Mobile strategy games have really grown in popularity over the last few years, with offerings like Clash of Clans and Game of War: Fire Age getting millions of downloads and making huge bank based on both player popularity and lucrative marketing campaigns, featuring the likes of Liam Neeson and Kate Upton, respectively.

Per a report from Chartboost, games like these, as well as Supercell’s Boom Beach, rule the top-grossing charts on mobile, raking in millions of dollars a day through in-game transactions, according to numbers reported by analytics company Think Gaming.

But before any of these games existed, earlier games helped pave the way for their success, including 2009’s Kingdoms At War from A Thinking Ape. Even though it took a little time for the profits to start rolling in, that title would eventually become one of the highest grossing games for both 2010 and 2011. From there, Kabam stepped in with Kingdoms of Camelot: Battle For the North, which became the number one grossing iOS game for 2012.

How we look at strategy-based games, however, has changed immensely. Back then, these games didn’t have a huge campaign to drive their success, only customer rankings and, with the right placement, advertisement in an app store. These days, companies like Supercell produce multi-million dollar campaigns to spread the word about its titles, and more often than not, these campaigns pay off — like the well-received Super Bowl ad featuring Liam Neeson, threatening to get revenge on a player who destroyed his land. (The commercial is below.)

And what’s more, there’s always room for more competition to come in and make mad money on a good strategy game. Big Huge Games’ DomiNations has managed to earn a strong place in mobile in a short amount of time; and others, like NaturalMotion’s forthcoming Dawn of Titans, are expected to drive in even bigger sales upon release later this year.

Chartboost has broken down this success in a number of factors with its report, starting with a historic timeline that looks back on when the genre got its start (following the launch of the iPhone in 2007 and the Android market in 2008); and then also breaks down a number of design tips for effective mobile ads for strategy games, as explained by Zynga. (These include keeping certain goals in mind, imagining your game having presence at a dinner party, following the tenets of good design, testing and optimization, and knowing when it’s a good time to break the rules on game design.)

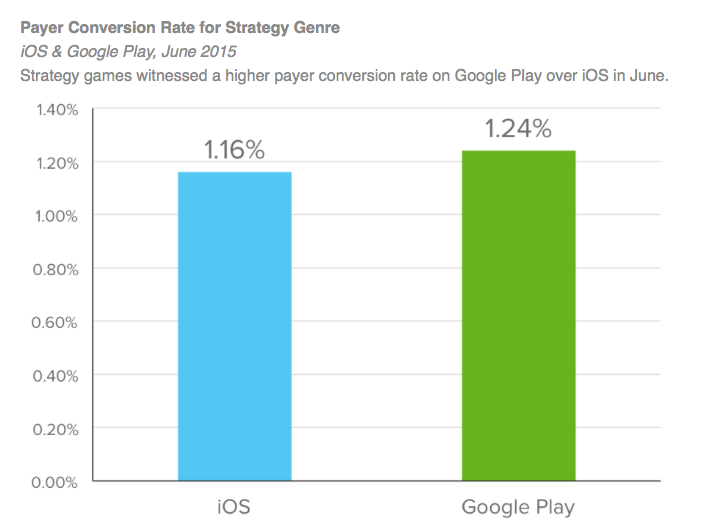

Another factor to keep in mind is player retention, and having players around for the “long haul” when it comes to continuous play. As you can see by the chart below, player retention is quite important for the strategy genre, especially with Google Play gaining ground on iOS for last month. The report breaks this down with various numbers as well, including spend per transaction ($16.90 on iOS compared to $12.57 on Google).

There are also some strategies from mobile strategy game creative as well, including a breakdown of how certain games are designed. One example of this includes Samurai Siege from Space Ape Games, which breaks down into three steps:

1. Stack of characters oriented toward the CTA and logo, training viewer’s eyes on the essentials while still looking exciting.

2. Creates a sense of urgency, motivating higher install rates.

3. Gameplay screenshot ensures players are clicking because they know exactly what they’ll get.

Finally, DomiNations‘ success is broken down with an explanation in various parts, including entering the mobile market, finding the right development team and appeal, and prioritizing the in-game experience. “We don’t really try to teach facts,” said Big Huge Games co-founder Tim Train. “But we do try to convey our love of history, and designing for mobile meant we could do so for a much broader audience than other platforms. In the old days, if one of our games sold two million units, that was a staggering amount — [but] with DomiNations we have a real chance to reach 100 million players or more.”

The full report can be found here. It’s quite the read for those who want to learn more about the growing strategy market.