Analysis from SuperData CEO Joost van Dreunen, follows:

- Fallout Shelter delivers critical hit, earning $5.1M in first two weeks.

- The $86M acquisition of ESL validates eSports as investments heat up.

- AAA publishers copy indie release strategies to avoid botched releases.

- Meet the SuperData Analysts at Casual Connect SF and Gamescom.

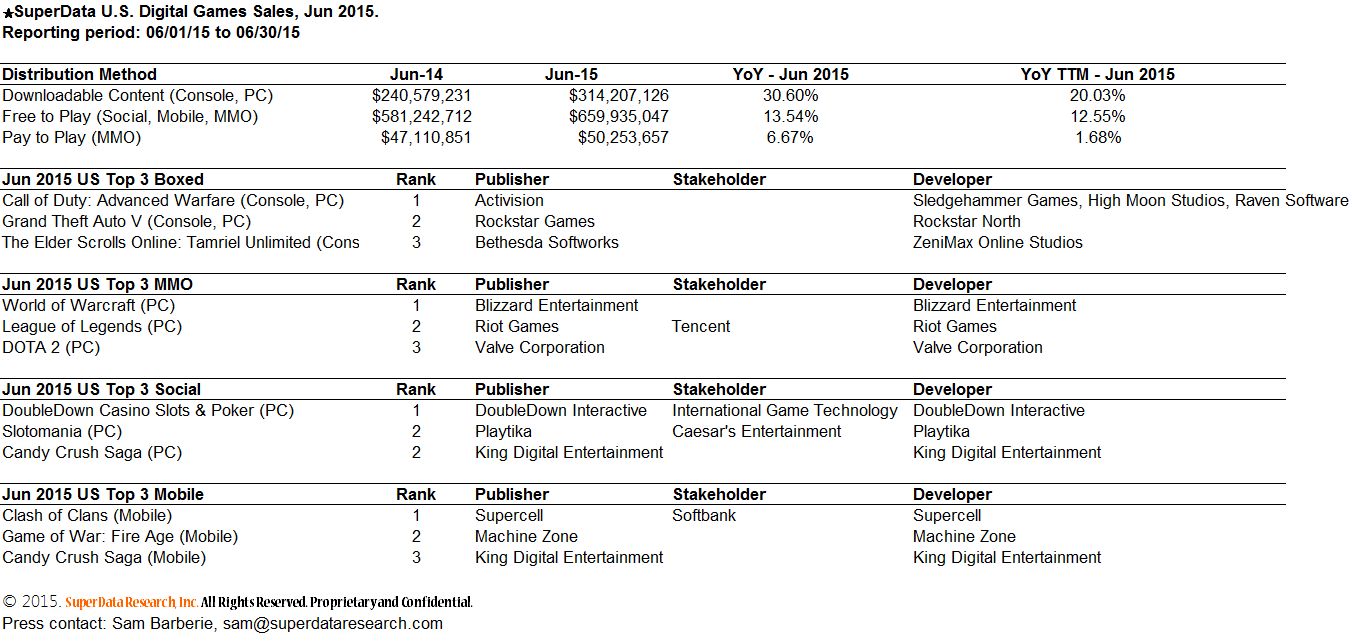

June is packed with surprises as digital games grow 18 percent to $1.02 billion. Following one of the best editions of E3 in years, the overall market proved robust as digital game sales were up. Generally speaking, western engagement with mobile games often falls during the summer, but last month’s mobile revenue was up 4 percent over May. Mobile revenues were up 20 percent compared to June 2014 and reached $367 million. Digital console and PC sales reached a combined $314 million, up 30 percent year-over-year. The big winner this month was Bethesda, which managed to do well both on console and mobile. Previously only available on PC and Mac, its newly-released console version of The Elder Scrolls Online sold 138,000 digital copies. Pent-up demand and the removal of its mandatory subscription fee propelled the game to the top of the charts for total units sold. Sales of the game were enough to temporarily buoy the contracting pay-to-play MMO market, which rose 7 percent year-over-year to $50 million.

Fallout Shelter delivers a critical hit, earning $5.1 million in its first two weeks. In a stroke of marketing brilliance, Bethesda managed to win E3 early by delivering a superb press conference and launching a top-grossing mobile game in its wake. Originally developed as a marketing tool for the release of its upcoming Fallout 4, the mobile game is a hit in its own right, passing King’s (NYSE: KING) Candy Crush Saga on the iOS top-grossing charts. While we’ve seen mobile spin-offs based on AAA game franchises before – Call of Duty: Heroes, Halo: Spartan Assault and Heroes of Dragon Age — Bethesda managed to maximize exposure and reap the benefits. More significant than the publisher’s success is the notion that core gaming fans proved to be willing customers for a free-to-play mobile game. By emphasizing unobtrusive monetization and offline playability, Bethesda managed to earn the respect of a consumer group that is otherwise highly critical of free-to-play monetization. The game’s success further underscores the value of a strong franchise in the otherwise crowded mobile games market.

The $86 million acquisition of ESL validates eSports as investments heat up. Swedish broadcaster MTG (OMX: MTG) has purchased a controlling stake in Germany’s Turtle Entertainment, the parent company of ESL. As one of the world’s largest organizers of eSports leagues and tournaments, top-tier ESL events can draw up to a million concurrent online viewers and 100,000 in-person attendees. Competitive gaming has been a long-standing practice in Asian markets and has slowly gained popularity in Europe and North America. Allowing advertisers access to a tech-savvy, affluent audience that defies traditional viewing behaviors has proven key to the recent success of eSports. The acquisition by MTG is evidence that old school media firms are seeking to maintain their relevance as a generation of digitally literate consumers emerges as an important demographic. In 2015, the global eSports market will see 134 million viewers and $612 million in revenue. The next frontier in competitive gaming will likely be sports-betting and fantasy leagues, as companies like AlphaDraft, Unikrn and Vulcun have all recently received investments to the tune of $5 million, $7 million and $12 million, respectively.

AAA publishers copy indie release strategies to avoid botched releases. The increasing complexity of AAA game development continues to haunt publishers as the industry transitions to digital distribution. Warner Bros. Interactive Entertainment (NYSE: TWX) made the unprecedented step of pulling the PC version of its hotly anticipated Batman: Arkham Knight — the latest in a series of buggy releases — from both digital and physical shelves. A continued emphasis on cross-platform development and the emergence of a more fragmented market has raised the stakes for blockbuster launches, leading to a growing list of ramshackle releases. Previously, DriveClub by Sony (NYSE: SNE), Assassin’s Creed: Unity by Ubisoft (EPA: UBI) and Halo: The Master Chief Collection by Microsoft saw the light of day despite severe technical problems. In response to these difficulties, which tend to sour consumer sentiment toward both game titles and publishers, game companies are starting to experiment with the lessons learned from the indie scene. Releasing games that are still in active development, a model popularized by Mojang’s Minecraft and Steam Early Access, is proving to be a reliable way to identify problems early on and mitigate risk. In December, Square Enix (TYO: 9684) will release its upcoming Hitman game in chunks, and Xbox One owners can now buy in-development games through the Xbox Game Preview program.