Newzoo continues to provide detailed reports on the game market, and its latest data report, “Spotting the Mobile Spenders,” is replete with interesting data on the most important part of the mobile game market — the people who spend money. After all, it does little good if your game attracts millions of players but only a handful actually pay you something, unless you’re making money from advertising or through sales of some other product.

Newzoo starts by outlining the size and shape of the mobile game market, noting that by the end of 2014 1.5 billion people worldwide will have played a game on a smartphone or a tablet. That’s 51 percent of the global online population, an impressive achievement for an entertainment medium once confined to a small number of enthusiasts. Perhaps even more impressive is the fact that almost one third of these gamers (32 percent) have spent money on (or in, via in-app transactions) mobile games, which is 485 million consumers worldwide. The numbers for North America are just as impressive: Some 151 million people have played a mobile game this year, 49 percent of the online population, and 64 million of the (42 percent) have spent money.

That population of spenders averages $4.30 per month (on average, worldwide), which provides a total of some $25 billion in revenue generated by mobile games worldwide in 2014. In North America, the average spending per paying player is higher at a monthly average of $7.68, providing $5.9 billion in revenue this year. One need look no further than these numbers to understand why investment in mobile games continues to be strong. Newzoo interprets these numbers as a positive sign for the future. “It illustrates that global growth is still, for a large part, fuelled by mature markets contrary to some recent reports about a saturated mobile games market,” said Newzoo’s Emma McDonald.

Newzoo’s report is careful to point out that mobile game spending patterns are not that dissimilar from console and PC game spending. “The share of spenders on smartphone and tablet games are steadily growing closer to that of console and PC games,” noted McDonald. “This comes as a surprise to some due to the common misunderstanding that a pay-upfront business model gives a 100 percent player/spender ratio. In the case of console gamers in the US, UK, Germany and France for instance, 67 percent of all Console gamers and 59 percent of all MMO/MOBA gamers spend money on games. For mobile games, this share has increased from 36 percent to 46 percent when comparing 2012 and 2014. Monthly single digit conversion rates of individual games are often misinterpreted as share of mobile gamers that spends money.”

This is a key revelation, showing that the revenue potential from mobile games has yet to be fully realized. That’s not surprising, really considering the relative youth of the mobile game market (really, only the last 7 years as a significant segment) and the newness of the business models being used. While can take a year or more to build a top mobile game these days, it can take years to refine and test new business models — and new business models with variations are still being created. When 95 percent of your audience isn’t making you any money, that should be seen as an opportunity of enormous proportions.

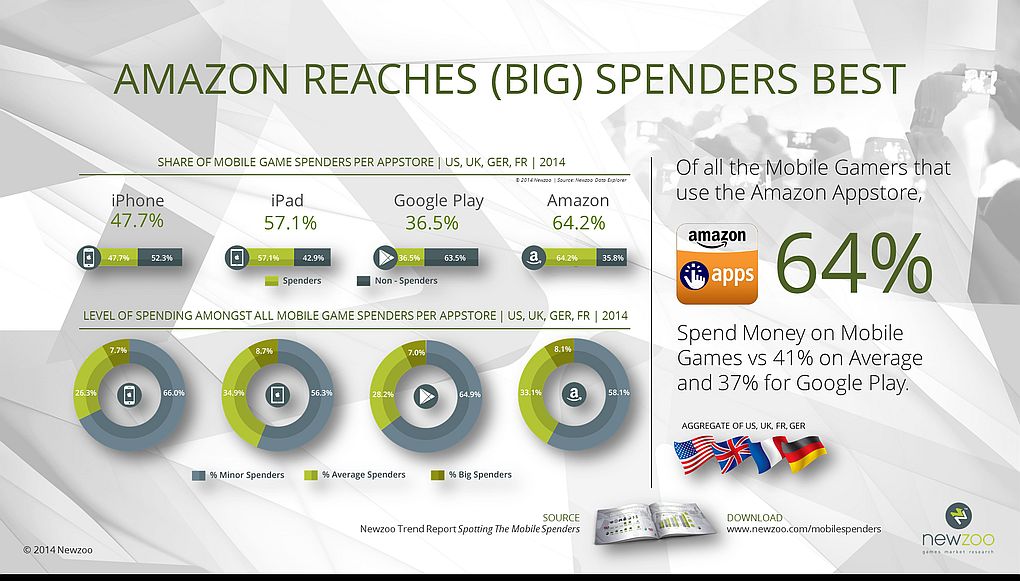

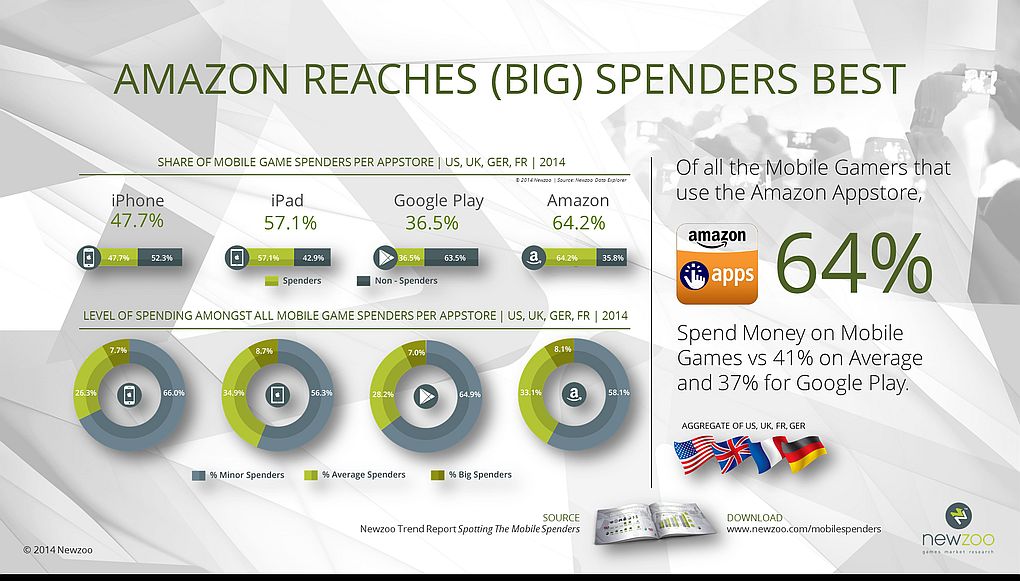

Newzoo’s report showcases an often overlooked competitor in the mobile game market: Amazon. Amazon has its own app store that’s separate from Google’s, and thus it’s sometimes overlooked when people are reviewing the market. Amazon also makes a habit of not announcing its hardware sales, so we have no precise numbers directly from the company as to the number of Kindle Fire tablets that have been sold, or Amazon Fire TV consoles (and now the Fire Stick). “While the world focuses on the battle between iOS and Google Play, the report shows that it is Amazon that reaches the most valuable gamer,” McDonald said. “A closer look at spending behaviour per app store in the US, UK, Germany & France, not only reveals large absolute gamer numbers but, more importantly, shows that gamers using the Amazon Appstore are the most likely to spend money.”

That’s a highly desirable audience to attract, and it’s particularly interesting that Amazon device owners are more likely to spend money, given that Amazon devices are sold at a very low cost compared to leading tablets like the Samsung Galaxy. This is perhaps due to the efficiency at which Amazon uses its control of the platform to market games, which is of course one of the key reasons Amazon has entered the hardware market. The company isn’t making a big profit from tablets, but it’s intent on getting those tablets into as many hands as possible because they are a wonderful shopping platform for everything else Amazon sells.

McDonald notes the “These gamers also have a high share of big spenders, characteristic for tablets such as Amazon’s most popular devices: the Fire Tablets. Combined with its more family-oriented demographics, the opportunity presented by Amazon might be largely underestimated. This suggests that developers should shift marketing resources towards the Amazon Appstore.” If you are already creating an Android version of your game, it seems like an obvious move to add the Amazon app store to your development targets.

Newzoo also profiled the average game spender, which is critical to maximizing the revenue potentital of your mobile game. “The majority of (big) spenders on mobile in the US and Western Europe are male and have kids,” said McDonald. “For men, the share of spenders rises with age, while for women it drops. On average one in five mobile spenders is a man older than 35 and spenders are most likely to have a full-time job and a large income.” That part shouldn’t be surprising, since people with more money are more likely to spend it.

The report showed the influence of children on mobile game spending. “More than a third of mobile spenders play together with their children regularly and spend a large share of their game budget on their kids,” McDonald said. “Mobile spenders do a lot more shopping, are more active on Twitter and Google+ and have a distinct preference for certain mobile service providers. In-depth profiling of spenders illustrates that this is a valuable target audience also outside of their game spending behaviour.” That’s excellent news for game developers seeking to bring advertisers into their revenue mix.

The Newzoo report provides some interesting details to help flesh out a picture of the mobile gaming market. This next year looks to be another solid year of growth, change and opportunity in the mobile game market, and it’s important to keep up with the latest information about the market to make the most of what lies ahead.