The rise in eSports has been significant enough to attract the interest of non-gaming brands in recent years. We’ve seen Coca-Cola and American Express sponsoring League of Legends in various ways, but the corporate connection doesn’t stop there. As the eSports audience grows, brands are attracted more than ever to the demographic of the eSports audience: young sports fans who aren’t followers of classic sports, where the brands reach them through television. This is a worldwide audience, too, and it’s getting significant attention from global brands who are forward-looking enough to see the opportunity.

Analytics firm Newzoo has just made available a new report on The Global Growth of eSports: Trends, Revenues and Audience Towards 2017. The company spent the past six months developing Newzoo’s Global eSports Audience & Revenue Model to create an exclusive 68-page report, which it bills as “the first of its kind in the industry.”

Newzoo’s taken a comprehensive look at the eSports market, looking to provide exactly the sort of data and insights a brand would need to evaluate whether or not to use this as part of its marketing strategy. In Newzoo’s words, “The report provides a much-needed overview of the eSports economy and a realistic estimate of its future potential in terms of viewers, participants and revenue streams. It contains a mixture of trends, proprietary data from our models, primary consumer research and input from key players within the eSports space. Global sports marketing research company Repucom assisted in setting up an extensive comparison with traditional sports on revenues and consumer engagement. This comparison, which has revealed valuable new insights on the potential future of eSports in terms of revenues, also highlights the factors that will determine the future of what once was a ‘niche pastime.'”

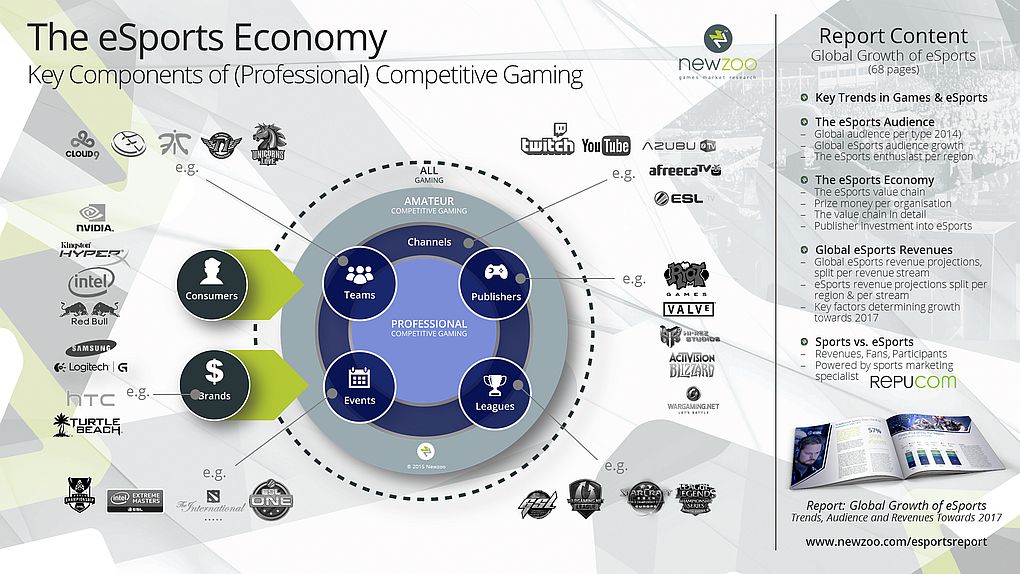

The eSports Ecosystem

Newzoo’s model incorporates five key components: Channels, Publishers, Leagues, Events and Teams. These components are not mutually exclusive with many companies taking on more than one role. ESL for example owns a channel (ESL.TV), organizes events for publishers and sponsors and owns its own leagues and events. Money from both Brands and Consumers are feeding this thriving ecosystem, Newzoo notes.

“Over the past few years we have seen a large number of global brands entering and investing heavily in this space,” Newzoo said. “This is not surprising as the report clearly indicates that the eSports audience is far more likely to spend big money on games, digital media subscriptions, hardware and peripherals, making it impossible for gaming hardware manufacturers to stay away. Brands outside of the games industry such as Coca-Cola, RedBull, Nissan and Samsung seemingly cannot resist the lure of eSports and the valuable young male audience it appeals to.”

“eSports provides us the perfect platform to engage and celebrate gamers, competitive gameplay and the gaming community,” said James Grunke, Director of Global eSports, NVIDIA.

The latest big brands to leap onto the eSports bandwagon include Duracell and Taiwanese mobile phone maker HTC, who has just been announced as the sponsor for team Liquid, Team SoloMid, and Cloud9.

HTC doesn’t want to be known just as a smartphone maker any more, notes The Verge in its report on HTC’s eSports sponsorship. Cloud9, Team Liquid, and Team SoloMid have all warmly welcomed HTC into the realm of e-sports, promising to produce “a top-notch video series with players” from each team and HTC’s support. There’ll be giveaways as well, giving e-sport fans “opportunities to snag some amazing new HTC devices.” This comes at a time when HTC is preparing to introduce its newest Android smartphone, the HTC One M9.

HTC’s participation in e-sports is not unusual for tech companies that have a gaming interest, but HTC doesn’t — at least, not so far, though that may change in the future. In the gaming arena, Asus is sponsoring a DOTA 2 team, while Polar, Gigabyte and Alienware run small-scale tournaments, and hardware brands like Astro, Kingston, Logitech, Eizo, and Razer are associated with either individual players or teams.

“eSports is a major part of Intel’s marketing strategy with regard to gaming enthusiasts,” said George Woo, Worldwide Event Marketing Manager, Intel. “They are web-savvy people who know exactly how to avoid traditional marketing, do not watch TV, use ad block in their web browser and consume their entertainment almost entirely on-demand. Our answer to this was to partner with ESL to create the Intel Extreme Masters, a series of competitions that visits every corner of the world and has become one of the primary sources of entertainment for millennial’s everywhere. The Intel Extreme Masters has proven more than worth the spend for Intel.”

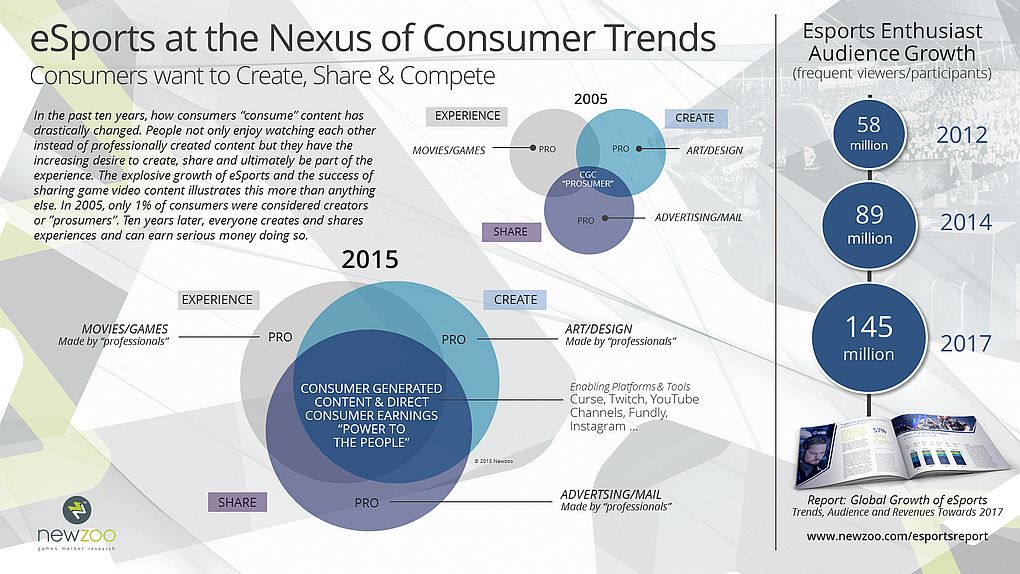

Newzoo sees eSports as “the nexus where a variety of powerful global industry and consumer trends converge,” the company said. “This is why we will see 145 million enthusiasts by 2017, up from 89 million last year. The fact that there are another 100 million people across the globe who view eSports content occasionally only increases this potential. The free-to-play business model has demolished entry barriers to multiplayer gaming services and is a key component in the ranking domination of competitive games such as League of Legends, DOTA2, World of Tanks, Counter Strike and Smite. The cross-screen distribution of game video content by consumers themselves and the brand interaction this creates are other factors contributing to the success of eSports. Consumers interact with and participate in their favorite brands through a variety of digital media, consumer-generated content and real-life events.”

“eSports gives teams like FNATIC a fantastic opportunity to have high quality engagements with their audience through a variety of rich digital mediums, i.e. Social media and live streaming, that traditional sport teams just haven’t got a grasp of yet,” said Saad Sarwar, Sales Director, Fnatic.