Imagine having a deed to a coveted work of art or a one-of-a-kind baseball card that can’t be forged, duplicated or lost because it exists in a permanent database. This kind of deed exists. It’s called an NFT, which stands for non-fungible token, and it’s creating a frenzy in the digital world.

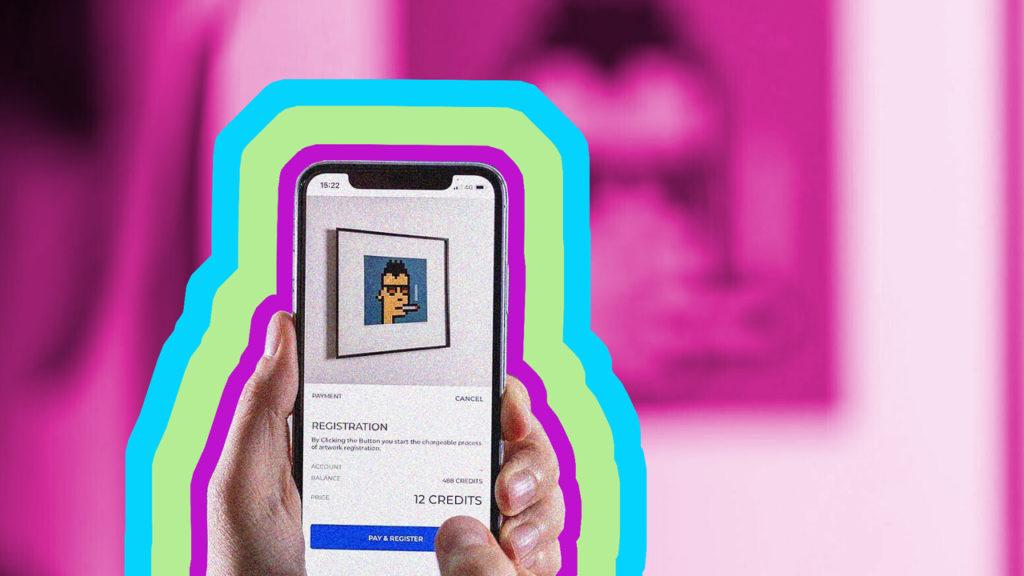

By definition, an NFT is a digital certificate of authenticity for a real or virtual object. This digital file is stored on a digital ledger, also known as a blockchain network, that certifies it to be unique and interchangeable. So, what’s all the hype about these tokens? Basically, NFTs create digital scarcity, enabling people to acquire and then flaunt collectibles or certain assets. They give people the power to say, “Hey, I own this and it’s the only one like it in the world.” Needless to say, NFTs as technology are a really smart idea and definitely have a future in a world that’s increasingly being dominated by tech and the desire to stand out.

With the recent buzz around Twitter chief executive Jack Dorsey’s auctioning his first tweet, the sale of several high-profile memes and digital artist Beeple’s creation of the first all-digital NFT (sold at Christie’s for $69.3 million)–it’s not hard to understand why some are fascinated with NFTs. NFTs aren’t currently being used as deeds to homes or cars, but they are primarily being used for cards, art and collectibles.

Despite making headlines in recent months, NFTs aren’t necessarily new. One of the first consumer-facing NFTs was actually an Ethereum blockchain trading game called ‘CryptoKitties’ by CryptoPunks. Launched in June 2017, it involves the purchase, collection, breeding and selling of virtual cats. Some fetch enormous price tags and are among the most expensive NFTs to date, like the $390,000 CyrptoKitty Dragon. Since CryptoKitties was born, people have spent $174 million on NFTs and a bunch of industries have tried cashing in on them.

In the art world, NFTs are all the rage. In March, digital artist Beeple compiled his 13 years of art into a collage, titled it ‘The First 5000 Days” and auctioned the piece at Christie’s for $69 million. The sale sent shockwaves throughout the art world overnight. The interesting thing about this though is that it’s not as revolutionary as people would imagine.

Before NFTs, blockchain and computer technology, an art collector could purchase a work of art, own it, then display it indefinitely at a gallery or museum. In essence, the collector bought bragging rights and potentially an investment. Now, NFTs serve nearly the same purpose, just with non-tangible items instead. In a digital world, NFTs are the answer to owning, displaying, and investing in digital art. And I believe that, moving forward, NFTs will play a more important role in the digital art trade and subsequently inspire the creation of more digital art.

The use of NFTs in the digital art space benefits both artists and collectors and may allow the artist itself to act as a collector or as an investor would, but without the total loss that a sale of the art would bring. NFTs allow the creator to specify a “royalty” that they get every time the NFT gets sold. So imagine you create an artwork and sell it. Then that person sells it in a few years, you can get, say, 10 percent off of each time the artwork gets sold. That’s HUGE because in the past the sole beneficiary from the sale of art is the dealer. They buy it cheap while the artist remains unknown. But many years later the artist is either retired or dead and at that point the art is worth way more money. Now when it gets sold, a royalty gets paid to the artist (or their family).

Another industry that stands to gain something from the rise of NFTs is the events space. Concerts, sporting events and conventions are ripe for a convenience haul. NFTs could digitize tickets and may even incentivize event organizers to offer special perks to loyal fans. In turn, these fans would be able to effortlessly display their super-fandom given that their NFT tickets indefinitely remain on the blockchain. Plus, NFTs as a concert ticket could be a way to stop scalpers. In fact, the Dallas Mavericks are thinking about switching their tickets to NFTs.

Record labels and musical artists are also tapping into NFTs. One early adopter is Warner Music Group (WMG), which just announced a worldwide partnership with Genies, an avatar technology company that just debuted its 3D Avatar and Digital Wearables NFT SDK. According to the press release, WMG artists’ favorite cultural moments will be transformed into “Digital Wearable Drops”—apparel, accessories and tattoos—and sold to fans’ Genies avatars. Fans can own and use these digital wearables on their Genie avatar until the end of time. The process will take place on the Genies Marketplace, which will run on Dapper Labs’ Flow Blockchain. Side note: Dapper Labs is the blockchain technology company and maker behind NBA Top Shot (which WMG is invested in).

If the NBA’s dabbling in NFTs via Top Shot is any indication, the events industry is edging closer to NFT adoption. Top Shot is the Association’s attempt at selling officially licensed digital collectible ‘Moments.’ Moments are just that—moments in which a player did something in a game worth converting into an NFT. NBA Top Shots are appealing in part because they boast common, rare and legendary game day moments, causing new packs to sell out within minutes after release. Collectors who miss a drop can purchase a specific moment from other collectors. This gives fans the flexibility to “own their fandom,” according to the NBA. Seeing how simple and successful the NBA has been with Top Shot, it wouldn’t surprise me if other sports and game franchises like Pokémon venture into the NFT space.

The fast-food space has also leveraged NFTs as a marketing tool. Around the time that Beeple’s art was being auctioned off at Christie’s, Taco Bell issued 25 digital assets, taco-themed GIFs and images, on the NFT marketplace Rarible. As The Verge reports, the NFTs sold out in 30 minutes and proceeds benefited the Live Más Scholarship through the Taco Bell Foundation.

Lest we forget how the luxury fashion brands fit in the NFT picture. In March, Gucci tested the waters before going full-on NFT by dropping $12 augmented reality (AR) sneakers on its app and the Wanna app. The label sold the AR sneakers as a part of an access pack that let shoppers virtually try on the shoe by taking a picture or a video, which would then unlock the shoe on Roblox. As some critics have already noted, when luxury brands support NFTs, they contradict their sustainability commitments because of their environmental impact.

You’re probably wondering how something intangible like blockchain technology can have a negative impact on the environment. In a nutshell: NFTs are bought and sold on digital marketplaces that use the cryptocurrency Ethereum, which is like Bitcoin but also supports NFTs. In order to “mine” Ethereum, a lot—and I mean a lot—of energy is required. And it has to be energy-intensive in order to prevent anyone from messing up the ledger. In total, Ethereum uses almost as much electricity as the entire country of Libya. That’s no joke.

Other than addressing its environmental footprint, if NFTs are to last, there’s a lot of work in terms of regulation that has to be done. As of this writing, there are no laws that say the seller of an NFT has to do one thing or another. There’s no rule mandating that the NFT URL for a piece of digital art remain intact indefinitely, or even that the artist must maintain the site or keep the artwork displayed on that URL. What if the artist were to take the site down or trade the artwork for another? The buyer is screwed. Unfortunately because a regulatory body governing this space doesn’t yet exist, those involved in NFT transactions must have a high risk tolerance. That, or an immense amount of trust in the technology.

For those working with Christie’s, the NBA, or Taco Bell, there isn’t much to worry about. But for ordinary folks engaging in transactions with each other, the issue of trust, accountability and integrity come into play. Anytime anyone in the NFT space is asked what the solution is to this caveat, the response is the same: “We’re working on it.” I say–don’t hold your breath.

One other area that hasn’t been fleshed out that I think we’ll hear of more in the coming years is the intersection between crime and NFTs. Think about it—it’s the perfect arena for money laundering and other shady activities. Even the infamous Christie’s transaction makes me a little nervous given that the buyer of “The First 5000 Days” was actually a business associate of the artist! Not quite sure how this didn’t raise any red flags. Or maybe it did, but there were no regulatory bodies to look into it.

Ultimately, I believe NFTs could permeate every sector in some way. When you purchase a house or even a car via NFT, you could avoid banks and the bureaucracy involved with ownership of such assets. That means less title issues and more confidence about these assets’ existence and authenticity. As for influencers and reality television personalities, NFTs could create scarcity and monetization opportunities around content and episodes. If that happens, the number of brand partnerships could plummet.

NFT is simply a new technology that decentralizes the marketplace, which isn’t necessarily a novel concept. It’s simple and straightforward once you get past all the blockchain jargon. The issue is, blockchain technology is still on the fringe of people’s minds. They’ve heard of it, they know it has something to do with Bitcoin, but it’s still pretty alien to them. Once NFTs become more mainstream, the possibilities for brands, influencers and fans are limitless.