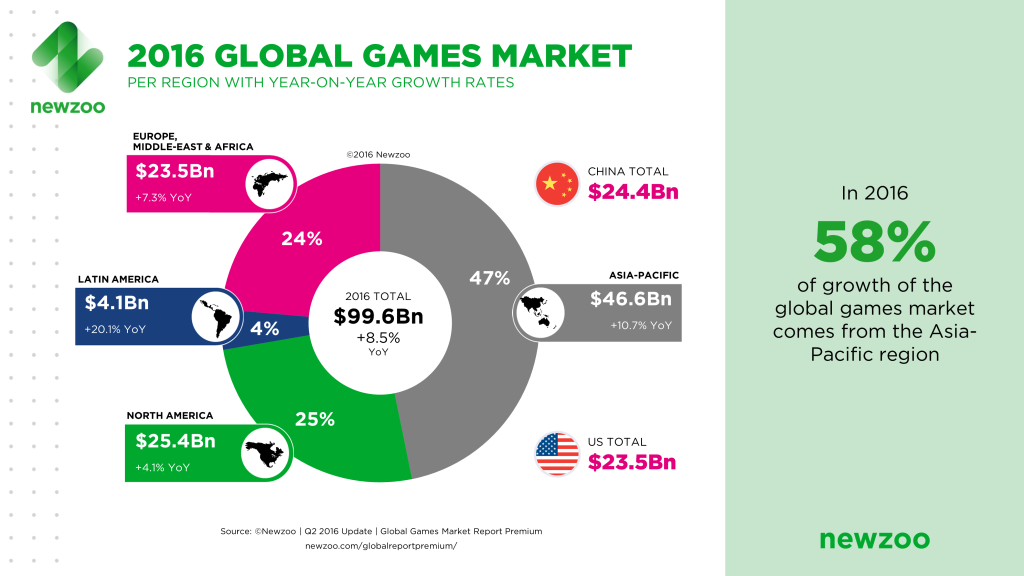

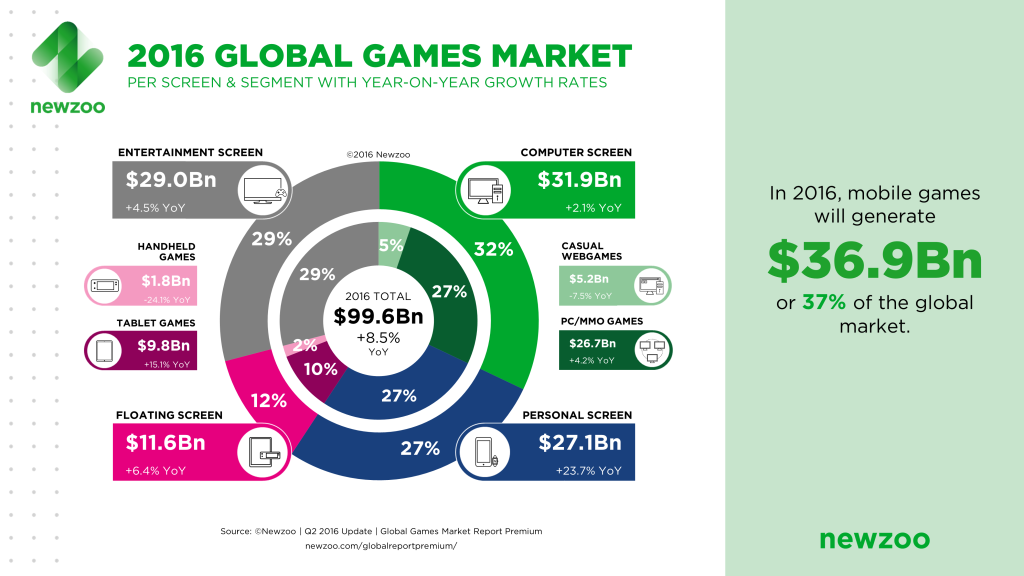

Newzoo recently released an update to its quarterly Global Games Market Report, and it shows that gamers worldwide will generate a total of $99.6 billion in revenues in 2016, an 8.5 percent increase from 2015. Furthermore, mobile games will surpass PC and console revenues for the first time in history with $36.9 billion, a 21.3 percent growth globally.

It should come as no surprise that Asia is expected to continue dominating worldwide revenues, making up 47 percent ($46.6 billion) of the worldwide gaming market. One quarter of those revenues ($24.4 billion) will come from China alone. Newzoo predicts that the global market will eventually grow to $118.6 billion toward 2019, with $52.5 billion from mobile gaming.

North America takes second place, and is expected to make up 25 percent ($25.4 billion) of global revenues. Of that, the U.S. will bring in $25.4 billion, which is 4.1 percent year-over-year (YoY) growth rate. Newzoo notes how console revenues are still relatively stable as they move toward digital formats and continuous monetization. Meanwhile, Western Europe will see a growth rate of 4.4 percent in 2016, mainly because the region has been slow to adopt mobile games lately. Eastern Europe will see an even higher growth rate of 7.3 percent.

Latin America will comprise only 4 percent ($4.1 billion) of global revenues in 2016, but that means that the region will make a major recovery from its recent economic problems with a massive 20.1 percent YoY growth rate. About $1.4 billion of those revenues will come from mobile games, which is $900 million more than last year. Other reports suggest higher revenues, but Newzoo expresses that, “despite a huge mobile gaming audience of more than 190 million consumers, spending has remained low.”

Revenues By Screen

Newzoo further breaks down the global games market according to screen types, and with this kind of segmentation, computer screens (PC and Mac) will bring in the highest revenues ($31.9 billion), thanks largely to MMO games, while casual web games decline. This number is followed very closely by television screens ($29 billion) and personal mobile devices like smartphones ($27.1 billion). Smartphones have the fastest YoY growth rate of 23.7 percent, which is expected to globally outpace all others by 2018. Meanwhile, tablets and handheld consoles will be the least important gaming screens as the latter continues to become less relevant. Handheld revenues are expected to drop another 24 percent this year.

The report further notes that VR is not considered its own screen, and expects revenues from it to “remain marginal for the near future and to largely substitute other game spending on console, PC and mobile.” With VR being at such an early stage, software revenues are absorbed into existing PC, console and mobile revenues. Newzoo further states that, “VR and AR will in the long term change how consumers communicate with each other and interact with content. In the short-to-medium-term, Newzoo expects the lion’s share of VR revenues to be generated by hardware sales, spectator content, and live viewing formats.”

ESports Key To Global Growth

Some of the biggest drivers of revenue growth will be the global convergence of games and video, primarily due to the spectacular growth of eSports. Newzoo states, “This trend is transforming games into all-round entertainment franchises, opening up new ways of engagement and complementary revenue streams. This is good news for the games industry, which was already on a healthy growth curve through success on mobile.”