The surprise announcement by Nintendo that it will enter the mobile game market has generated an amazing amount of comments and column inches. Certainly investors have reacted with glee, driving up Nintendo’s share prices by 50 percent in the past two days, giddy with the idea that Nintendo is finally entering the largest, fastest-growing segment of the game industry.

The responses to the deal have been, in some cases, well over-the-top. “This is huge news that could change what the future of the industry looks like,” gushed Jeff Grubb of VentureBeat, in an article titled “Nintendo on mobile ‘is an earthquake that will change the entire games industry‘.” In that article, Grubb quotes analyst Dr. Serkan Toto. “I really think there is gaming before and after March 17, 2015. This is probably the biggest news in gaming in recent years. Nintendo doing mobile apps is an earthquake that will change the entire games industry, globally.”

It’s time for a little calm thinking about the future. While there’s certainly cause for optimism in this development, it’s far too soon to decide what effect this will have on both DeNA and Nintendo, let alone the whole game industry. Reality has set in even for investors, with Nintendo’s share price falling over 11 percent today as the euphoria of the deal fades and people start to think about what it really means.

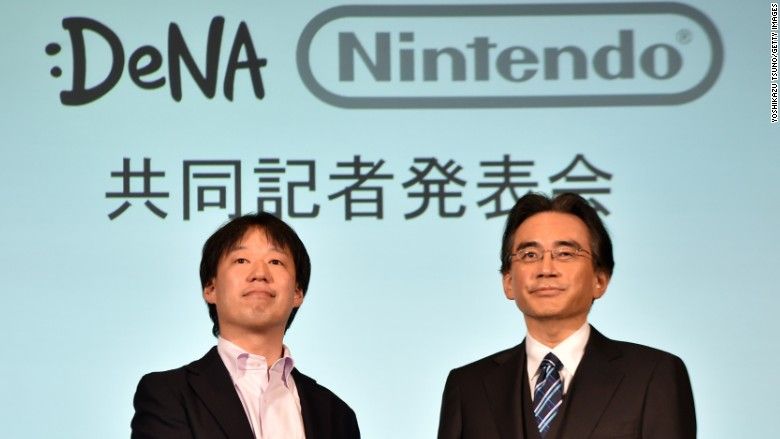

First, let’s look at the details that have been announced so far about how Nintendo and DeNA are proceeding with this deal. One major question has been how involved Nintendo would be with the actual game design, and Nintendo CEO Satoru Iwata clarified that in an interview: “Development of smart device games will be mainly done by Nintendo,” Iwata said. Nintendo will use DeNA’s expertise in handling network issues at a large scale, and all the service operations that go with that, along with developing a social network. That all seems eminently sensible, playing to the strengths of both companies.

Still, this is not a slam-dunk. Mobile games have some fundamental differences from console games, not the least of which are the interface issues. Now, Nintendo does have some experience with touch screens dating back to the Nintendo DS, up through the 3DS and the Wii U. But the touch screens on mobile devices are far more capable and flexible than the stylus-driven screens Nintendo is mostly used to. Games on these devices all had a full complement of buttons and joysticks and triggers to use, and those were the primary controls used in almost all games. So Nintendo’s got some serious learning to do here, starting many years behind other companies in the industry.

The play patterns on mobile devices tend to be very different than typical console games, too. Smartphone games tend to be shorter play sessions that are easily interruptible, while many of Nintendo’s classic games require intense concentration and timing for extended periods. Not an insoluble problem, but not trivial, either. Yes, DeNA has the experience to help with all of these issues, but announcing a deal and then having teams actually form and work together productively are two completely different things.

Monetization is a more difficult thing to deal with for Nintendo. Ideally, the best monetization in games comes when it’s integrated into the design from the beginning. Nintendo’s introduced a few free-to-play games like Steeldiver and Pokemon Shuffle — but the games have not been well-received. DeNA has plenty of experience with monetization, but some of those mechanics (like the now-banned kompu gacha) are not ones Nintendo fans will be happy about.

Fortunately, Nintendo is well aware of the monetization issue, as Iwata made clear in a Time magazine interview. “I understand that, unlike the package model for dedicated game systems, the free-to-start type of business model is more widely adopted for games on smart devices, and the free-to-start model will naturally be an option for us to consider,” Iwata said. “On the other hand, even in the world of smart device apps, the business model continues to change. Accordingly, for each title, we will discuss with DeNA and decide the most appropriate payment method. So, specifically to your question, both can be options, and if a new Nintendo-like invention comes of it, then all the better.”

Ultimately, the core problem that Nintendo and DeNA have to solve is that their games have very different audiences. Nintendo’s got a great fan base for their games, and they are mostly hardcore gamers who appreciate the craftsmanship, deeply involving gameplay, and delightful characters — most of those gamers, these days, with nostalgia from growing up with Nintendo characters. DeNA and other mobile game companies have created huge audiences from non-traditional gamers who enjoy casual diversions on their phones. These two audiences don’t have much crossover, at least not in huge numbers.

Look at the top-grossing games on mobile, like Clash of Clans, Game of War, Candy Crush Saga — these are not game genres that Nintendo is particularly skilled in. Or look even further at top mobile games, at endless runners, match-3 games, social casino games, card battling games — none of those genres are really in Nintendo’s top franchises of all time. Just adding Nintendo characters to a clone of an existing game isn’t going to set the world on fire.

So either Nintendo has to figure out a way to get a massive mobile audience enjoying a different type of game than they currently do, or try to get their current fan base to enjoy a different type of game than they currently do. Or, somehow, create a new type of game that’s attractive to both audiences. And don’t forget the vast gulf in monetization: Nintendo fans are used to paying a fixed price up front and then getting everything for free, while mobile players are used to paying nothing up front and being able to pay for free as long as they want, with an option to pay something for an added item or function. Convincing either of those groups to enjoy a different way to pay is not easy at all.

Yes, perhaps Nintendo can come up with a new way to monetize games, as Iwata hinted at, some sort of hybrid that will satisfy both audiences. And certainly you should never underestimate Nintendo’s ability to come up with clever game designs, so perhaps they can develop new genres or hybrid genres that can make both audiences happy. But neither one of these things is easy, nor a sure thing.

Perhaps Nintendo could be nicely profitable if its mobile games really didn’t make much money, but served mostly as a marketing tool to get people interested in Nintendo premium products. That might boost sales of Nintendo hardware and premium games, but it’s certainly not something that would make DeNA happy. DeNA is looking for the Nintendo IP to provide a big audience boost and a big boost in revenue, too. They don’t need audience-building loss leaders; DeNA is looking to earn more revenue from titles, as well as expanding its audience.

Iwata made the following statement to Time magazine about revenue: “On the other hand, Nintendo does not intend to choose payment methods that may hurt Nintendo’s brand image or our IP, which parents feel comfortable letting their children play with. Also, it’s even more important for us to consider how we can get as many people around the world as possible to play Nintendo smart device apps, rather than to consider which payment system will earn the most money.” That’s not exactly music to DeNA’s ears, but the opportunity to cross-promote a huge Nintendo-attracted audience to DeNA’s other games will no doubt help console them.

Some games seem more likely to be adaptable than others to mobile: Animal Crossing, for instance, or Pokemon, rather than Super Mario World. But we won’t be seeing ports of existing games, Iwata has assured us. The games that come from this alliance will be brand new. That’s ultimately got more promise than rehashing old titles, but how well it will actually work is an open question. It’s perfectly possible to aim at combining two huge, different audiences with some sort of cross-over product, and miss both of those audiences.

For any long-time gamer, the phrase “Play Nintendo games on mobile” has a definite appeal. Whether the reality is as appealing as the daydream is something that we’ll have to wait to find out. It’s a difficult task to make the most of this deal, but from the statements Nintendo has made so far they are pondering the right issues. Even with the best of intent, success is not assured. It seems highly unlikely that Nintendo will suddenly convert hundreds of millions of people completely unfamiliar with console games into dedicated Nintendo-style gamers. Mobile games have been developing on their own, and evolving in interesting and unexpected ways. Nintendo’s got to innovate to succeed here, not just look to the past — but that’s something they’ve already acknowledged. Still, we know not all of Nintendo’s innovations succeed. The Wii was a huge hit, but the Wii U (with arguably even more innovations than the Wii) has not been a hit.

The success of Nintendo and DeNA is something that would help the rest of the mobile game industry, bringing in new mobile players and perhaps creating even more engagement with mobile games. Everyone should hope for their success — but not be blinded by that hope to the very real challenges the two companies face in the years ahead.