Instead of relying on high-priced, in-game TV ads, more marketers are turning to the second screen this year to tap into digital-native audiences with hopes of piquing new fan interest. Brands like Mercedes-Benz, Rovio Entertainment, Ally Financial and Pizza Hut are giving TV a stiff arm for the Super Bowl, looking to level up sophistication of digital engagement by implementing mobile game marketing campaigns.

With over 106 million viewers annually since 2010, the Super Bowl still remains the most-watched TV event each year and one of the last mass-media vehicles for marketers to introduce a new product, or lift a long-standing marque.

Mobile devices, however, should not be ignored. Forty-seven percent of fans who tune in will use the second screen while watching the game, and 68 percent will use a device to view social media, according to an Adtaxi report.

As brands turn to mobile games more often to engage consumers, marketers are now viewing the Super Bowl as a media-buy Lombardi Trophy that demonstrates a large-scale user acquisition undertaking.

A Game That Sets Up Next Year’s Super Bowl Strategy

Mercedes-Benz, a Super Bowl TV advertiser in four previous contests, is trying to play a big game on the small screen this year with “Last Fan Standing,” a mobile competition that tests the patience and stamina of fans during the game. The last person with a finger planted on the vehicle of the virtual Mercedes-AMG C43 Coupe will win the real car, which is valued at over for $55,000.

“We looked at the mobile-gaming landscape and realized that this wasn’t going to be the year to attempt to make a commercial or viral video,” Mark Aikman, general manager of marketing services at Mercedes-Benz US, told AListDaily. “Since we don’t have a TV spot this year, we wanted to have a more contemporary, disruptive and brand-building activation that would be buzzworthy during the game.”

The backdrop of the mobile game takes place at the newly built Mercedes-Benz Stadium, home for the Atlanta Falcons and the site for next year’s Super Bowl. Aikman said the experience, which channels “hands on a hardbody” promotions auto dealers have used in the past, serves as an appetizer for a larger Mercedes Super Bowl marketing strategy in 2019.

“In some ways, this mobile game is a long lead,” said Aikman, adding that it forces a level of consumer engagement and attention that is specifically on the product. “It’s safe to say we’ll have large-scale activations next year.”

Aikman said that since digital and social are still a growing part of the automaker’s marketing mix, they wanted to use the social co-viewing phenomena to deliver a compelling prize. In addition to building brand awareness, winning new consumer consideration and simple information capture for future marketing use, the goal of the game is to get people gathered at parties to ask, “what are you doing on your phone?” and get the conversation started about Mercedes.

Due to the sheer number of car companies that advertise on super Sunday, the entire category experiences a bump in purchase consideration following the game, said Aikman, so shunning TV does not have as much marketing impact as one would think.

Down, Set, Hut!

Brands will have their own game to play this year as well on Sunday, courtesy of Twitter, which is upping the stakes for marketers with “#BrandBowl52,” a competition that will award advertisers that drive the most engagement on the platform around the Super Bowl.

The friendly brand battle further proves that owning the conversation on social and digital channels is just as critical as shelling $5 million for a 30-second TV spot on the NBC-televised game. The network is expecting to cash-in on close to $500 million in Super Bowl-related ad spend this year.

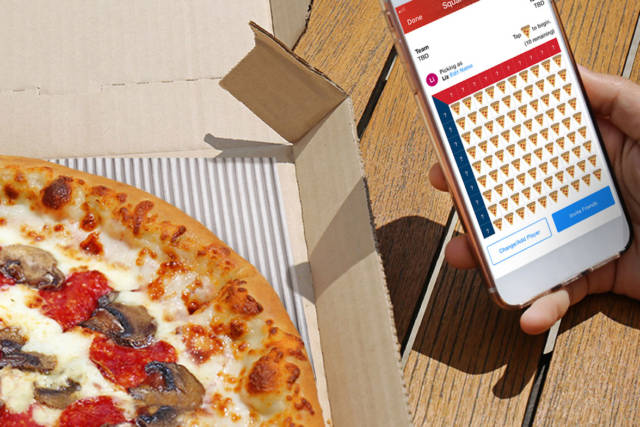

Another brand looking to capture consumers on gameday through a mobile game is Pizza Hut, which is operating on a multi-pronged Super Bowl strategy highlighted by Squares, an experience through Yahoo! aimed at driving new sign-ups to its loyalty program.

Zipporah Allen, CMO for Pizza Hut, said a mobile game makes more sense for the brand because time spent on mobile devices during cultural events like the Super Bowl continues to rise.

“Pizza Hut has a legacy of bringing more entertainment to the pizza category, and mobile gaming fits with that,” she said. “Our focus is being where the consumers are. We think it’s an effective way to drive brand preference on mobile, through sharable and engaging content.”

Allen said the brand recognizes that if it creates fun experiences for customers, the business will follow. The piemaker is also partnering with former players for a pregame, livestream ad and an in-game promotion that will potentially award pizza for an entire year to prizewinners.

“We’re always looking to maximize marketing efforts, and the right digital activations can be an effective way to increase reach, and engagement,” she said. “We view the mobile game Squares as a way to add even more enjoyment to gameday while reaching consumers at a point when they are one click away from purchase.”

NFL And Traditional Games Publisher Go For Win-Win Partnership

NFL And Traditional Games Publisher Go For Win-Win Partnership

For Rovio Entertainment, owners of the Angry Birds IP, the Finnish company’s bread and butter is video games, but because of the similarities in highly engaged audiences, live sports also serves as an interesting domain within linear TV.

Looking to expand to a more mature audience profile, the publisher partnered with the NFL to gamify the Super Bowl and used a cultural event of mass scale to reach new audiences in the US, the developer’s primary market. In turn, the NFL will potentially reach younger audiences who play mobile games as it tries to pump some younger blood into its viewership make-up in its current quest to boost slumping ratings.

“Traditional media buying has been quite inaccessible—or at least hard to justify—for mobile game publishers, as the vast majority of market growth has been built on digital performance marketing,” said Ville Heijari, CMO of Rovio Entertainment. “We see experiential marketing integrations like this as a way to build measurable, profitable and of course repeatable activations around major regional and global events.”

Fans who play Angry Birds 2 and Angry Birds Evolution can now launch their flock with the choice of any of the 32 NFL teams in new Super Bowl-themed game levels as well as in-game competitions. Collectibles can be acquired through gameplay activity, or in-app purchases (IAP), so the activation is monetized with IAP and in-game advertising.

“Some of the fastest-growing and the most-engaged audiences at the moment are found in mobile gaming,” said Heijari, adding that mobile games are now leaning toward running efficient live operations around recurring in-game events.

Successfully operating modern, free-to-play mobile games is all about running in-game events, said Heijari, and the ability to provide a fresh set of challenges and engaging content with each event.

Topical in-game events on the small screen allows for Rovio to become a part of the spectacle as it happens.Heijari said engaged audiences have become increasingly fragmented in many pockets of entertainment across different games, platforms and streaming media, which makes a company like Rovio a unique partner for the NFL to create large-scale collaborations in the mobile games segment for contextually relevant events.

A Counter Message Through Augmented Reality

Consumer spending power for the Super Bowl is substantial. Americans are slated to splurge an estimated total of $15.3 billion for the game this year, an 8.5 percent increase from 2017, according to the National Retail Federation.

With plenty of advertising aligned at taking a sack from the consumer pocketbook, Ally Financial is countering all of the cash spend by tapping into its brand ethos and flipping the playbook with “The Ally Big Save,” an augmented reality game that encourages people to “collect” money during commercial breaks through the visualization of a virtual dollar drop.

“Today there are more choices for marketers to reach their target audience than ever before,” said Andrea Brimmer, CMO for online-only bank Ally Financial. “Acceptance and usage of AR is becoming more pervasive, so this seemed like a great time to use the technology in a way that disrupts what you normally see in big-game marketing.”

The mobile game is designed to define the Ally brand’s marketing toward money mindfulness and marks the beginning of a strategy that will take the brand through 2018 and beyond, Brimmer said. It includes large-scale disruptor campaigns, as well as their traditional, digital and contextual social marketing.

Brimmer said that through previous promotions and programs, she’s identified that experience marketing like mobile games work and reach new groups of consumers that don’t necessarily consume media in the traditional ways.

“There are moments where TV is the lead, and there are moments where TV and digital seem like they are right on the same playing field,” said Aikman. “It all comes down to if the message you’re trying to deliver is right for a national audience, and if the timing is right for you.

“We certainly hope that our mobile game marketing will help win consumers who have not considered the brand before.”