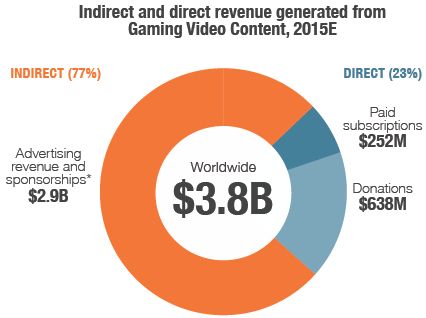

The battle for the attention of gamers is reaching new heights, as the worldwide revenue is projected to reach $3.8 billion this year, according to SuperData. The worldwide audience for gaming related video (both streaming video and recorded video) I 468 million people, and it’s projected to grow significantly in the next few years. Gaming video content earns more on Amazon-owned Twitch than on YouTube thanks to revenue from subscriptions and donations, SuperData noted. Advertising funds almost 80 percent of broadcasting, according to the report.

SuperData, the leading provider of market intelligence on playable media and digital games, today released its report Gaming Video Content Market Brief 2015 on the worldwide market for online videos and live streams related to gaming. Valuing the total market at $3.8 billion in 2015, the United States has seen a tremendous rise in the number of people who watch gaming video content online, from 86 million in 2013 to 125 million this year. By 2017E, the report anticipates the total addressable market for this type of content to reach 790 million. (Download the full report here.)

Key findings in the report include:

- Gaming video content is worth $3.8 billion globally. Today 486 million people tune in to walkthroughs, trailers, live streams and other gaming video content made by fans and publishers.

- Advertising revenue and corporate sponsorships bring in $2.9 billion in US revenue for 2015E. Advertising accounts for 77 percent of revenue earned from gaming videos, with content creators earning $890 million through paid subscriptions and donations.

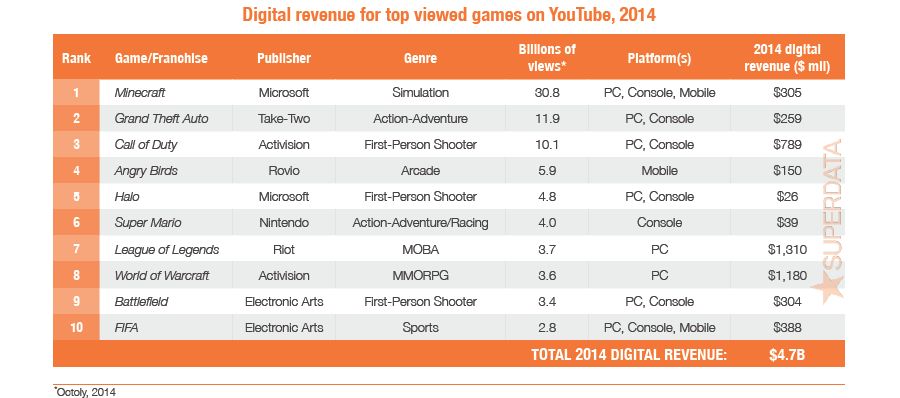

- The top 10 game franchises on YouTube earned a combined $4.7 billion in 2014. Sixty-nine percent (69 percent) of viewers watch trailers of upcoming releases while personality-driven videos sustain the popularity of individual games and franchises.

- YouTube draws more viewers, but Twitch earns more money. YouTube is the largest platform for gaming video content, but Twitch claims the highest market share by revenue (43 percent) because of monetary contributions from hardcore gamers. New video platforms are spurring innovation, but only command around 10 percent of viewership.

- American livestream viewers donate an average of $4.64 a month to content creators. Approximately 44 percent of livestream viewers pay for subscriptions, spending $21 each month on paid content. Single donations to popular broadcasters have reached upwards of $30,000.

- Sixty-five percent (65 percent) of viewers who identify as hardcore gamers watch live streams, and a third watch eSports. Last year, 27 million people watched the League of Legends 2014 World Championship while only 12 percent of casual gamers watch eSports.

SuperData CEO Joost van Dreunen spoke with [a]listdaily about the report and some of the insights that can be gleaned from it.

Joost van Dreunen

Joost van Dreunen

Where do you see the biggest growth ahead for gaming video content, geographically, in the next year or two Will Asia gain faster, or will North America still lead ?

I think it’s going to be the U.S., because that’s where most of the advertisers will congregate. I suspect the eSports category will do really well in Asia. There are channels out there on the same level and size as Twitch, and those will continue to grow, but they tend to be more genre-specific. In absolute audience numbers it’s very likely you’ll see more of the developing markets do well. Latin America, for instance, or even a Russia. Each of these geographies will grow in its own regard for some reason.

What’s amazing is how gaming has really taken over new media like streaming. It seems like there’s a feedback cycle that’s expanding interest in gaming, which expands interest in game streaming and videos, which then expands interest in gaming. Will this continue, and for how long How far can this grow?

In the short term, absolutely, If we step out of gaming for a second, this is how audiences behave online. A lot of people who watch a TV show do this while they are sitting on a message board or a social network, live-commenting on the show. Going online and wanting to share with other people, or uploading a video right after an episode is very fundamental to the contemporary experience for media consumers. They want to share it, they want to show that they like it, exchange views on it, and so on. If you pull it back to gaming, this is a fairly recent that gaming has entered into mainstream consumption. Like you say, there’s a feedback loop that’s going to continue to build the gamer culture. In the short term that will happen. I n the longer term, this will just become another staple, just like you have Star Wars fans. The audience is very much topic based — they’re interested in a particular activity, and there are going to be tastemakers and leaders. The feedback cycle is going to crystallize into a few opinion leaders.

Will the emergence of mobile gaming that’s more core (like Vainglory) mean that mobile will become more important as a streaming and video source, not just as a viewing platform?

Yes, but I’m not really sold on mobile as having massive appeal for core gamers. Vainglory is doing fine — they have a strategy that says we’re growing this organically and slowly, but the question is that how it is now or is that an outlier Is the first of how life will be after this or is this an anomaly in the industry It might actually be that mobile may be much more of a video and streaming source. You have Meerkat and Periscope on the outside of gaming. The difference is that I’m not seeing the monetization in the same way. On the Twitch platform, it’s much easier to embed and integrate advertising. On mobile, I don’t know how you can do that — it might have audience, but I’m not exactly sure how you can embed advertising. Will there be a PewDiePie on mobile I don’t know. You can reach millions of people, but I don’t think you can monetize them as easily.

It seems pretty clear that game developers should consider how a game they are designing can work with this trend in gaming video. What are key factors to incorporate in a design to maximize its potential for sparking gaming video production?

That’s a good one. I think that gamers are tech-savvy enough to not really care. Making games appealing enough for people to stream or make videos about is not really the big obstacle. Games that are popular as eSports were not necessarily designed to be viewed. We will soon see a new generation of games that are specifically designed for viewers. What should people do Visual simplicity . . . it has to be immediately obvious for the audience. If I’m flipping channels on my TV, within a second I know exactly what I’m watching — a sitcom, sports, reality TV, a commercial. For videogames it’s going to be the same. You already see a lot of this. The MOBA and FPS genres have an obvious set of visual conventions around them. If they want to address a huge audience they shouldn’t be too experimental. You want to stay in genre conventions visually, but also offer something unique.

What’s the best way for brands and advertisers to take advantage of this explosion in gaming video? What brands are doing it really well?

In the same way the industry at large is shifting from a core audience to a mainstream audience, gaming video content is transitioning. From game trailers and gameplay videos I think we’re now entering a space where it’s more celebrities and influencers. From a spectator perspective, a PewDiePie can do whatever he wants. He doesn’t have to be beholden to brands. That’s good for him, because he’s authentic and real, but that can be a slippery slope for brands — handing over your brand to a guy you can’t control. There might be some resistance to that kind of model. When comes to brands that do it well, I think Coca Cola with eSports, Intel, for them it’s an obvious bet because they want to connect to this audience. To reach this these affluent tech-savvy audience you have to go for these kind of channels. To take advantage of this, you have to target these people. If you look at it in traditional ways with traditional rules you’re going to miss an opportunity. It’s the brands that really take it further, that really make an effort to understand their audience, they’re going to do well. An Intel, a Mountain Dew, a Coke, they’ve been at it longer so they are at an advantage as well.