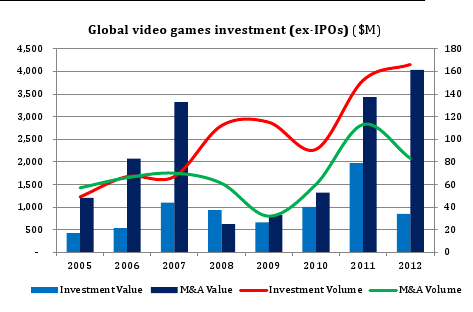

Digi-Capital believes that social game investment fell 94 percent in 2012 from its peak in 2011 to $853 million, a decline of over $1 billion. With the figure closer to the total in 2010, it seems that the social market has indeed collapsed on itself to a degree.

Middleware/Gamification was the most popular sector for investors, accounting for 35 percent of the $853 million and 29 percent of all investment transactions. Mobile was also popular, seeing 31 percent of the value and 39 percent of the volume.

Despite the declines in investments, M&A activity rose 18 percent to $4 billion, with 83 M&A transactions in 2012. MMOs saw 38 percent of that investment, with mobile seeing 27 percent of the value and 28 percent of the volume.

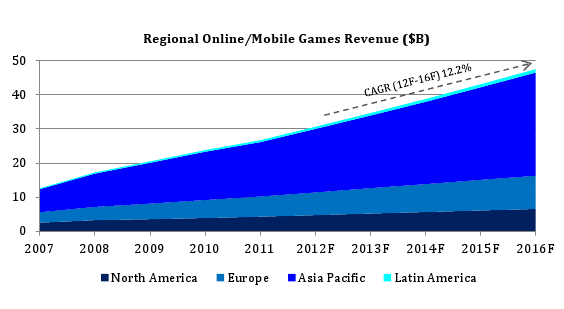

The investments show the emergence of Asian companies on the scene as seven of the 10 most valuable M&A deals were made by companies from China, South Korea or Japan. Asian markets will be increasingly important as part of mobile and online markets as China, South Korea and Japan are predicted to generate more than half of all revenue by the end of fiscal year 2015.

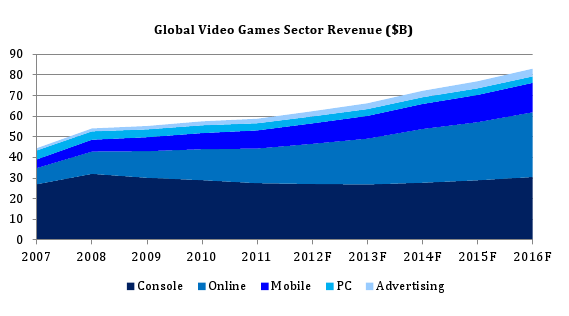

Digi-Capital expects mobile and online to push growth in the industry overall. By the end of fiscal year 2016, they believe online and mobile will account for more than 55 percent of the market’s total value of $83 billion, while the free-to-play business model will comprise 55 percent of all mobile/tablet app revenue and 93 percent of app downloads.

Source: Digi-Capital.com