Analysis by Newzoo, the international market research and predictive analytics firm, shows that Apple was by far the largest technology brand in China in 2014 with revenues eclipsing those of traditional powerhouses such as Samsung, Sony, Microsoft as well as all Chinese technology firms. According to Newzoo, Apple’s “Asian Pivot” in 2014 may end up in the history books as one of the greatest corporate strategic achievements of all time: The first Western firm to become the leading brand by revenues simultaneously in the two biggest markets in the world, U.S.A. and China.

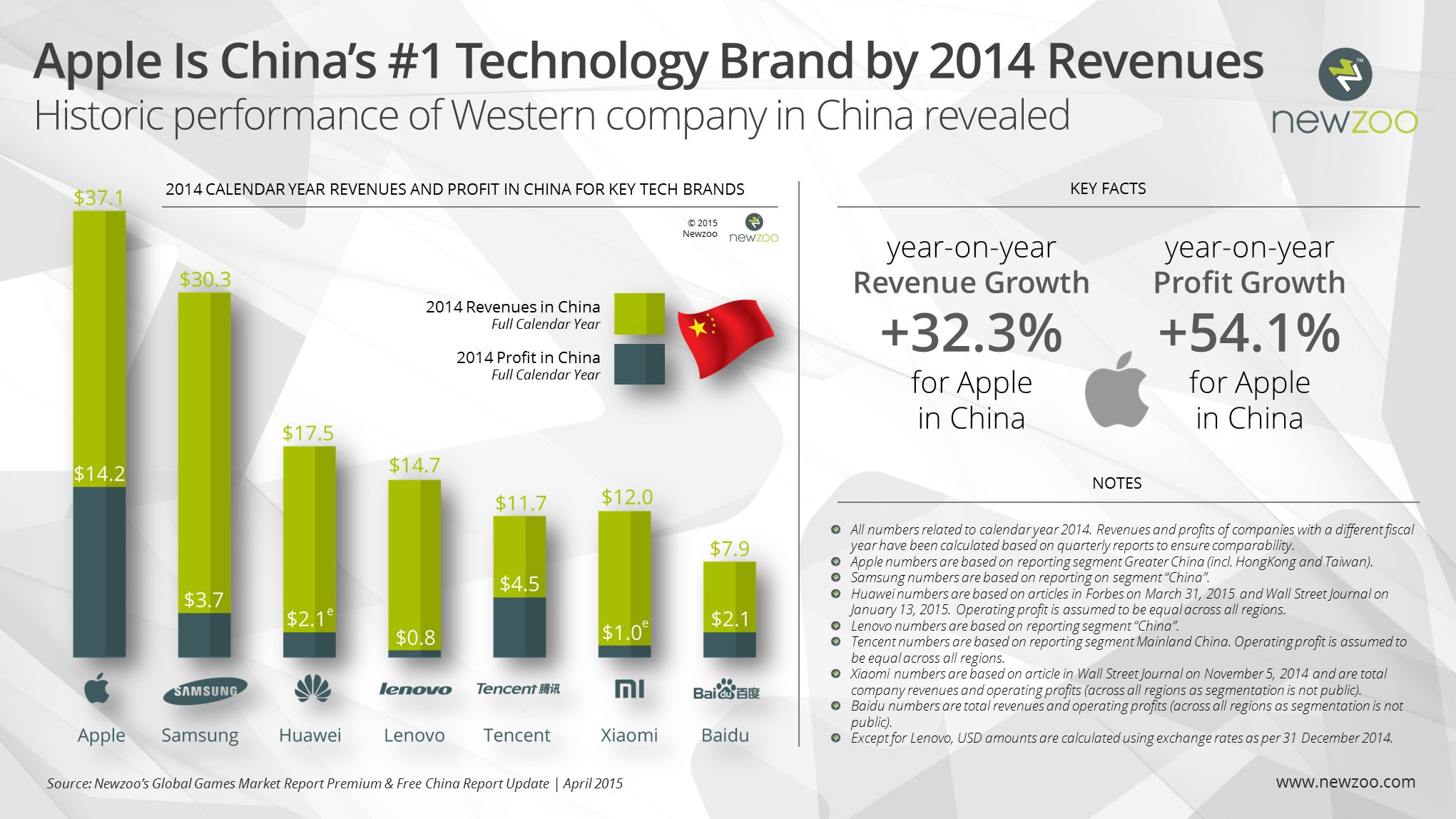

Newzoo’s analysis reveals that in 2014, Apple generated over $37 billion in China. This is more than double the revenues of Huawei ($17.5 billion) and Lenovo ($14.7 billion) in their home market, and is almost three times that of Tencent and Xiaomi. Although these companies have very different core businesses, they are all competitors in the pivotal area of mobile devices and services. Huawei, with its roots in telecoms infrastructure, has a fast growing consumer devices business, Lenovo reduced its dependence on PC and laptops by acquiring the Motorola Mobility devices business from Google in 2014 and Tencent and Xiaomi are “mobile first” companies.

The analysis also shows that even though Apple’s competitors in the mobile devices market such as Samsung, Huawei and Xiaomi may have a larger market share in terms of units shipped, Apple is in completely different league when it comes to revenues and profits. This is a direct consequence of its premium pricing and is often overlooked when market share statistics are published, statistics which are primarily based on unit sales and not revenues.

“With the introduction in September 2013 of the iPhone 5S and the less expensive 5C, many analysts believed the lower priced 5C was finally a product tailored to Asian markets, in particular China, said Newzoo CEO, Peter Warman. “Whether by luck or design, Apple’s blockbuster products in China are not the less expensive iPhone models such as the 5C, but the high-end 5S, 6 and 6 Plus, along with iPads and iMacs. If there was ever any potent evidence needed that Chinese consumers have money to spend and are willing to pay for quality and status, this is it”

In addition to the sheer size of its revenues and profits, one notable observation with potential implications for other Western firms is that Apple has achieved its unprecedented success by appealing directly to its Chinese consumers, using a more or less uniform global sales and marketing strategy. It did not abide by the conventional strategy of using a local partner to conquer China (with whom you must consequently share a significant part of revenue and profits).

For other leading technology firms such as Microsoft and Sony, China is evidently also a very important market, although Microsoft generated less than 10 percent of its FY2014 revenues of $86.8 billion in China. Sony generated 6.7 percent of its revenues, or $4.4 billion, in China in its FY ended March 31, 2014. Of the other tech titans, Google and Facebook have both been severely hampered by restrictions on their services in China, while Amazon faces a formidable competitor in Alibaba. Interestingly Volkswagen, the largest car manufacturer in the world and number one passenger vehicle brand in China, generated 38.1 billion ($46.1 billion) in 2014 in the whole APAC region, placing their Chinese revenues far below those of Apple.

Newzoo performs continued company analysis for a variety of its products including the Global Games Market Report {link no longer active}, the 2015 version of which will be launched in June.