The Entertainment Software Association has released its 2013 survey of the US game playing market, which offers some very interesting facts and figures. First, let’s look at some context: The US retail market for games is in its fifth straight year of decline from its high point in 2008. Hardware and software sales in retail stores have been falling, and not all of it can be attributed to nearing the end of a generation among consoles. At the same time, the gaming industry has undergone an incredible expansion with mobile, social and online games globally. “It was the best of times, it wast the worst of times,” as Dickens put it.

One thing is crystal clear: Gaming has become something the majority of Americans do. The ESA notes that 58 percent of Americans play video games, with an average of two gamers in every game-playing household. Some 51 percent of American households have a dedicated game console, and most every household has either a PC, a smartphone or a game console. The average age of a game player is now 30 — gaming is not just for kids anymore. How gamers play is mostly with others — 62 percent of gamers play with others, either online or in person, and 77 percent of those who do play at least one hour a week with someone else.

The demographics of gaming are changing in another way — women are increasingly a part of the audience. In fact, the ESA found that women 18 or older are a larger part of the gaming audience than boys 17 or younger (31 percent versus 19 percent). The overall gaming market still skews slightly male (55 percent to 45 percent), but that is a far cry from where the gaming industry was twenty years ago when it created games for ‘teenage boys of all ages.’

The ESA found online games are dominated by puzzle games (34 percent) and action/sports/strategy/RPG (26 percent as a group) while what they labeled ‘casual and social’ games are only 19 percent of the online gaming audience. The remainder are in ‘persistent multi-player universes’ and ‘other’ categories. On mobile platforms, casual/social and puzzle/board games each take about 35 per cent of the audience, leaving the rest to action/strategy and other.

The ESA found that 85 percent of people are aware of the ESRB rating system, and 88 percent of parents felt it was helpful. Some 93 percent of parents said they pay attention to the content of the games their kids play, and 89 percent of the time they are present when games are purchased or rented. It’s hard to see how this explains the sales of Grand Theft Auto — are parents really aware of the content of that series

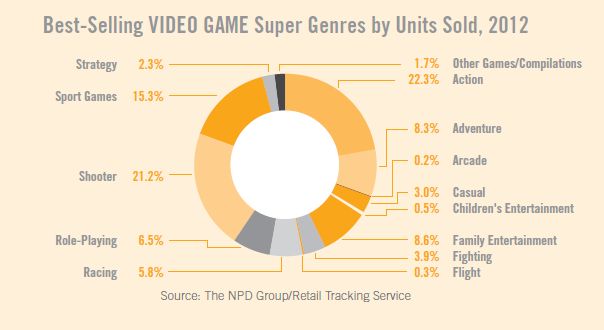

Predictably, console games in 2012 were dominated by action (22.3 percent) and FPS (21.2 percent) titles, with sports games in third place (15.3 percent). The rest of the genre breakdown had no category taking more than 10 percent of the audience. Computer games were fairly evenly split among roleplaying (28 percent), casual (26.7 percent) and strategy games (24.9 percent), with the remainder scattered amongst various genres. For both console and computer games, these numbers reflect only the number of units of titles sold at retail — which means missing a substantial amount of the action on computers, both in terms of units sold and in amount of time played. Something like League of Legends isn’t even considered in this data.

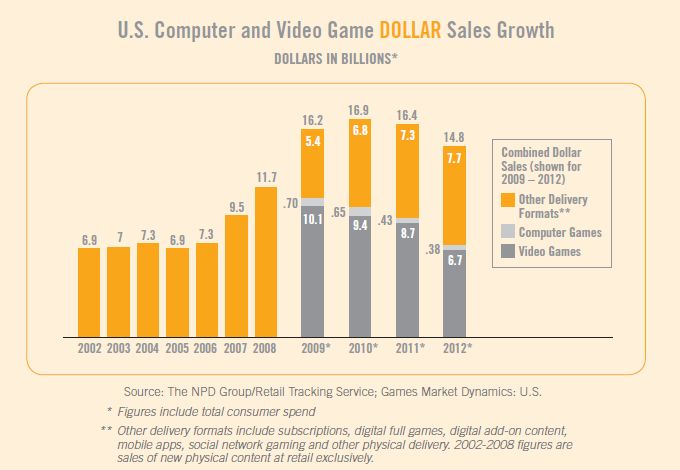

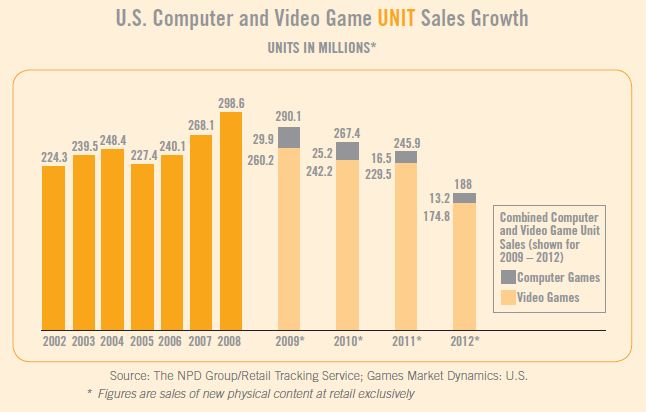

The ESA tried to put a brave face on the data regarding sales and units sold by combining retail sales data with digital revenue data from NPD. Still, the drop in unit sales and dollar volume at retail can be clearly seen since 2008. The rise in dollars from digital revenue should be looked at with the understanding that it’s not clear how NPD arrived at those numbers (and whether it’s accurate or complete), and that not all of that digital revenue went to the same publishers that were losing retail sales revenue.

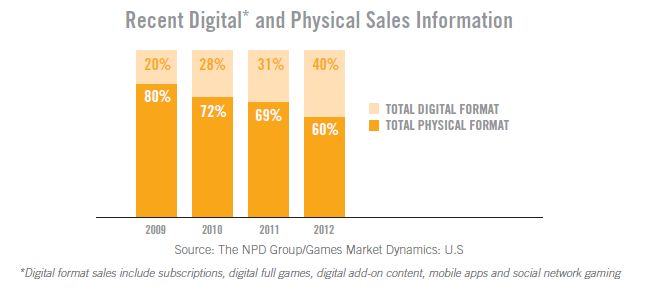

Finally, it can be seen that the total share of the market for physical sales continues to diminish, and even if you only consider PC, online and console games while ignoring the mobile market, digital revenue will be overtaking physical revenue sometime in the near future, probably this year. That does not mean physical retail sales are going away, nor does it mean an individual publisher will be doing better or worse. This shift of revenue to digital is, however, an inexorable change sweeping over the game industry, and every publisher and developer needs to determine a business strategy for it.

Source: ESA