For years, MMORPG (massive multiplayer online role-playing game)-style games have been dominant in the game industry, with Blizzard’s World of Warcraft leading the charge. However, the MOBA (multiplayer online battle arena) genre has been picking up steam, thanks to games like League of Legends and Smite. According to Gamesindustry International’s latest analysis, they could be on their way to leading the forefront of the industry.

EEDAR analyst Ed Zhao laid out an examination of the market, explaining how the free-to-play approach with certain games, like most MOBA’s, is an effective approach for publishers.

“Firstly, the upside is tremendous: F2P allows for an unparalleled audience size, which can be a bedrock for engagement and community,” explained Zhao. “In addition, users can spend infinite amounts of money. While traditional retail titles have relied on a gated $60 for access, F2p titles can generate hundreds from their core users through a plethora of visual and game-affecting microtransactions.”

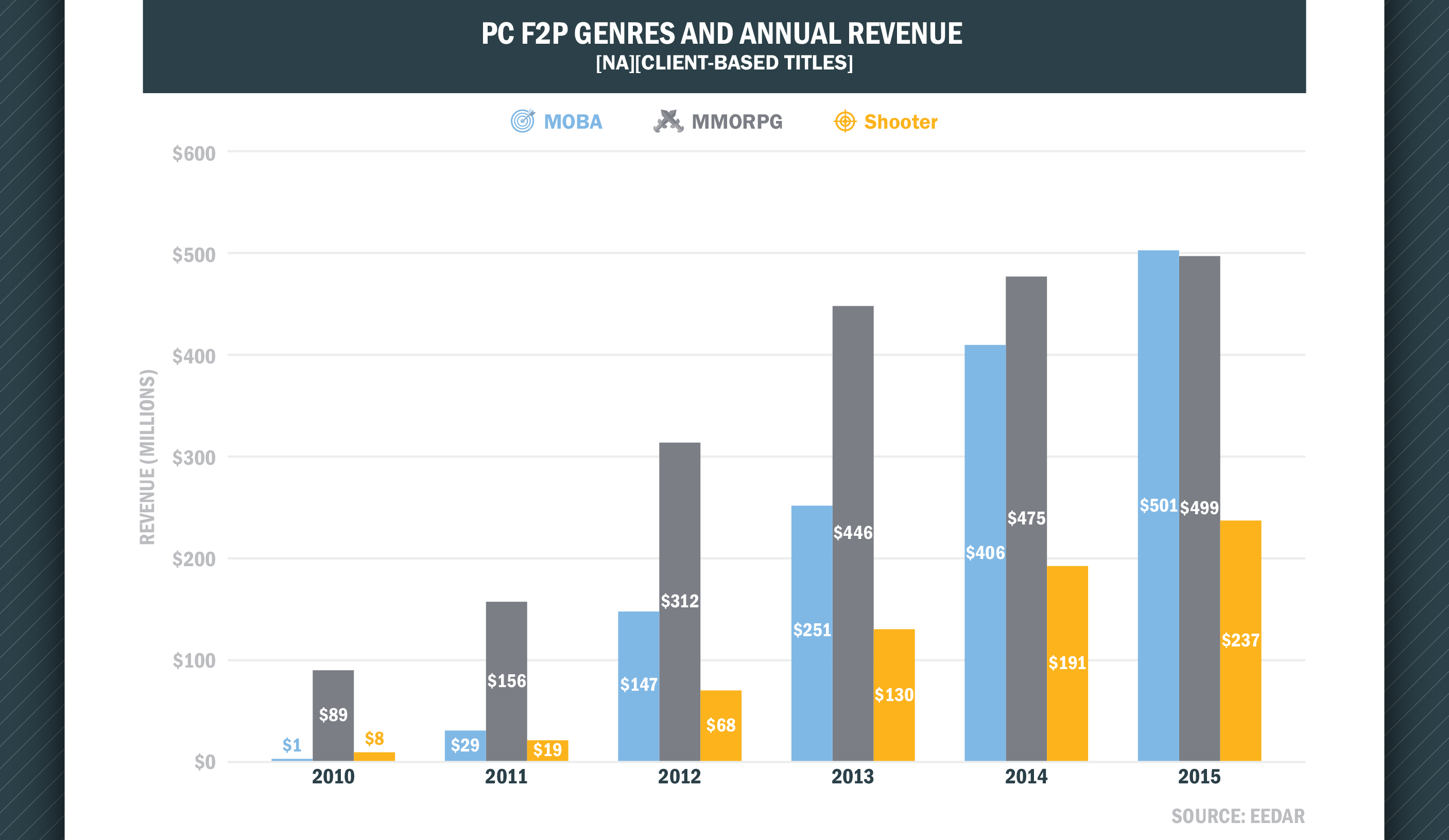

MOBA’s seem to take advantage of this formula quite nicely. “MOBAs can take advantage of a large, competitive audience while monetizing through champion-specific microtransactions,” Zhao continued. “While the biggest revenue driver in F2P has historically been the MMORPG, EEDAR predicts that, by year’s end, MOBA titles will reach $501 million annually in North America and account for the greatest percentage of F2P dollars.”

The chart above shows the increase in popularity with the genres. Back in 2010, it was clear that MMORPG led the charge, with barely any sign of effort from the MOBA field. However, just five years later, MOBAs have managed to catch up, even flying past the traditional shooter field by over double, at $501 million compared to $237 million. Meanwhile, MMORPGs stand at just under $500 million, putting MOBAs in the lead.

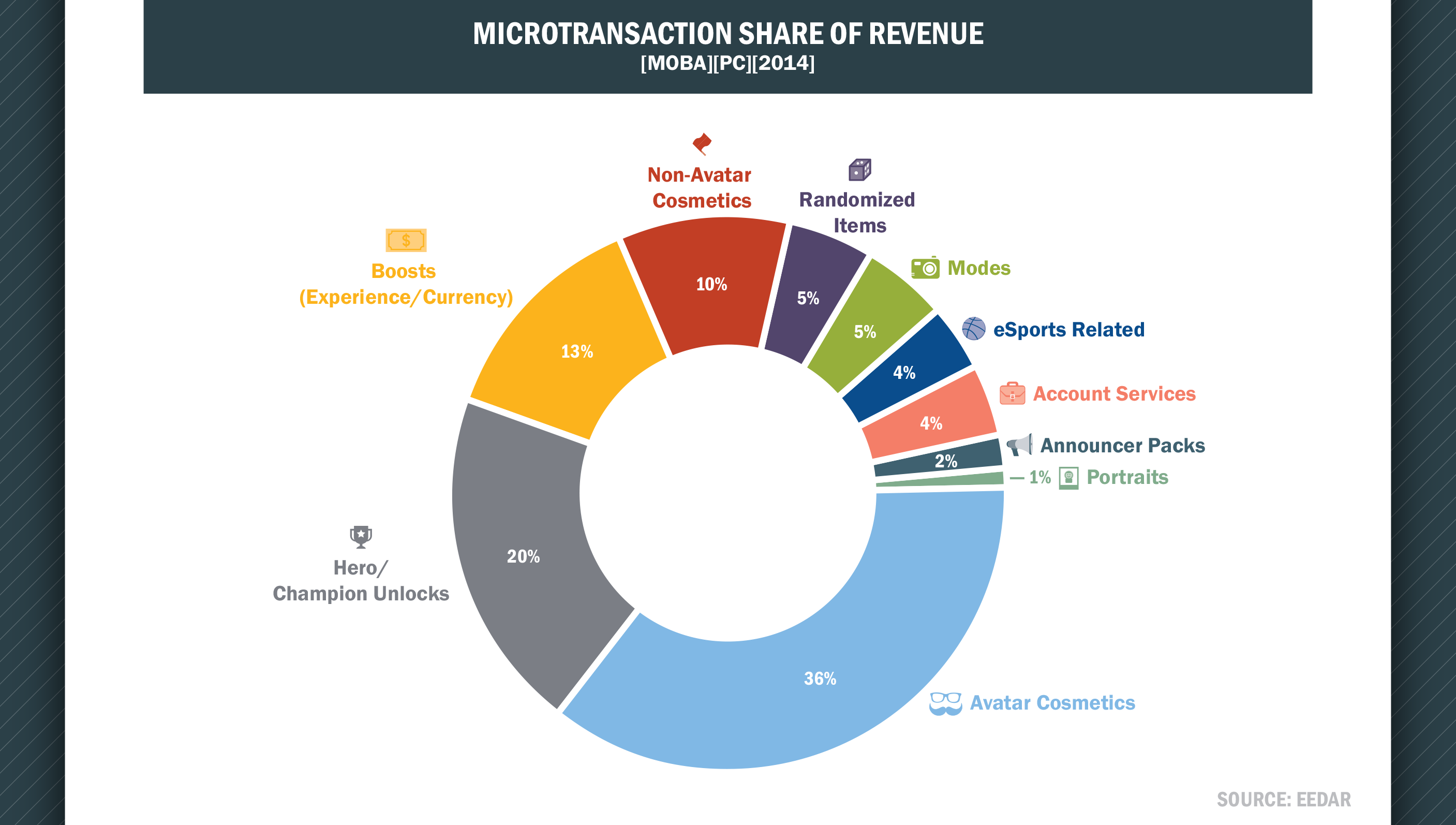

“Titles such as League of Legends and DOTA 2 generate their greatest amount of revenue in this way, with an estimated $180 million (or 36 percent of revenues) coming from avatar vanity items,” said Zhao. “One primary reason is the bird’s eye third-person view, which allows players to constantly view these cosmetics. This isn’t the case for other genres, such as F2P shooters, where a first-person view can obscure; thus, avatar cosmetics are only the third highest revenue driver for F2P shooters.”

Another chart breakdown, pictured above, indicates just where the money is spent with microtransactions, with avatar cosmetics taking the largest chunk. Closely behind are hero/champion unlocks and boosts, with other eSports related goods going more into single-digits.

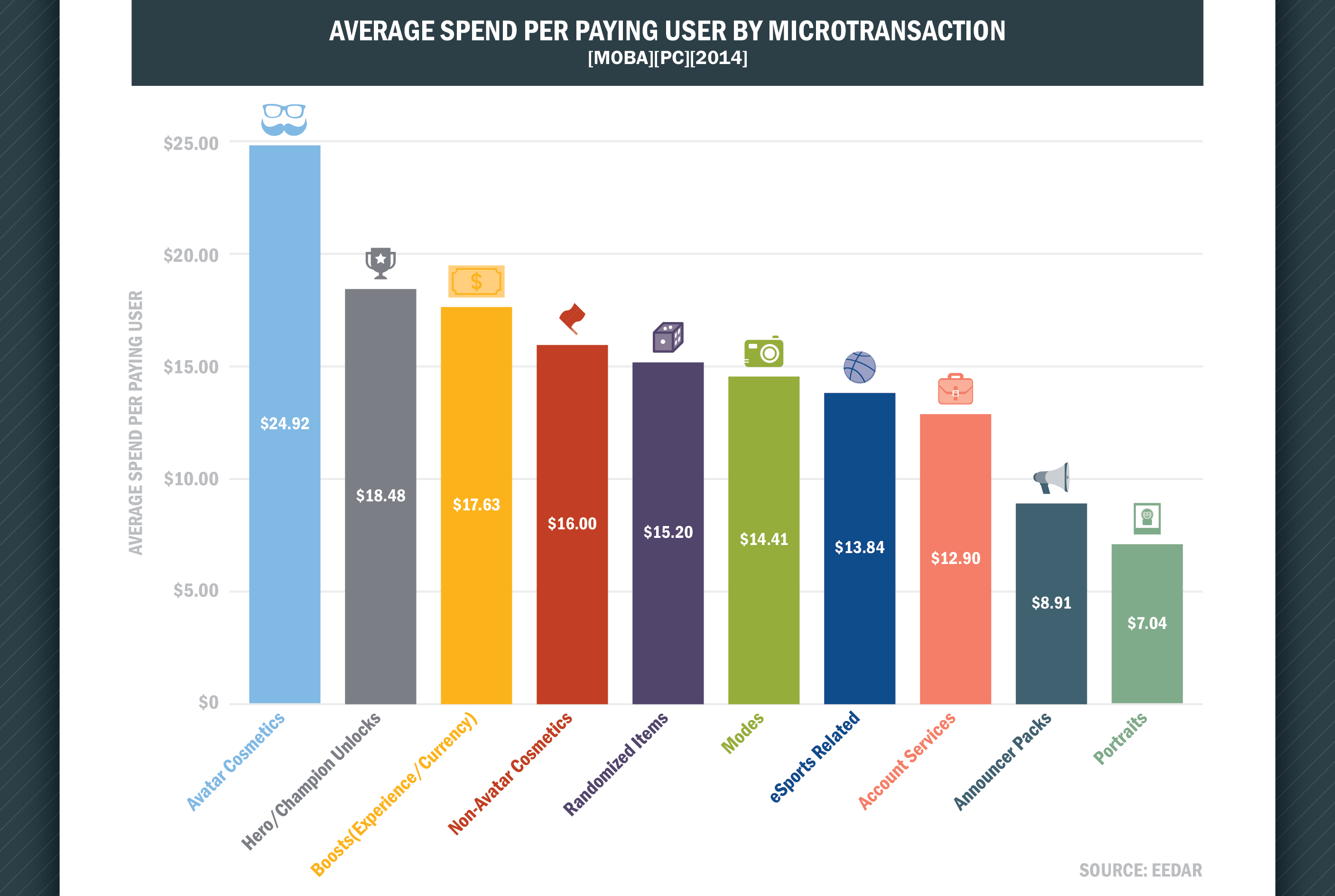

Avatar cosmetics also lead the way in terms of what an average user spends in a game, with nearly $25. Closely behind, as with the other chart, are hero/champion unlocks and boosts, followed by other items.

“Ultimately, certain games benefit more from different business models,” said Zhao. “F2P is perfectly suited for MOBAs due to large audience sizes, fierce competition, and individual character investment. Other genres, such as MMORPGs, monetize well with hybrid subscription models.

“Geography can also be an important factor, as Western Markets are happy to purchase premium titles such as Call of Duty or Battlefield whereas Eastern Markets prefer F2P variants. Choosing the correct business model is fundamentally important for a game’s success, but that choice has to foremost adhere to gameplay and audience.”

This could be the year that MOBAs step up and truly show who is the champion.