As leading streamers face revenue challenges, top platforms like Amazon Prime Video and Netflix are leaning into new ad strategies, offering new opportunities for brand marketers as competitor FAST channels see gains.

Amazon Brand Marketers With New Measurement Tools

“Advertisers are navigating a myriad of challenges—media fragmentation, ad identifier loss, incomplete insights, measurement complexity…” said Colleen Aubrey, SVP of Ad Products and Tech, Amazon Ads in a company press release. “Our NewFront illustrated how our premium content across a wide range of Amazon properties, combined with advanced campaign planning and measurement solutions, bridges content to commerce—so that customers can easily move from enjoying their favorite movie or music to buying their favorite product or service.”

Amazon’s new push to appeal to marketers includes the integration of geo-customizable and advanced audience targeting capabilities for advertisers during Thursday Night Football broadcasts. In addition, Amazon Live will now produce shoppable livestream content in collaboration with publishers and media brands, not just influencers. This represents Amazon’s deeper push towards shoppable entertainment, as customers with the integration of livestream shoppable content from Tastemade and REVOLT.

Amazon also announced VideoAmp and iSpot were announced as new streaming TV measurement services available to advertisers seeking to measure cross-screen impressions in addition to the first-party measurement options available within Amazon Ads.

Amazon Marketing Cloud (AMC) Audiences also launched at NewFronts, a “clean room” based measurement option allowing advertisers to integrate their data with Amazon signals to review multichannel customer journey insights. From the clean room, advertisers can review and use them to adjust their Amazon Demand-Side Platform (DSP) audience-buying choices automatically.

What It Means For Marketers:

Amazon’s new options mean that brands have greater control over ad choices but many of the new measurement capabilities will keep them rooted in the Amazon ecosystem, even when their data comes from external sources. Amazon is making its ecosystem more inviting for brands, but it faces pressure from competitors seeking to draw brands in with better audience management or ad targeting options. That means Amazon may continue to enhance its ad-targeting offerings to match competitors like Roku.

Roku Launches AI-Powered Tools For Marketers

“Roku is not fighting for turf in the streaming wars,” said Charlie Collier, Roku’s president per Deadline. “Roku is the turf. The streaming wars are not happening to Roku. We’re not in the streaming wars. The streaming wars are playing out on our platform.”

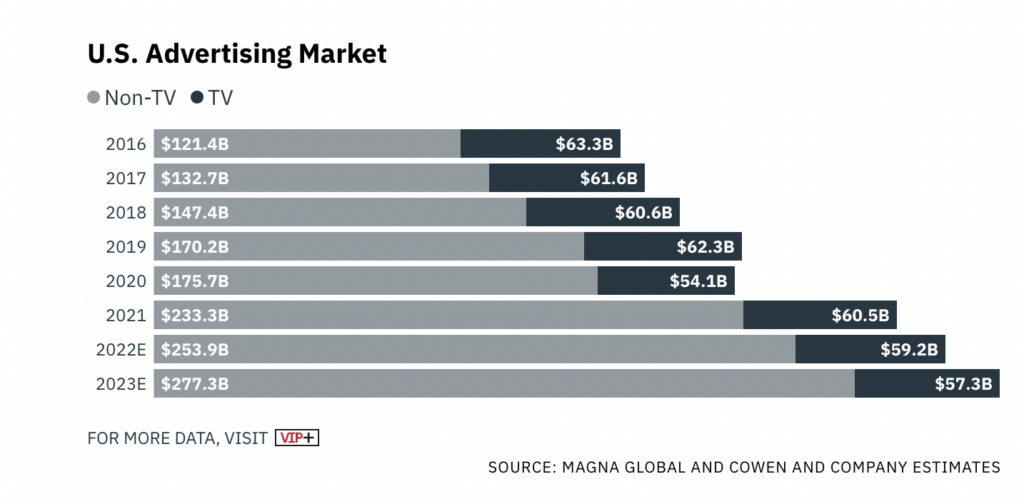

Collier’s confidence is likely tied to Roku’s efforts to draw in brands with a guarantee: that advertisers with Roku will reach bigger primetime audiences with their service than through cable. While that promise might be hard actually to measure, since the idea of a “primetime” audience has been muddied due to streaming, there’s something there. Brands are looking to new players to reach audiences that are streaming much more than they are sitting in front of the TV at a set time. The TV ad market has been shrinking since 2021, and brands are looking for options that give them audiences—wherever they might be.

That may be why Roku has launched a context-focused ad product. Roku’s offering uses AI to automatically run relevant ads next to moments in TV shows and movies, allowing brand marketers to “iconic plot moments” that align with brand messaging. Adding to the sweetener, Roku is also offering brands real estate on its iconic homepage – ostensibly allowing them to offer links to content or retail experiences that brands on demand can customize.

What It Means For Marketers

Roku—with almost 72 million subscribers per Statista—has added more than $20 million subscribers over the last two years, but its revenue declined by $70 million in 2022 over 2021. That tracks with Roku’s effort to raise its profile and offer tools that make ad targeting more precise and customizable. As Roku ramps up its efforts to become more attractive to brands, new opportunities to leverage content-driven contextual marketing may arise.

The takeaway? It’s a buyer’s market. Brand marketers can easily create solutions that match their objectives with better audience analytics and ad targeting tools. With so many choices, marketers can afford to diversify their marketing strategies between major platforms as the streaming wars continue.