Eric Seufert, head of marketing at Wooga, gave a presentation at the Price Waterhouse Coopers Outlook conference in Amsterdam earlier this month on 5 Trends in Mobile Games. The Slideshare of the presentation is included here if you want to see all of the details of the presentation, including all of the charts.

Seufert led off by noting some salient facts about the current state of mobile games. Six out of the top 10 grossing apps are games, and four out of the top 10 top grossing apps (in the US) are published by two developers. These apps are, for the most part, not new — eight of the top 10 grossing apps were first published in 2012 or earlier, and Game of War and Farm Heroes Saga were first published in 2013. Part of this stickiness for the top apps may be explained by the fact that King Digital (publishers of Candy Crush Saga) and Supercell (publishers of Clash of Clans) are both said to be spending $1 million per day on marketing.

The growing footprint of major companies in the app space is a concern for Eufert. Four companies (Apple, Facebook, Google and Yahoo) own the apps responsible for generating 70 percent of the unique visitors to the top 25 mobile apps, Eufert pointed out, giving them an inordinate amount of sway in the app charts.

Eric Seufert – 5 Mobile Gaming Trends 2015 – PwC Outlook Conference October 2014 from Eric Seufert

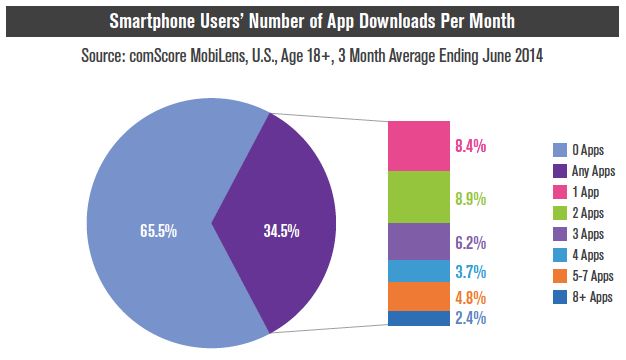

One of the areas that should be of great concern for mobile game developers is the resistance of most of the user base to adding new apps. Eufert pointed to research showing that most smartphone users download zero new apps per month, and nearly half of all time spent in mobile apps is devoted to a user’s single favorite app. That makes the task of grabbing someone’s interest for a new game that much harder. The underlying implication here is that most users just aren’t actively looking for new games (or other apps), but only add them when they are prompted to do so for some reason. Figuring out a good reason for that is obviously a key task for game developers.

Some other aspects of the business for mobile game developers to consider, according to Eufert: Only 20 percent of brand advertiser’s budgets goes to mobile, and that is expected to hit 35 percent by 2018. Advertising opportunities are growing in low ARPU regions, Eufert pointed out, quoting Facebook as saying that the ARPU for an average user in the second quarter of 2014 in the U.S. and Canada is six times that of a user in Asia.

Overall, though, the mobile market is still growing, with mobile devices continuing to ship in huge number (1.5 billion in 2017, for instance). Mobile game revenues should exceed $22 billion in 2015, and growth is expected to continue strongly.

Acceptance of mobile advertising is also growing, opening up a significant revenue source for mobile games. It’s especially important for free-to-play games, which typically only monetize somewhere in the single digit percentages of their user base. Finding a way to monetize the other 98 percent of the audience would be a huge boost to the bottom line for game companies.

Here are the key trends Eufert highlighted in his talk:

1. Fundamental evolution of “App Install Ad” format

2. “App constellations” causing app store “chart position inflation”

3. Increasing overall monetization

4. Increasing platform lock-in

5. More franchise tie-ins

New verticals are beginning to move into mobile advertising, notes Seufert. He argues that improvements in technology like retargeting and deep linking will allow for better and more natural ad formats. Native ads are less intrusive, especially as they become more context-aware. Continued innovation in ad formats should improve the utility of advertising in games, and make them more acceptable to gamers.

Massive companies with several major apps (like Facebook or Google) are able to get their enormous audiences to download all of these apps, with these “app constellations” thereby causing “chart position inflation” and effectively moving most other apps down the chart. Where once those chart positions could potentially be acquired by advertising, that’s no longer an option at the highest levels.

Eufert notes that while tablet sales have been slipping, “phablet” shipments have been growing and may overtake both smartphone and tablet shipments eventually. This, Eufert argues, is a good trend for game developers, since gamers tend to spend more money on games that are played on bigger screens. Meanwhile, CPMs are trending upwards, which means more revenue from ads is in the future.

The trend towards platform lock-in, where operators are competing to keep developers in their proprietary tool chain, will continue, according to Eufert. Still, the way in which platform holders are competing is good for developers, since adding more tools and making platforms easier to use is a benefit for all.

Finally, Eufert sees the rising marketing costs and the chart position inflation trends as incentivizing developers to partner with existing, well-known IP to driver greater uptake on games. Examples include Kim Kardashian: Hollywood and The Simpsons: Tapped Out, which have both been highly successful due to the terrific audience base that the licensed IP brings to the game.