Mobile games now account for half of the entire global digital games market and revenue grew 18 percent over the year before. In case you’re wondering how much money that equates to, the mobile gaming market generated $40.6 billion in worldwide revenue—equal to all global box office sales during the same time period.

In fact, Americans spent five percent more year-over-year on mobile games in 2016 and that number will continue to rise, according to a new report called, “Can’t Stop, Won’t Stop: The 2016 Mobile Games Market.” To further illustrate just how popular “gaming on the go” has become, the report by SuperData Research and Unity Technologies states that Americans play mobile games more often than they watch Netflix, Hulu or YouTube.

Comparing Apples To Robots

Android is the most popular platform for mobile games in every country except the US. Android players were worth eight times more than iOS in China, but for US developers, iOS users generated 45 percent more revenue. While Android gamers represent 78 percent of the global market, iOS continues to yield higher spending overall.

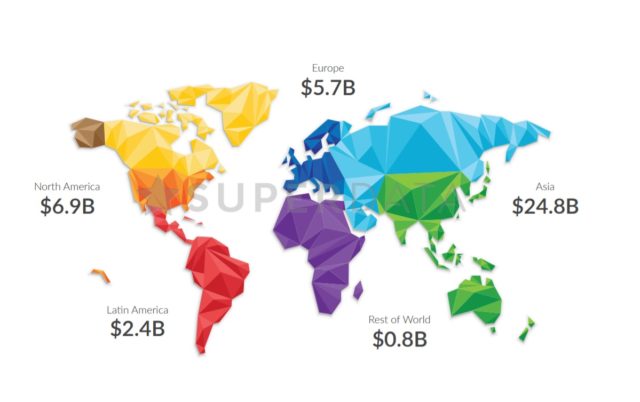

Meanwhile, Asia still represents by far the largest mobile games market in the world, producing $24.8 billion in revenue in 2016—while North America and Europe generated $6.9 billion and $5.7 billion respectively. Indonesia is showing increased potential for brands, experiencing a 192 percent increase in installs in 2016. Spenders also play 84 percent more than the average Indian player, SuperData noted, creating an “undeniable opportunity for developers.”

“Puzzling” Popularity

It’s probably not surprising to learn that 58 percent of gamers play puzzle games, compared to 40 percent who play action games and 26 percent who play simulation games. However, action games represent 30 percent of the share of game installs by genre, while puzzle games represent only 14 percent. While more players are downloading action titles, quick gameplay leads to lower retention—70 percent of the rate that puzzle games do.

A Strong Year For VR

Virtual reality (VR) revenue totaled $1.8 billion in 2016, with 6.3 million devices sold. The top-selling hardware was Samsung Gear VR with 4.5 million devices sold due to “a low barrier to entry as compared to high-price competitors like Oculus.” With nearly a million sales by the end of 2016, Sony’s PlayStation VR was the king of non-mobile headsets.

Restricted to the Pixel phone, Google Daydream headsets sold a little more than a quarter of a million units last year. That is about to change, SuperData predicts.

“2017 will be the year of Daydream,” Stephanie Llamas, VP of research and strategy at SuperData told [a]listdaily. “Samsung gained a healthy market share with its first-mover advantage, but as people upgrade their phones this year, many will be VR-compatible whether that’s what they are looking for or not. Google invested heavily in content from trusted studios and IP, and they’ve carefully planned this release so as to coincide with these new phones. Given recent Samsung phone malfunctions and the lack of universal compatibility for the Gear VR, Google is also benefiting from better PR and awareness.”

According to the report, users engaged with VR more often than they did with games, movies or TV last year. In addition, mobile VR users engaged in 48 sessions per month, while PC and console users engaged in 36 sessions per month. Average sessions were only around 10 minutes at a time across mobile and console/PC, something that SuperData predicts will change over the coming year.

“Short sessions largely have to do with physical and hardware constraints,” Llamas explained. “Aside from motion sickness, smartphones overheat after about a half hour. The most popular VR content also tends to require shorter time commitments, so developers are creating more content that is friendly to these constraints.”