By Peter Warman & Steve Peterson

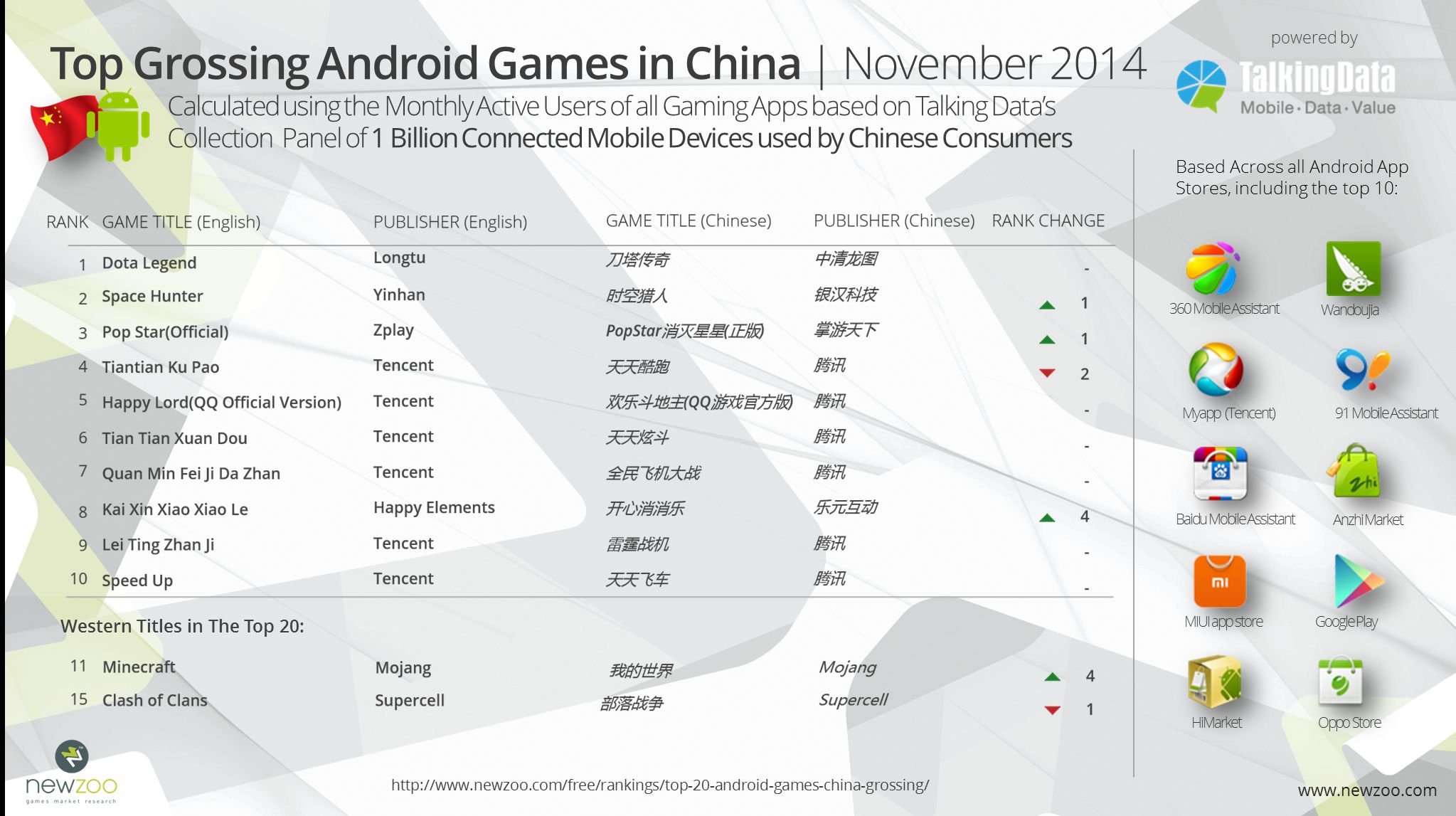

Together with our partners Talking Data, we are today launching a new & unique monthly mobile ranking: The Top 20 Grossing Android Games in China. The data is gathered by tracking the use of apps on 1 billion mobile devices in the Chinese market. The new ranking, based on game revenues, complements the existing monthly overview of Top 20 Android Games by Installs and MAU and Top Android AppStores in China by Installs. This is the first grossing game ranking in the world that combines all of the Android stores in China, representing approximately $2.8bn in revenues in 2014.

DOTA Legend Reigns Supreme

DOTA Legend has made a huge impact on the charts since its release in February of 2014. The game is a DotA themed real-time Battle card game, using characters from Valve’s popular MOBA title. It is published by Longtu Games and has been the top game in terms of revenues since September. The World Cyber Arena (WCA) hosted an esports event in October where games like DOTA 2, Hearthstone and World of Warcraft took a backseat to DOTA Legends — which boasted a $1.1 million prize pool.

Space Hunter from Yinhan has also been solidifying its place in the charts, now at number 2 followed by PopStar Official. Space Hunter, an MMO RPG with similar game play to Hearthstone, was first released in November 2012 and grossed $7 million in its first six months. The success of these titles demonstrates how the Chinese love affair with MMO/MOBA style games is not limited to the PC screen and mobile versions of this genre can prove extremely lucrative.

PopStar Official from Zplay, which is the third highest grossing title, has been the number 1 game in terms of MAU since May.

Western Winners: Mojang & Supercell

Although none of the top 3 titles come from Tencent, the Internet giant makes its presence very well known in the charts. Of the top 20 grossing games in November, eight are published by Tencent. This is especially impressive when you consider that no other publisher has more than one title in the rankings. There are two Western publishers with games featured in the top 20 — Minecraft from Mojang at number 11 and Clash of Clans from Supercell at number 15 respectively. Looking beyond the top titles, PopCap and Gameloft are the only other Western publishers inside of the Top 50 grossing rankings.

RPG Best for Revenue

As noted previously, the highest average time spend is dominated by Board & Card and RPG titles. Not surprising then that the #1 and #2 titles fall into these genres respectively. In terms of overall dominance, the majority (20 percent) of the top games are RPG titles with Space Hunter, and Tian Tian Xuan Dou the best performing games in this genre. More casual genres such as Tile Matching are also popular, with three of this type of game featured in the Top 20.

The [a]listdaily queried Peter Warman about some of the insights he’s gained from studying the Android game market in China. He provided us with some exclusive information about the report.

To what do you attribute Tencent’s domination of the list Is it the company’s dominant position in chat with QQ and WeChat, or just good choices in games, or something else?

Tencent dominates the channels in the Chinese mobile games ecosystem. They have two”super apps” which they use to promote their games (QQ and WeChat) and own a popular third party appstore- MyApp. On top of this, they have a huge portfolio of and investment into new games.

Tencent’s appstore MyApp is installed on 25 percent of all 1 billion connected devices that our partner TalkingData tracks . . . That gives them direct access to a connected mobile audience that is larger than that of the US.

RPGs and card games are obviously big winners in the current list. Does this say something about the demographics of the early smartphone adopters in China? Do you expect this to change as smartphones broaden their reach in China, perhaps with more casual games appearing on the top-grossing lists?

China is not in an early adoption stage of smartphones. The billion devices tracked are all online and predominantly smartphones and tablets. Still, the demographics skew young and male compared to the US and Western Europe. This increases as we move through the funnel towards mobile gamers that spend a lot. For instance: 57 percent of Chinese mobile gamers is male rising to 69 percent for big spenders on mobile games. Of this last group the majority is between 21 and 35: 83 percent.

The fact that we are starting to see cannibalization of PC/MMO revenues by mobile confirms the feeling that these are the traditional Chinese gamers that are spending. The same accounts for the popularity of poker games.

Casual games will rise but this will be slow when it comes to spending. This is not particularly because of a broader use of smartphones but a change in cultural and social attitude towards games. Gaming (and spending money on it) is seen as a young male activity, more so than in the West.

Do you think Western games will be able to do better in China over time? Does a Western game have to be an RPG or a card game to have a good chance in China?

Western franchises are popular in China. If the games are localized well and supported by local distribution partners they have a good chance of succeeding even without being a RPG, Card Battle or Poker game. Just look at Minecraft and Clash of Clans on Android and Clash of Clans and Boom Beach on iOS. The games should appeal to the male skewed audience though . . .

With iOS picking up some market share in China over the last quarter, can you comment on how the top-grossing list for iOS in China is similar or different to the Android list?

iOS has roughly a third of the market in terms of revenues. The top 10 games on the iPhone are different with the exception of Lei Ting Zhan Ji and Quan Min Fei Ji Da Zhan both from Tencent. Both charts are dominated by RPG titles.

Analysis

The amazing impact of mobile games in China has extended even into the eSports realm, which is something that has yet to occur elsewhere in the world. Yet it seems inevitable that mobile games will develop eSports, and when there’s over a $1 million prize pool, as noted above, it’s sure to attract attention and competitors.

One thing about the top-grossing list that’s quite interesting is the concentration of RPG and card battle games; the top-grossing games in China seem to have somewhat less variety than in other countries. Whether this is due entirely to the nature and quality of the games currently on the market, or it’s a fundamental difference in preferences, remains to be seen. Tencent’s domination of the charts isn’t surprising given its command of the messaging app market, but it’s a very different picutre than we see in the West. Messaging apps exert a powerful influence in guiding players to games, as is also seen in Korea with Kakao and in Japan with Line.

Will messaging apps ever exert such influence in the West That’s hard to say, but you can bet there will be plenty of interest in trying as discovery continues to be a major issue for all mobile game publshers.

Also of great interest is that while iOS has far fewer devices in the market, it still commands one third of the total revenue for China’s mobile games. That speaks to the nature of the iOS device buyer in China, and it will be interesting to see how this evolves over time.

Newzoo’s Focus on Asia

The new China ranking reflects Newzoo’s desire to assist its clients with understanding, sizing and seizing opportunities in the worlds’ fastest growing games markets. Combined with our In-Depth Consumer Insights and Chinese gamer and revenue projections from our Global Games Market Data, this provides us with an unrivalled overview of the Chinese (mobile) games market. In addition, our free China Report puts the local games market in a broader cultural and digital media perspective. More recently we performed our biggest research effort to date focused on Southeast Asia, resulting in a 75-page report and and abundance of data that can be used to benchmark all countries across 200 variables.

About TalkingData

TalkingData offers the best-in-class Big Data products varying from highly-scalable data mining, deep data analytics, DMP (Data Management Platform), analytical reports, industry benchmarking, and deep-dive market insight reports. Today, 80 percent of the Top 50 developers in China rely on us to track their app metrics, analyze user data points, and monetization. Our service has reached more than 700 Million unique devices from 50,000 applications.

About Newzoo

Newzoo is the leading global market research firm focused purely on the games market. The company provides its clients with a mix of primary consumer research, transactional data and financial analysis across all continents, screens and business models. It is also known for actively sharing a variety of insights by means of free trend reports, infographics, blogposts and monthly rankings. Newzoo’s clients include Tencent, SEGA, Logitech, Wizards of the Coast, Nvidia, Microsoft, EA and Visa/PlaySpan.