When you’re working day-to-day on products, it’s important to take a look around once in a while to see how the landscape is changing. That’s incredibly important in the fast-moving games industry, where the only thing that remains constant is change. Fortunately, there’s some guidance, since the folks at market intelligence firm IDC teamed up with app analytics firm App Annie to take a comprehensive look at how the games industry changed in 2015, with some surprising results.

Mobile Gaming Takes The Lead

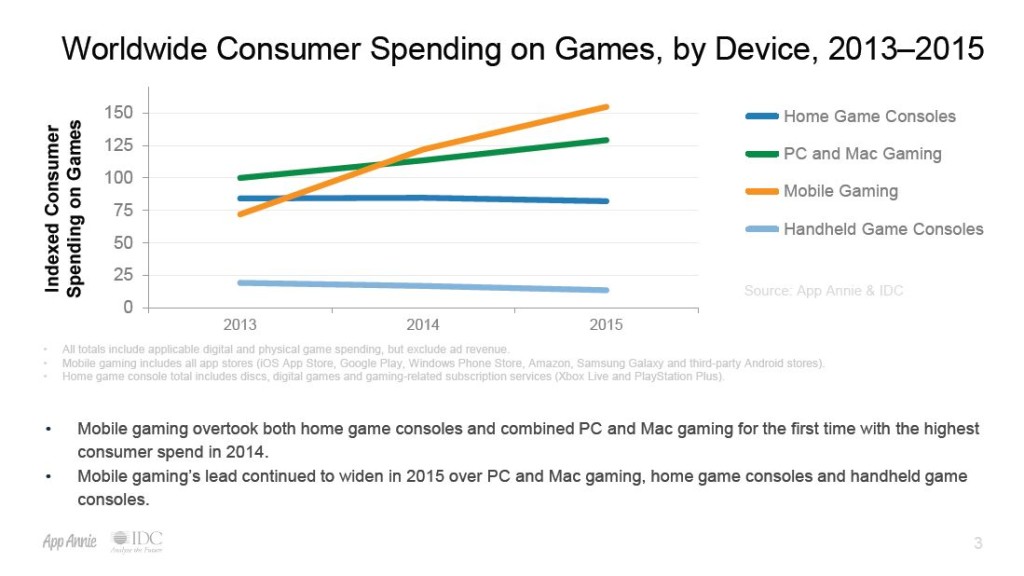

The report takes a look at worldwide consumer spending on games by device between 2013 and 2015, and the trend lines are clear: mobile games have taken over and continue to climb faster than other types of game. “Mobile gaming overtook both home game consoles and combined PC and Mac gaming in consumer spend for the first time in 2014; the gap widened in 2015 and shows no signs of slowing,” the report stated.

Games still represent the biggest share of revenue by far among all mobile apps, accounting for more than 80 percent of the total worldwide spend combined for the iOS and Google Play app stores, despite a slight decline in downloads (from 40 percent to 38 percent in 2015). Games are a bigger percentage of Google Play consumer spending, but there are more dollars spent on iOS games than Google Play games.

At the same time, PC gaming has been growing steadily, though not at the same pace as mobile gaming. In contrast, console game spending has dropped overall, despite the introduction of new consoles in that time frame. The decline in last-generation console sales happened more swiftly than was expected, and even though the latest consoles have outsold the last generation’s first couple of years, the decline is still there.

The place where there should be no surprise is the decline in handheld console spending. Sony has all but given up on the PlayStation Vita, and Nintendo’s 3DS platform has been underperforming compared to the DS platform. Nintendo has continually had to revise its sales estimates downward for handhelds. The reason seems to be obvious; with smartphones and tablets being in the hands of a vast number of people, the need to buy a handheld device specifically for gaming seems pointless—especially when the latest smartphones have more power and better screens than the 3DS and have an enormous selection of games.

At this point, the continued pre-eminence of mobile games seems assured, and there’s no obvious way this could be reversed. While a new handheld device (such as one rumored to be part of Nintendo’s NX console) could be profitable for its maker, there’s no way a new portable hardware platform could sell enough to make a significant dent in the huge mobile gaming market.

Game Platforms Segregate By Geography

The picture gets more interesting when you look at the game spending by region and platform. Mobile and PC gaming both rose 3.4 percent in Asia-Pacific between 2014 and 2015, and that region has the largest share of worldwide gaming revenues. The region also gained in handheld game consoles by 1.6 percent, offsetting the drop seen elsewhere to some degree.

The vast bulk of consumer spend on home consoles is seen in North America and Europe, with only a minor amount seen in Asia-Pacific and the rest of the world. The lifting of China’s 14-year-old ban on video game consoles had no major effect on sales in that region. Gamers in China have already found plenty of fun on PCs and mobile platforms, and the relatively high cost of consoles and the low number of games available in localized versions did not cause much of an impact in China.

Top Mobile Games Are Stable

Contrary to the early days of the mobile games market, the top-grossing positions have been remarkably stable over the last few years—far more so than on handheld and home game consoles. The report partially attributes this to the fact that handheld console games are largely sold in retail stores, and thus there’s a tendency to rotate out slow-moving packages.

That’s really a good sign for mobile game marketers. It means that if you’ve managed to create a strong mobile title, you can potentially have a long life ahead for the game. Of course, you’ll have to make sure that the game keeps introducing new content, that the game’s economy doesn’t spiral out of control, and that you’re constantly acquiring new players to replace those you’ve lost. It’s not easy being at the top, but at least multiple titles show it’s possible to stay there with hard work and the right strategy.

Console Games Have The Highest Spend

While console games are mostly popular in North America and Europe, and they are declining slightly in overall spending, they still have one huge advantage: consumer spending per device is about five times that of mobile games. That in itself explains why we see so many publishers eager to spend large sums on new console games.

Something that the report doesn’t point out about console games is the importance of brand-building across platforms. Strong console brands have demonstrated an ability to generate huge revenues on PC and mobile platforms as well. Witness the cross-platform strength of Call of Duty or Grand Theft Auto V between PC and console, for instance. Or how FIFA has generated hundreds of millions in mobile revenues from the strength of its console and PC franchise. Or the amazing power of Minecraft to generate astonishing revenues across PC, console, and mobile.

Consoles may not have the overall growth potential of mobile or PC, but where they shine is in targeting core gamers who are the heaviest spenders. These gamers are also prone to spending across platforms and are great influencers of other spending. Marketers looking to spread their brand impact need to have a strong console strategy.

Gaming Demographics Broaden Across Platforms

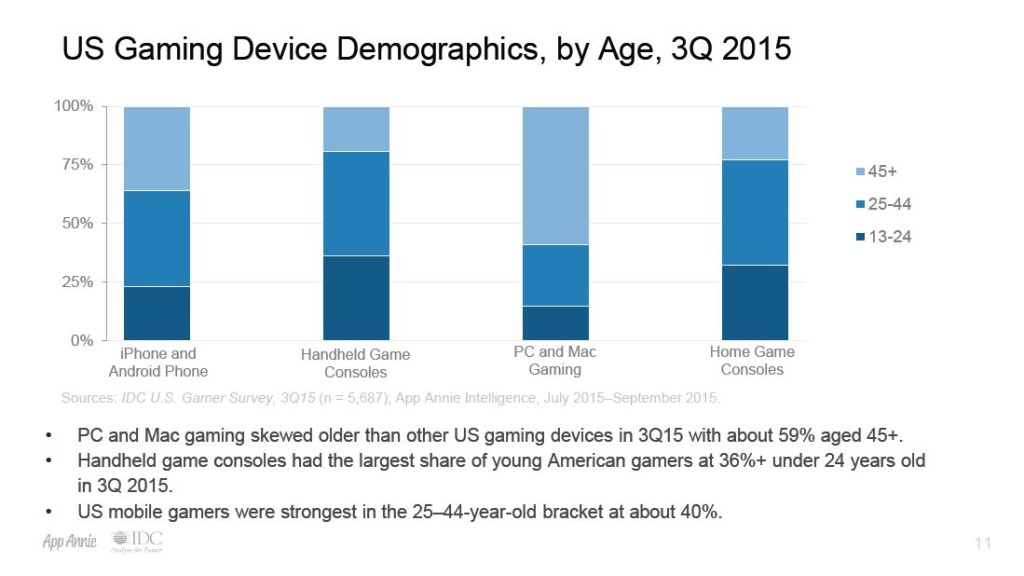

The report looked at US gamer demographics across all platforms as of the third quarter of 2015, and it’s a powerful message: “Males and females were represented evenly among US iPhone and Android Phone gamers and combined PC and Mac gamers,” according to the report. While console games still skewed male, that was still only a 59 percent to 41 percent split. Handheld game consoles actually skewed female (53 percent) in the US.

Age is also becoming a broad demographic for gaming. Gamers age 45 and older make up nearly a third of mobile game players, more than half of all PC gamers, and about a quarter of console game players. So, don’t leave older gamers out of your calculations when creating marketing strategies. By the way, older gamers are more likely to have higher incomes and more spending money. Interestingly, the 13-24 year-old gaming crowd is comparatively smaller, perhaps because they’re too busy with other pursuits.