The global market for games is growing, and Asia is already in the lead — and growing faster than other regions. So it should not come as a surprise that games market research firm Newzoo is opening a new office in Shanghai, and presenting some new data about the Asian games market to highlight that effort. This office marks the first step in its international expansion strategy and signals Newzoo’s desire to be closer to its Asian clients and partners. If the current growth in China continues, it will surpass the U.S. as the biggest games market in the world at the end of 2015. China houses numerous games and digital media companies with global ambitions encompassing both the West and Asia itself. Newzoo already serves a number of Chinese companies including Perfect World, R2 Games, Tencent and Baidu.

Wybe Schutte

Newzoo’s upcoming research effort in Southeast Asia (SEA) is an example of how it aims to foresee the needs of global companies in general and those in China specifically. “We are very excited to start our first international office in Shanghai,” said Newzoo’s VP of Business Development, Wybe Schutte. “In recent years, Newzoo has become a well-known brand in Asia. At the same time, we realize that a local presence is required to optimize our service towards our Asian clients and take away every threshold for companies seeking to work with us. Of course, it will also help us to expand our network of media and data partners in the region.” Schutte will be leading Newzoo’s Shanghai offices for the time being, according to Newzoo CEO Peter Warman.

Newzoo also announced its biggest research effort to date, focused completely on Southeast Asia. The project was kick-started earlier this year by several launch clients including Facebook, Microsoft, Electronic Arts and Chinese internet giant Baidu.

The effort involves local primary consumer research in Thailand, Vietnam, Malaysia, Indonesia, Singapore and the Philippines in combination with financial analysis and transactional partner data. To understand the growth drivers and potential, the report will also give insight into the cultural and digital media landscape of each country. The six countries represent 550 million consumers, an online population of almost 180 million and close to 110 million connected gamers. This year, these consumers will generate $1 billion in game revenues. The average annual growth rate of 22.9 percent (CAGR) towards 2017 for the six countries combined makes it the largest growth region in the world. More information on the SEA project can be found here.

“Over recent years, Southeast Asia has steadily risen in priority for our clients,” said Schutte. “We have waited to research this very diverse region in full depth until growth started to accelerate and that moment is now. Our clients all have a global outlook and want to be able to benchmark markets in Southeast Asia with growth opportunities in other continents. Adding six Southeast Asian countries to our existing primary research portfolio of nineteen countries allows them to do exactly that.”

To celebrate the opening of the office, and to meet with friends and partners in China, Newzoo VP Business Development, Wybe Schutte, will attend GDC China in Shanghai from October 19 to 21. He will be available for meetings both at the show and the Newzoo office. For the fourth year in a row, Newzoo will also be an exhibitor at G-Star in Busan, Korea from November 20 to 23. More information on the opening of the Shanghai office can be found here.

Providing additional insights into the growth of the Asian gaming market, Dr. Serkan Toto, a Japan-based game industry consultant, gave a presentation recently in Malaysia. While his data showed that all segments of the game industry are showing growth except for retail packaged games, the growth of mobile games is the highest. Dr. Toto showed numbers from the International Development Group with estimates of some $8.9 billion in mobile content for Asia this year out of some $20 billion total worldwide, rising to $11.4 billion in 2017.

Dr. Toto noted some other important trends in the Asian gaming market. While smartphones and tablets are growing rapidly, this is still one of the regions of the world where feature phones are a major part of the market. The spread of smart devices will grow as lower price points become prevalent, with sub-$100 smartphones and tablets poised to make big inroads into markets like India.

Similarly to North America and Europe, the easy availability of app stores is contributing to a rise in indie developers all over Asia. Again, similar to their Western counterparts, these Asian developers can have a difficult time finding an audience for their games.

One key thing about the Asian mobile game market (and, for that matter, the PC game market): It’s almost entirely free-to-play. While the app stores on iOS and Google are important, messaging platforms like WeChat, Line, and Kakao are extremely important as places to distribute games in Asia.

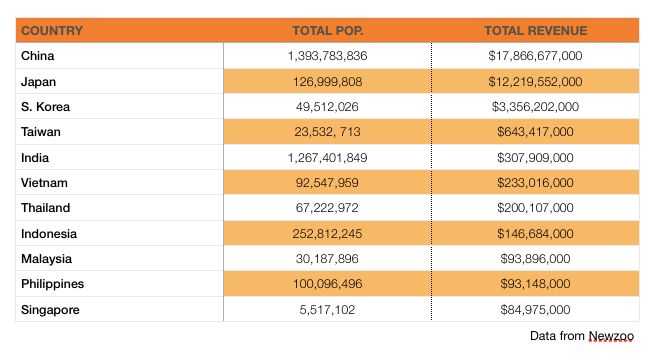

Courtesy of Games In Asia, they’ve lined up some data from Newzoo in convenient charts to show the leading countries for overall games revenue. China, as you would expect, leads Asia not only in population but in game revenue with $17.8 billion, with Japan trailing behind at $12.2 billion.and South Korea in a distant third place with $3.3 billion.

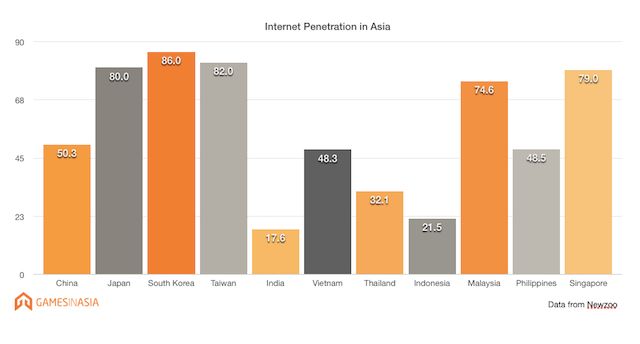

The data gets even more interesting, though, when you consider the Internet penetration in each country. China’s population on the Internet is still only half of the total population, and India is a mere 17 percent of the total population. There’s plenty of growth left ahead as devices and Internet access spread to the general population.