SuperData is a research firm for the games industry that’s doing more than just looking at sales numbers. The game industry has been evolving rapidly in the last few years, with new business models emerging in a virtual Cambrian Explosion of forms, building on the revolutions wrought by digital distribution and the rise of smartphones and tablets as the leading gaming platform.

All of this rapid change has been difficult for game companies to manage, and SuperData took a detailed look at the UK game development community in order to see how various companies are coping with the evolution of the games industry.

The introduction to the study noted this: “It is tempting to think that the emergence of new technologies and platforms has rendered useless all wisdom regarding markets and industries. Yet, in spite of the spectacular ascension of mobile games as a key entertainment market, valued at $21 billion in 2014E worldwide, many of the same principles apply. For instance, the increasingly crowded mobile and social games markets now demand a strong and properly-funded marketing strategy, much like the traditional retail-based games business. Similarly, audiences have come to expect more sophisticated game play even from relatively simple games. In total, this amounts to an increase in development costs and, consequently, risk.”

SuperData’s study found four key areas for game developers that together comprise the company’s business model. The four areas are customers, partners, platforms, and revenue models.

While the most well-known game companies are the ones that create games to sell to consumers (either directly or through distribution partners), many smaller developers subsist partially or wholly through developing games for hire. Large game publishers don’t necessarily have all the staff they need to create every game, so some projects are given to small developers. In the past this was the classic way development studios got started — a few people would break away from a big publisher, form a studio, and get contracts to (usually) create ports of a game from one platform to another. Eventually, having proven themselves over time, such a studio might be hired to produce an original title under contract. Some of the best studios eventually became publishers themselves, or more often were purchased by large publishers.

SuperData found that for the studios they spoke to, 36 percent had consumers as their main customer, 27 percent sold to businesses primarily, and 37 percent said both were an equal part of their business. Diversifying your revenue streams is a good way to reduce risk, though the danger is that the company may lose focus and be less effective at either or both types of business as a result.

Now, though, the model can be different. The advent of digital distribution means developers can market games directly to consumers without the need for a sales force or the capital to build inventory. Still, there’s plenty of risk in that undertaking.

Partners are a key strategic consideration, SuperData notes, and one that’s important in reducing risk. Building strong relationships with other businesses is crucial to success, and to reducing risk. Not surprisingly, studios focused on partners that provide access to markets as being very important to them. This might be platform holders (as in working with Steam or Apple’s App Store) or it might be publishers. In some cases it’s licensing partners or even media partners, as some studios have found that including media partners in sports games is a great way to help promote the games.

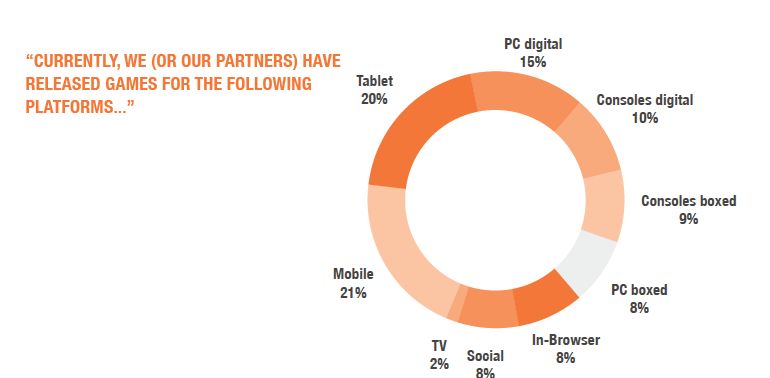

The platform mix is one area that’s changing rapidly for game studios. The massive growth of tablets, and the device’s suitability for games, is no doubt responsible for the 136 percent growth of that platform in the past two year’s for the survey respondents. Social grew 67 percent, which may surprise some given the drubbing social games have taken in the media (and some high-profile declines like Zynga). Yet social platforms like Facebook are still a good business, and a relatively easy platform to work with (as well as having low technical requirements). Mobile has gained 50 percent, and PC digital 46 percent, while browser-based games have grown 22 percent. Digital console games are flat, while boxed digital games have dropped 8 percent as a target platform, and PC boxed games have dropped 2 percent.

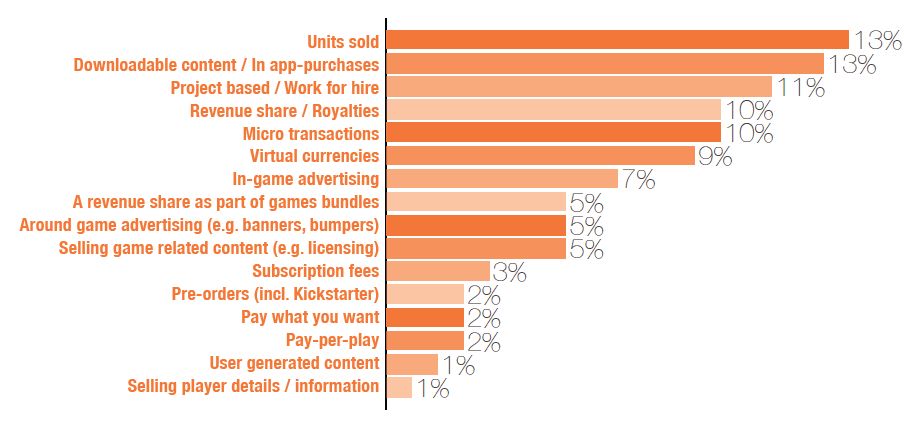

The revenue model, or monetization, is “where the game industry has really innovated over the last few years,” SuperData’s study proclaims. Indeed, the diversity in exactly how games make money these days is vast and often bewildering. Most firms are not relying on any single on revenue stream in particular, SuperData found. Quartic Llama, an independent developer, mentioned that in order “to reduce the risk, we operate using a number of models depending on the game.” While this approach is not appropriate for everyone, SuperData points out, “it highlights the adaptability required in an unpredictable marketplace.”

Interestingly, the most popular way to generate revenue among the UK companies surveyed is by selling boxed games. As the study notes, “Despite the emphasis in industry publications on the shift to digital, selling units is still the backbone of game revenue in the UK, in combination with selling downloadable content. This is, however, changing, with an AAA console studio positing that ‘the market is moving away from high price point console titles.'” As you might expect, the study found that for most independent developers the goal is to get out of the work-for-hire cycle and create their own original titles.

Summary

SuperData noted in its summation that “The advent of digital distribution channels is changing the gaming industry. Specifically, it is changing how UK games companies’ define and operationalize business models. Indeed, 63 percent of our respondents changed their business models in response to the changing landscape — a shift in power structure, a massive increase in competition and a decoupling of content from physical information carriers resulting in more possibilities to generate income and longer product life-cycles. The overall trend we are seeing is a greater emphasis on business model configurations that attempt to de-risk a company’s actions and outputs.”

It’s important to realize that there is no one correct answer for all companies. Different businesses have different strengths and weaknesses, and the essence of a good strategy is taking advantage of your strengths and minimizing your weaknesses. There are many more choices available to developers these days in all areas, from customers to partners, from platforms to revenue generation. That’s both good and bad, as it means the chance of finding a successful strategy is greater, but it’s also far more difficult because so many more variables are involved.

It’s important for game developers to stay on top of changes in the business and continually gather information — and that’s part of the reason that companies like SuperData, and for that matter [a]listdaily, are in this business.