The good news, Digi-Capital reports, is that 2014 saw a record $24 billion in exits for game companies, from IPOs to acquisitions, across the globe. The bad news, as Digi-Capital’s managing director Tim Merel cautions, is that growth in the games business overall is only forecast to show single-digit growth for the next few years, and that will make it tougher for companies in the middle.

Tim Merel

Tim Merel

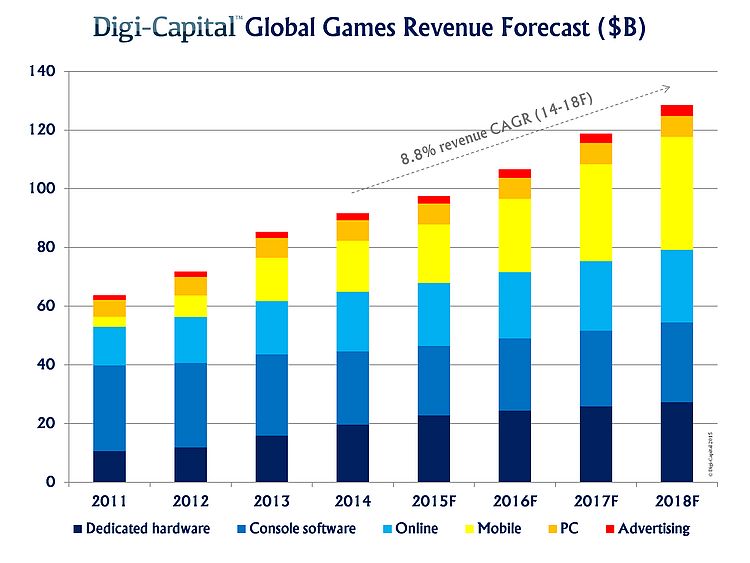

According to a new report from Digi-Capital, $15 billion of that record total for 2014 came through acquisitions, with $8.1 billion from five major deals. The remaining $9 billion was through IPOs, largely from Asian companies. “Asia accounted for over half the games IPOs in 2014, and has dominated games IPOs for the last 5 years,” said Merel. Asia is the number one market for games by revenue. Digi-Capital predicts it will reach US$45 billion in revenue by 2018, out of a total US$100 billion worldwide, with China, Japan, and South Korea leading that growth.

Mobile — which drove more than half of that $24 billion value — is the only sector of the industry showing “strong double-digit growth,” and Virtual Reality is the only other sector that has potential to breakout. As such, Digi-Capital forecasts a compound annual growth rate (CAGR) for games software and hardware of 8.8 per cent between 2014 and 2018.

“That sounds healthy,” Merel noted. “But it’s single digit growth and that changes things. A lot. In markets with single digit growth, a rising tide no longer lifts all boats. Competition becomes about the difference between the great and the good.

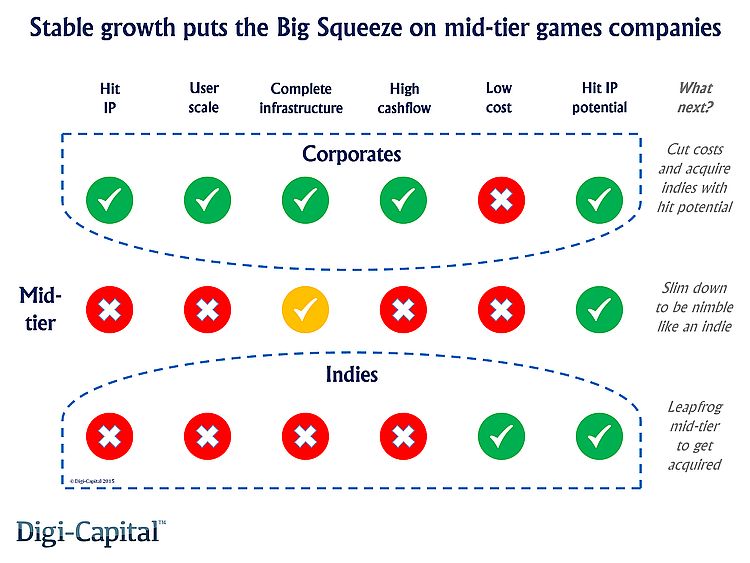

“In this phase of the market, corporates with hit IPs, user scale and cashflow can invest in the high costs of marketing and infrastructure to compete in a stable growth market, although this reduces everybody’s margins. Indies don’t have hit IPs yet or the scale advantages, but they don’t have the costs either. Both can produce hit games, even if they are few and far between. Mid-tier games companies have no hit IPs yet, no scale advantages, but infrastructure and marketing costs. They can produce hit IPs too, but their cost bases increase their risk.”

In other words, mid-sized companies need to grow to a larger size in some fashion in order to avoid stagnation or a downturn. The trick is that companies need to find some advantage that they have and organize around that to best effect. So it may be a large existing audience, or access to a hit IP, or a particularly creative design team, or a great understanding of a particular market segment.

The one thing that any company can’t afford to do in this growing, evolving game industry is to be complacent. Repeating the successes of yesteryear in the same fashion today, and next year, and the year after, is not a recipe for growth. That’s true in every aspect of the business, from design to distribution to marketing.