Mobile marketing automation company Swrve has released its latest report on mobile game monetization, and as usual, the data provided give marketers invaluable insight into the state of the mobile games market. This information is critical to not only the marketing, but to the design of mobile games, as the two are inextricably linked these days.

Swrve’s report deals only with free-to-play (F2P) games and the revenue delivered by in-app purchases, which means it does not address premium games such as the $6.99 Minecraft mobile, nor advertising-supported titles, subscriptions, or other variations on revenue. Still, F2P games account for well over 90 percent of mobile game revenues, and this data is vital to understanding what’s happening. One more thing to note is that this report covers the month of February 2016, so it doesn’t look at long-term patterns. However, it does cover tens of millions of users and their associated monetization events.

Swrve originally conducted this same study in January 2014, and found that only 1.5 percent of active players made in-app purchases. This time, Swrve saw an improvement, with 1.9 percent of players making a purchase within the month. “That means that excluding any revenue from advertising (which does not fall under the scope of this report), the vast majority of players deliver no revenue, again confirming that greater care should be taken in user acquisition to ensure, as much as possible, that onboarded users fit the subset of ‘spenders’. Why spend money on users who will never generate revenue?” Swrve noted.

These numbers bear close examination, because of both the trends and the overall situation with F2P mobile games. Most games seem to operate with a very small percentage of players providing the bulk of the revenue, which should concern everyone. If you have a million players but most of your money comes from only a thousand people, what if something happens to drive away that small number? It’s more than just theoretical; as there have been games that rolled out a design change, thinking it wouldn’t matter, but ended up losing a significant number of high-value players because of it.

Thus, keeping an eye on the general state of mobile F2P games is important when deciding your own marketing and design strategy for your mobile games. After all, the players are comparing games all the time, and there are plenty of alternatives if yours isn’t a good play value for the money.

Swrve looked at a number of other important mobile game monetization aspects. For instance, the report found that the monthly mean average spend is $24.66, up from the $22 seen two years ago. The average number of purchases per month is 1.8, with an average value of $13.82, both an increase over 2014.

Multiple purchases are uncommon, since 64 percent of players only make a single purchase in the month, which is up from 49 percent in 2014. At the other end of the scale, over 7 percent of paying players make five or more purchases in a month, which is down some 13 percent from 2014. Swrve notes that this may be due to a change in the behavior of gamers, or developers encouraging that pattern, or perhaps something of both.

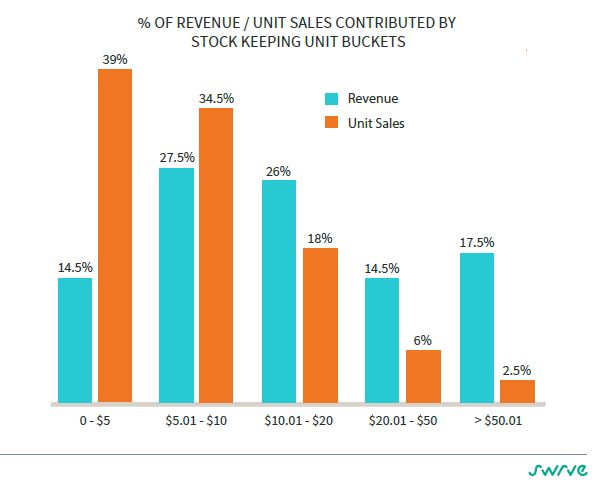

The report notes that while the bulk of purchases (over 39 percent) are between $0 and $5, they only account for 14.5 percent of the revenue, down from 27 percent in 2014. The trend has gone in the other direction at the high end, sales over $50 make up only 2.5 percent of the total purchases, but supply 18 percent of the revenue—an 11 percent increase from 2014. Clearly, so-called “whales” are more important than ever to generating revenues.

Price points all over the scale generate significant revenue in different ways. That is, there’s no clear data pushing marketers and game designers from preferring one price point for in-app purchases over another. The best price points are therefore going to be determined by the nature of the game, its audience, and the data derived from purchases over time. It’s a good idea to have a range of price points to give the audience a chance to show what they like and how much they are willing to pay for it.

Back in 2014, Swrve’s report showed that over 50 percent of all revenues within the month came from just 10 percent of those making purchases, which meant that less than 0.2 percent of the total player base generated more than half of a game’s revenues. “Apparently things have got a little ‘better’,” Swrve’s report noted. “Sure, a full 48 percent of revenue still derives from the top 10 percent of payers, but that’s a little down on previous trends. To add context to that number, if we express that group as a percent of total players, they still represent a mere 0.19 percent of that group. In other words, over 48 percent of all revenues come from a mere 0.19 percent of all players!”

At the same time, some 60 percent of all payers contribute a little less than 20 percent of total revenues, which is an improvement over 2014. Clearly, marketers must learn as much as possible about the customer base and figure out how to acquire, engage and retain the best-quality players. The possibility for improvement is enormous, given that a small percentage of players have a huge impact on revenues. On the flip side, if you get any part of acquisition, engagement, or retention wrong, you could see a huge drop in revenues. No pressure, right?

Swrve also noted that over a quarter of the sample size were “new.” That is, playing the game for the first time in February. That’s down significantly from the over 50 percent it once was, suggesting that players are more likely to stick with a favorite game than constantly look for new ones.

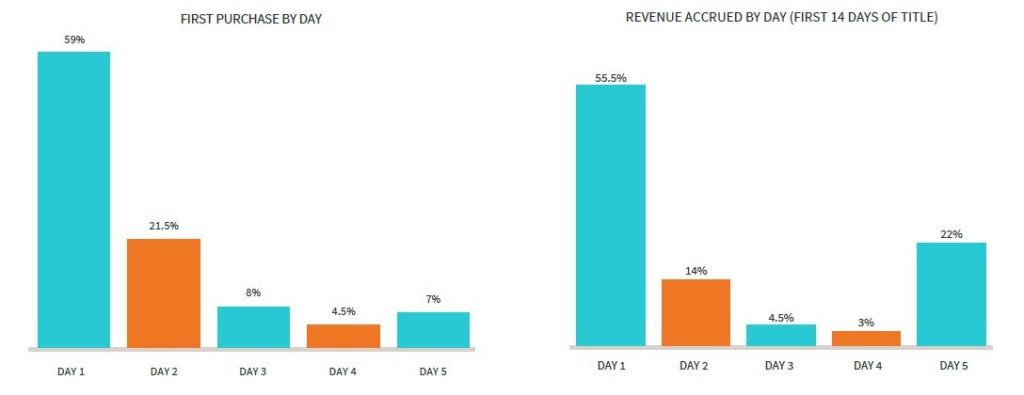

Notably, the time to first purchase has dropped to 14 hours, and 59 percent of purchasers make that purchase in the first day after install. Some 55 percent of all revenue comes on the first day, and only 22 percent comes after day 5.

Marketers face more responsibility than ever for the success of a game, particularly a mobile game that relies on converting users into paying players and keeping them for a long period of time. It’s no longer enough just to acquire installs. Marketers have to find high-quality players who are likely to stick with the game and be motivated to spend. Certainly, the game’s design bears some responsibility, but designers need to rely on marketers for insight into the marketplace.