The growth of the Chinese market for games has been impressive over the past decade, and it doesn’t appear to be slowing down anytime soon, largely spurred by the ever-growing mobile game market. Market research firm Niko Partners released its latest report recently, 2016 Chinese Mobile Gaming Report and 5-Year Forecast, showing that Chinese mobile game revenue will reach $8.3 billion in 2017 after growing 28 percent in 2016. Game publishers cannot afford to overlook such a huge potential market, but there are many obstacles to success in the China mobile game market.

That $8.3 billion in revenue represents a full 31 percent of all digital game revenues in China for 2017, according to Niko Partners’ estimate. That’s up from 11 percent of digital games revenue in 2013. China has surpassed the United States to become the biggest market for mobile games (particularly iOS) in terms of revenue, according to market intelligence firm App Annie. China’s revenue from iOS games nearly doubled in one year.

App Annie found that locally developed games were dominant in China, and the main reason for the strong growth. “Specifically, massively multiplayer online role-playing games (MMORPG) like Fantasy Westward Journey, Westward Journey Online and multiplayer online battle arena (MOBA) games like Hero Moba were main drivers of China’s growth in iOS Games revenue. China will continue to present huge opportunities in mobile gaming. While foreign publishers have seen success in the the country—as evidenced by Clash Royale ranking at number 10 by iOS revenue in Q2 2016—local publishers dominate the top iOS revenue chart,” App Annie stated in the report.

Mobile games in China have made great strides in recent years as part of the total gaming scene in China, but all is not clear sailing for mobile game publishers.

Government Restrictions on Mobile Gaming in China

Back in June of this year, a Chinese government agency in charge of censorship issued a notice that mobile game makers must submit their content for approval with the agency 20 days prior to launch. Those games that are already on the market will have to be submitted for approval by October. The regulations appear “very comprehensive” according to Niko Partners’ manager and co-founder Lisa Cosmas Hanson. “It will insure that all mobile games get approval by 20 days prior to launch, and retroactively for those games already in the market,” said Hanson. “The games already in the market have until October to get their approval, and any major changes or updates to existing games must also be approved in the same manner.”

The effect of these regulations is mixed, according to Niko Partners. “The regulations that began in July 2016 will curb supply by slowing the new games into the market and speeding up market consolidation of smaller studios. But the regulations will not curb demand, which is still voracious, for the tens of thousands of games that are currently available to Chinese gamers.”

Opportunities for Mobile Games in China

Despite these new regulations, strong growth is forecast for mobile games, but it’s going to require more effort. “The new regulations are daunting, but by understanding the Chinese gaming audience, the rules and the process game developers can still release games into the market, albeit at a slower rate,” said Hanson. “Now more than ever it is crucial to study Chinese gamer behavior, build relationships with publishing partners, and invest in localization that reflects cultural understanding beyond the requirements for all games to include only Chinese text.”

The market size for mobile games in China is impressive, with Niko Partners projecting some 465 million Chinese mobile gamers by the end of 2016. That’s up by 100 million players in only two years, and the growth is likely to continue. The increasing market share of lower-priced Chinese-made smartphones is helping to spread the audience further, as these powerful devices reach an eager new audience.

The market for mobile games in China is increasingly dominated by two players, according to Niko Partners. Tencent and NetEase together command over 70 percent of the market share. Tencent alone has 53 percent of the domestically derived mobile games revenue. Both Tencent and NetEase showed significant growth in their recent second quarter results; Tencent’s revenue increased by 52 percent year over year to $5.3 billion, while NetEase’s revenue shot up 96 percent year over year to $1.3 billion. Those two companies continue to pull ahead of others in the Chinese market.

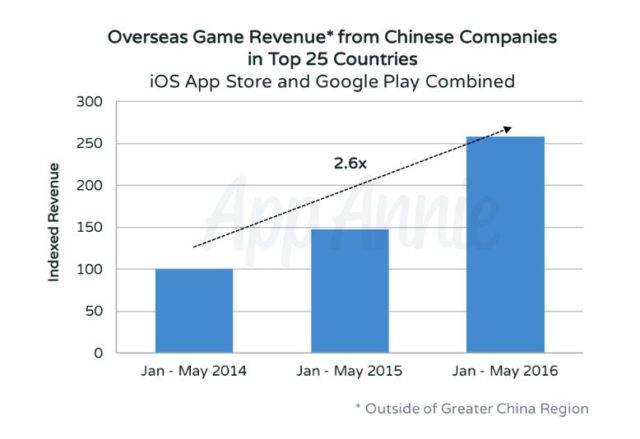

As well as improving revenue from China’s market, Chinese game publishers are doing well by exporting mobile games to other markets. Niko Partners reports that Chinese mobile game developers will generate an additional $1.3 billion in 2016 from mobile game exports to other markets, and nearly double that to $2.1 billion by 2020. While there are certainly cultural differences between some games popular in China and elsewhere, the leaders in the market are figuring out what works in other markets and how to adjust titles to succeed.

The opportunity for Western publishers in China is large, but not easy to seize. It’s no surprise to learn that many of the biggest game companies have deals with either NetEase or Tencent to help bring their games to market in China. That sort of partnership is beneficial on many levels, from providing help with localization to help with navigating government requirements. “Foreign publishers may see more success in the market by partnering with Chinese publishers to cater to local demand, secure distribution and generate awareness. Together, China, the US and Japan are responsible for approximately 75 percent of gaming revenue on iOS,” App Annie said. “Since Games is the single largest revenue driver on iOS, we predict that China has the potential to become the #1 market for overall iOS revenue in the coming quarters.”