Dark social — corners of the social Internet like SMS and peer-to-peer services that are significantly harder to track than sites like Twitter by virtue of their relatively private nature — is presenting itself as a complicated problem for marketers eager to target branded advertisements to diverse audiences. A recent RadiumOne report suggested that dark social accounted for nearly seventy percent of all content sharing, meaning websites likely have no idea where the vast majority of their visitors are coming from.

A study compiled from several sources including venture capital analyst Benedict Evans and published on Fusion enables us to discern two surprising takeaways about the present state of dark social and its consequences for marketers:

Facebook Controls Web Media

Amidst all of dark social’s confusing problems, one thing is for certain: In the kingdom of web media distribution, Facebook wears the crown.

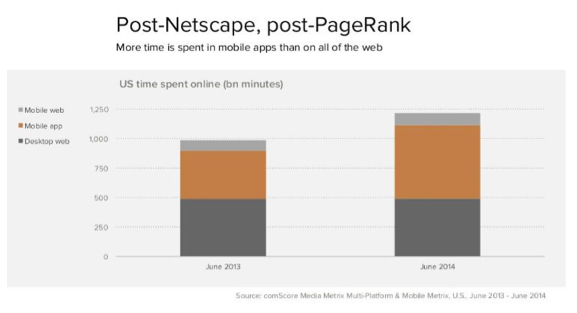

Mobile’s explosion, powered in large part by the mass availability of powerful smartphones, means Facebook is a more indispensable component of a consumer’s everyday life than ever before. The consequence for marketers and their brands lies with Facebook’s willingness to generate revenue by forcing brands to pay to “boost” their content to wider audiences, creating a situation in which marketers must spend money to generate traffic on mobile’s busiest highway.

New Software Makes Greater Sense of the Situation

Chartbeat, a popular web app used by media entities and their brands to monitor traffic in real time, launched an enhanced analysis of Facebook mobile users yesterday, December 8. As it turns out, somewhere between 10 and 50 percent of heretofore mysterious dark social traffic (depending on the link) originates from mobile Facebook users, explaining oft-reported discrepancies between dark mobile and desktop traffic rates while making Facebook’s giant scope in the mobile world that much more obvious.

Chart beat’s new reporting techniques allow the service’s analysts and marketers an unprecedented window into where web traffic — namely, referrals — originates. “These days, dark social accounts for about a third of external traffic to sites across our network,” Chartbeat’s Josh Schwartz said of traffic to their own network in an email to Fusion’s Alexis Madrigal. “That number is dramatically higher on mobile, with upwards of 50 percent of mobile external traffic lacking a referrer.”

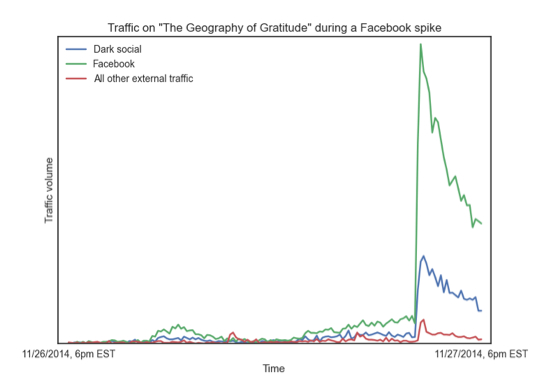

Schwartz and Chartbeat did their own research into dark social traffic origins and found three possible sources: Facebook mobile app traffic, Facebook desktop traffic when a new tab opens, and Reddit apps. Further sleuthing uncovered a suspicious spike in Facebook traffic every time dark social reported a spike.

The problem with Facebook, according to Schwartz, rested with apps like Chartbeat’s inability to record referrals from Facebook mobile apps as actually coming from Facebook until yesterday. Now that an enhanced Chartbeat is able to more accurately estimate Facebook app traffic, however, it is expected that their role as de facto gatekeeper of mobile social will appear stronger than ever as they snap up a large chunk of traffic once reported as dark social.