mobile gaming market on its launch weekend. The game was so popular, it even managed to attract new spenders, as 53 percent of those who made in-app purchases in Pokémon GO had made one mobile game purchase within the past six months. Comparatively, 16 percent of paying trainers purchased nine mobiles games in that time period.

When asked about player spending in Pokémon GO, Kenny McCubbins, manager of data analytics at Slice Intelligence explained to [a]listdaily that, “what’s compelling is the volume of spenders who are making purchases in Pokémon GO. We’ve previously reported about the state of in-game spending and found that Game of War in-game spenders spent an average of $550 in-app, but the big story with Pokémon GO is the sheer number of spenders who are making in-game buys. There has been a massive number of people who’ve been playing this game, which is resulting in a huge spike in purchasing.”

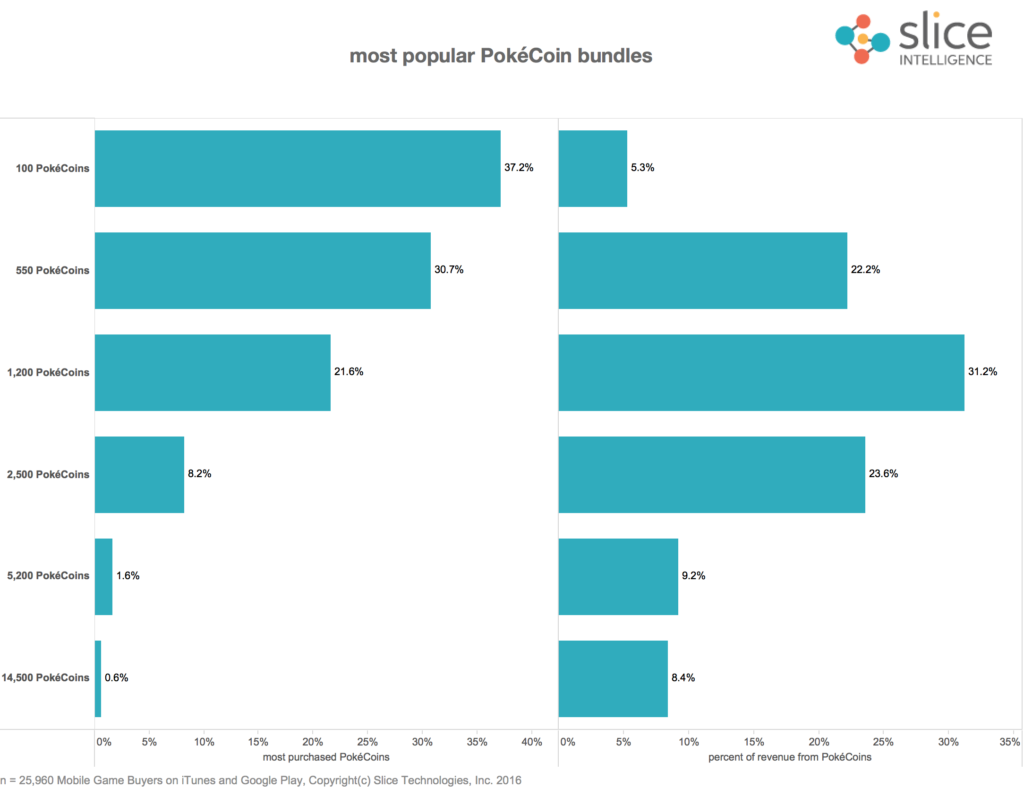

Slice Intelligence’s data, similar to Nielsen’s, shows that 52 percent of Pokémon GO spenders are between the ages of 18-34, and about three-quarters of players are men. The most popular item is the 100 PokéCoin in-game currency bundle, which accounted for 37 percent of in-app purchases. Additionally, the 1,200 PokéCoin bundle, which goes for $5, made up 30 percent of the game’s revenue.

“Currently, Pokémon GO shoppers are spending on average $10 for the first week of purchasing,” said McCubbins. “We’ll see how that matches up to the rest of the games as time goes on.”

Catching The Power

When asked what he thought what other mobile games might be able to take away from Pokémon GO‘s success with monetization, McCubbins said, “I think the biggest thing other mobile games can take away is that the mobile games market is not tapped out by any means. Nearly half of the Pokémon GO buyers hadn’t previously made a mobile game purchase prior to it. If we’ve seen anything from this phenomenon is that there is a very large untapped market for mobile games. Pokémon GO has captured the attention of hardcore gamers, kids and their parents, which is truly unique to this game.”

We also asked Pike what she thought was the most interesting aspect of Pokémon GO‘s success.

“A lot of people are referring to it as an AR (Augmented Reality) game, but I think the geolocation on it is just as, or more important,” she replied. “I think there’s always the stereotype that gamers are just sitting and not active, and Pokémon GO has really turned that on its head, where you have to get up and get out to play the game. There’s also how far it’s spread from a social perspective. We know that buzz and word-of-mouth are very important for a game’s success, but Pokémon GO has taken that to the next level with all the buzz, news and press it’s getting.

“The other thing that will be interesting to follow, moving forward, will be all the possible brand and co-promotion integrations that are possible. With gyms being located at certain businesses and the different PokéStops—it opens a lot of opportunities to partner and try to use brand integration in the game. As a researcher, I’m really excited to see what Niantic ends up doing with that.”