App Annie has released its latest numbers on mobile games for August, with an enormous surprise: Supercell has lost the #1 position on the top-grossing chart, only the second time this has happened in the last 19 months. The new #1 is the world’s largest game company, Tencent, which grabbed the prime position global iOS revenue earner by virtue of two new games: The Legend of Mir 2 and The King of Fighters’ 98 Ultimate Match. App Annie noted that both of these games leverage well-established IP, with the former based on a hugely popular MMORPG from the early 2000s and the latter based on a late 1990s title that was a hit both in arcades and on consoles. Interestingly, both titles are only available in China — which “further demonstrates the growing importance of this market and the impact it has on the worldwide rankings,” App Annie noted.

App Annie also pointed out the difference in the two gaming company’s strategies, “with Supercell focusing more on building and then scaling one smash hit at a time whereas Tencent takes more of a diversified portfolio approach with 200+ games in a variety of subcategories (ranging from puzzle to hardcore).” App Annie’s VP of marketing communications, Fabien Nicolas, spoke with [a]listdaily about the surprising August results and what this means for mobile gaming.

Do you expect Tencent’s position at #1 to continue Why or why not

What’s interesting from a market perspective is that iOS in China is growing very fast. Apple did a communication that July in China was a record month for App Store revenue. A big reason the spike was so high was the growth of China month per month. Tencent has this huge footprint in the Chinese market. We can never say for sure that next month you’re going to see the same trend, but they are on this rocket ship that is the iOS App Store. Whether they stay #1 or not remains to be seen, but they are very well represented in this number one market that’s blowing up. They have a wide portfolio strategy, with several games for different audiences, and as long as they keep at it they will remain very well positioned for the coming months.

Tencent embodies the portfolio strategy of doing a lot of good games and hoping for some hits, while Supercell does few games but does them very, very well. Is one strategy better than the other

We see some companies focus on fewer hits, like Supercell or Machine Zoneare illustrations of that. King for the longest time had a huge focus on Candy Crush, and then added Soda Saga to it. You have Tencent on the other side — ‘I’m doing games for many audiences’ — and a mix of first-party and third-party as well. Tencent is not just doing their own games, not just doing external games, but a mix of the two. It’s really new to see somebody with this more diversified portfolio approach that’s taking the number spot, versus people who are focused on doing fewer games (and first-party games only). It’s going to be interesting to see how other companies are reacting to that, whether they diversify and add more third-party games or not.

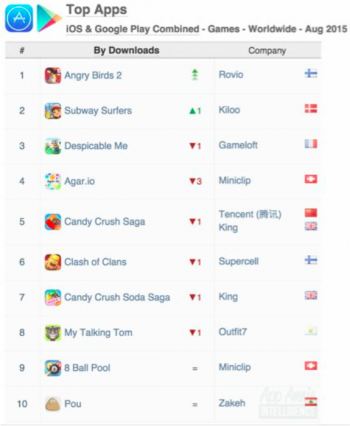

Angry Birds 2 has a great position in terms of downloads, but the revenue for that title hasn’t kept pace. Will that change

It’s always really exciting when you have a franchise like that branching out in terms of entertainment. The key aspect is we’re really focusing on the Top Ten but right now we haven’t seen Angry Birds 2 breaking into the Top Ten for revenue. When we look at the monthly active users, beyond downloads, they were #6 in August, which is good. That means the app is being able to engage users. It remains to be seen whether they are going to be able to monetize at a higher level in the coming months.

Most of the games in the top ten have been there a long time — are we going to see new games break in any time soon

Words With Friends had a major update from Zynga, so it was like a new release. This is what we’re seeing on our usage data for US users of iPhones. We’re seeing many games with staying power, even in the casual segment. It’s definitely not an easy thing to get a new game in the charts — our theme for our talk at Casual Connect was “beating the odds.” We’re closing in on 3 million games in the app stores. Many of those games have very significant marketing investments, so it takes a lot to really break through and stay up there. You can see Happy Wheels, a small independent developer that put a lot of heart and passion into their app and really polished it, getting great traction in terms of downloads and making it to #2 in terms of downloads. It shows there is the possibility of getting great traction worldwide for a small independent developer.

What are you excited about for the next quarter Will the new iPhones have a big impact on mobile games

The new iPhone is always exciting, and you can always see a number of games being put on new iPhones. The other thing that I’m really excited about is the Apple Watch. We’re already seeing over 12,000 apps. I think the number of games available now is really significant. What is essentially a new platform with very strong constraints will force a great deal of innovation. I’m looking forward to seeing more and more people cracking the code, and figuring out how to build either an extension of your core game or full-on new games that leverage the format really well. I’m excited by the extentions for the Apple Watch, and that’s where we’re seeing a lot of traction. This will turbocharge the growth in territories like China.