One of the most heated areas of interest in 2016 for the games industry, indeed for the entire technology sector, is the imminent arrival of Virtual Reality (VR) and Augmented Reality (AR). After several years of hype, development kits, glimpses of technology and demos, the hardware will finally arrive for consumers – and soon. Oculus has been taking orders for the Rift, with shipments beginning in March. HTC’s Vive, created with Valve, will also begin shipping in a few months; pre-orders are beginning February 29th. Sony’s PlayStation VR is also coming by the summertime.

That’s just the beginning; the next wave of hardware will be for Augmented Reality (AR), but that’s further away. Microsoft will begin releasing development kits for its HoloLens AR headset, and Google is rumored to have Google Glass 2.0 coming soon to some businesses for testing. CastAR’s low-cost AR will be in developer hands later this year if all goes well, and the mysterious Magic Leap has taken a huge stride forward by raising an additional $793.5 million in capital, bringing its total capital raised to $1.4 billion. “Here at Magic Leap we are creating a new world where digital and physical realities seamlessly blend together to enable amazing new experiences. This investment will accelerate bringing our new Mixed Reality Lightfield experience to everyone,” said Rony Abovitz, Founder, President, and CEO of Magic Leap, Inc. in a statement.

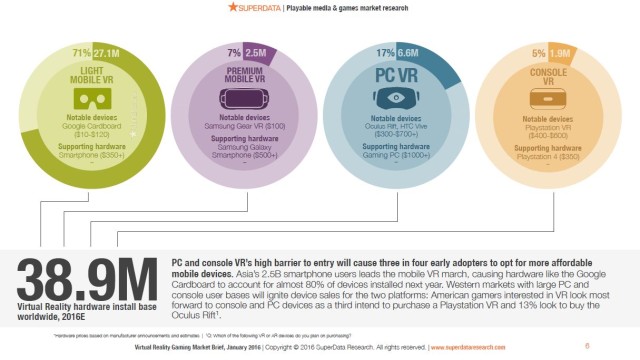

All of this means we should see three different major VR systems available for purchase by the summertime, and AR hardware should begin to be available perhaps as early as the end of this year. That sounds like a market opportunity – but how big is it? “The worldwide market for VR gaming will reach $5.1 billion in revenue in 2016E with an install base of 38.9 million consumers,” said SuperData Research in its recent VR Market brief. That’s coming as a result of over $6 billion invested in AR and VR companies between 2012 and 2015.

Let’s not get too excited, though. The potential profit for both hardware and software is not as big as it might seem, at least not right away. Oculus has already admitted that while it’s selling the Rift for $599, it won’t be making a profit on that right away. While Vive and Sony haven’t yet announced pricing for their VR hardware, it’s not likely to have large margins either because of the need to create an installed base so that the far more profitable software can be sold. So both Vive and Sony will be trying to keep the prices of their hardware as low as they can, but they are still likely to be in the same price neighborhood as the Oculus Rift.

Those prices will keep the unit numbers down for a while, and SuperData’s research indicates that what they call mobile VR will capture the largest installed base in 2016, with 71% of the market. The big market opportunity for 2016 is going to be with smartphones. Yes, Oculus and Vive and Sony are all attracting plenty of attention and will begin selling hardware in the next few months. While Oculus is looking to sell 5 million Rifts this year, SuperData projects that Mobile VR will reach 27 million units in 2016.

Devices like Google Cardboard and Samsung’s Gear VR, and competitors like MergeVR with its $99 headset that works with iOS or Android phones. At the low end we have Google Cardboard, which is so inexpensive that in many cases it’s been given away for free. Or with templates you can download for free and a little quality time with a utility knife and some cardboard, you can make your own. The Gear VR is $99, as is MergeVR, and no doubt we’ll see other low-cost units where you can slip in a smartphone and try out some VR experiences.

Yes, that mobile VR is nowhere near the immersion of the high-end VR hardware. But the hope is that the experience is compelling enough to get people motivated to spend the money on the high-end devices.

SuperData’s VR Gaming Market Brief projects $5.1 billion in revenue for 2016, but how much of that is in hardware rather than software? Probably vast majority… and given that Oculus at least is selling the hardware with little to no profit, according to Palmer Luckey’s statements, it doesn’t seem like there’s going to be much profit in this business in 2016. That looks to me like a very risky market for a small studio to enter. And with big publishers generally avoiding VR titles for now, that would also seem like an indication that profits are unlikely in the next year or two. Shouldn’t that concern companies looking to enter the VR market?

“Absolutely,” says SuperData CEO Joost van Dreunen. “The risk on an unproven market is enormous. But, it comes with the potential of great reward, namely, the opportunity to not just be a fast-mover, but to develop the application that defines a medium or a technology. Companies currently developing for Oculus or PSVR are wagering they’ll become the Angry Birds of VR.”

That’s a tall order, but van Dreunen believes the enthusiasm and investment in VR is evidence that the market is going to develop over time. “What’s unique about this hardware release is that everyone is so keenly aware of it,” van Dreunen noted. “I recall that around the launch of the iPhone there were skeptics than believers. For VR that is quite the opposite, fueling an already inflated sense of optimism.”

The market’s development this year is a critical period. According to SuperData’s count there are some 829 VR games under development right now, a stunning number. Yet, at the same time, it’s not at all clear what the business models will be for these games. Will we see $50 or $60 VR games? Will they be free-to-play with virtual goods? Or will there be some mix of different business models? No one knows yet, and certainly the first few VR games will be taking some chances no matter how they decided to earn money for their efforts.

This no doubt explains why the biggest game publishers like Activision and Electronic Arts aren’t leaping into the VR market just yet, instead keeping a close eye on it and experimenting with the hardware internally. Sony is the one exception here, as with their PlayStation VR headset they are funding a good amount of VR game development. Sony certainly knows that great software is needed to sell hardware.

Many of the answers to these questions will emerge over the next few months, and we can expect the E3 show to contain a great deal more information on the VR market. All of the major hardware will be in place and eager to set the stage for a big holiday selling season. The E3 show should see retail and marketing plans detailed, along with key launch titles for all of the VR hardware. There will also be some knowledge of the initial acceptance of VR hardware, as we’ll have some months of sales to look at along with plenty of game reviews and social media buzz.