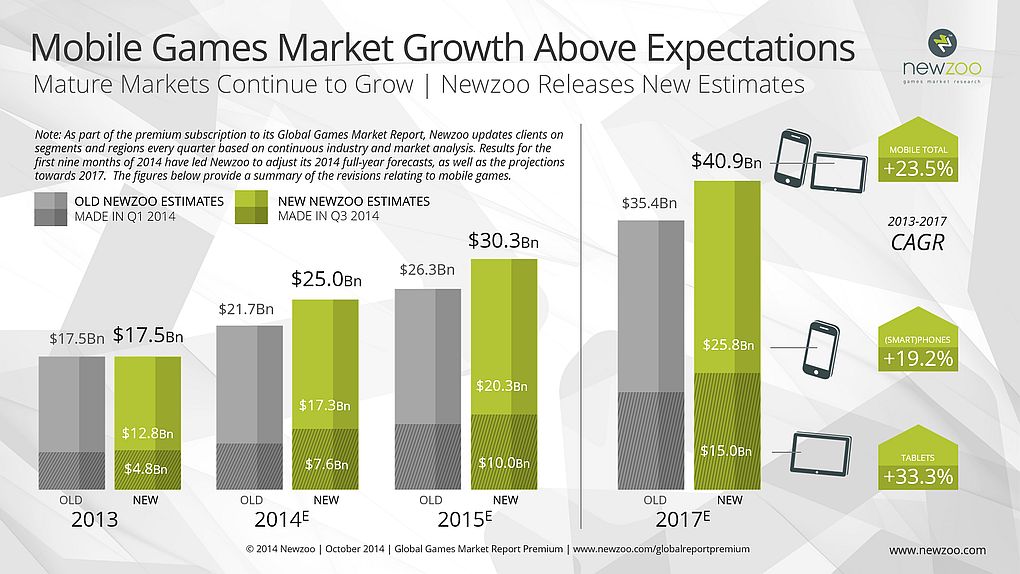

Newzoo, the international games market research firm, announced that its latest Quarterly Global Games Market Update, released to clients last week, includes a significant upward revision of growth forecasts for global mobile game revenues. It now expects global mobile game revenues to reach $25 billion in 2014, up 42 percent on 2013, following strong year-to-date growth in both mature and emerging markets, across smartphones and tablets. As a result, mobile games are on track to replace the traditional console market as the largest game segment by revenues in 2015.

Newzoo Revises Forecasts Upward Due to Strong & Broad Year-to-Date Growth

The growth of the mobile market is broad-based, with both “mature” Western and emerging markets growing fast in 2014. The North American market is now expected to grow 51 percent year-on-year and Western Europe by 47 percent. However, the fastest growth can be found in emerging Southeast Asian markets and China (+ 86 percent). The Japanese market also enjoys strong growth in iOS and Android game revenues, though overall remains stable due to the collapse of traditional feature phone game revenues. Despite a widely reported slump in new tablet unit sales, game revenues on tablets are growing faster than smartphones, cementing the position of tablets as a key gaming device.

According to Vincent van Deelen, Market Analyst at Newzoo: “With the public release of these new forecasts, Newzoo is deliberately countering the sentiment aired in recent months that the mobile gaming market is becoming saturated in mature Western markets, especially the US. This is simply not the case. We are also emphasizing that the recent results of individual high profile companies such as Rovio, King, DeNA and GREE are not necessarily indicative of the state of the mobile market as a whole. It is not in our interest to inflate market figures, but the hard facts have forced us to adjust our estimates upward. We have maintained our year-on-year growth rates toward 2017, ultimately leading to a $40 billion+ market in 2017.”

Mobile to Become World’s Largest Games Market Segment in 2015

Newzoo research shows that the high mobile growth rate is driven by both “organic growth”, lifting the overall market, and “cannibalistic growth,”, at the expense of other segments. In addition to the initial casualties of mobile growth (handheld console and online casual and social gaming), Newzoo notes signs of slower growth in (online) PC games and MMOs as spending is diverted to mobile devices.

Mobile is now expected to become the largest game segment by revenues in 2015, an astonishing feat given that Apple App Store only launched in 2008. According to Peter Warman, CEO of Newzoo: “In mature Western markets, we see the battle between iOS and Android shifting toward tablets. In most of these countries, including the U.S., Android smartphones gross more revenues than the iPhone, but the iPad keeps iOS ahead in overall mobile game spending. Android tablets seem to be in the same position its smartphones were in four years ago: fragmented in terms of device specs and a lower share of game and average spending. Amazon’s Kindle Fire is an exception, scoring high on both KPIs, but for now the iPad maintains its lead taking the lion’s share of tablet game revenues. Because mobile gaming is possible on two of the four screens (Smartphone & Tablet) it could theoretically claim half of consumer spending, leaving the other half for the remaining screens (PC and TV).

Apple’s Game Revenues Could Double Those of Nintendo This Year

The Apple App Store remains by far the biggest single platform in the mobile industry, accounting for about half the mobile games market revenues in 2014, with Google Play a close second. Newzoo estimates that Apple and Google will earn close to $4 billion and $3 billion respectively in games revenues in calendar year 2014, explaining the fast growth in Google’s “other revenues” in its recent quarterly results. To put this into perspective, Nintendo’s game revenues amounted to $2.4 billion last year and will likely be slightly lower this year. Other app stores likely to grab a significant market share in Android games include Amazon and several Chinese stores such as 360 Mobile Assistant, Tencent’s MyApp, Baidu Mobile Assistant and Xiaomi’s MIUI.