A mobile ad measurement platform called AppsFlyer, which we reported on earlier this year, recently released a new TV attribution tool capable of measuring the effectiveness of TV advertising for mobile apps.

AppsFlyer is launching the AppsFlyer Gaming Ad Network Performance Index, which tracks just how well the top 25 of over 1,000 ad networks tracked by AppsFlyer perform for game companies. The report provides a detailed review of each network’s performance, and looks at the all-important retention metric for games.

While every mobile game company would love to succeed using only organic installs, the reality is that smart use of an ad budget can help any game do better. Some of the key findings from the report are as follows:

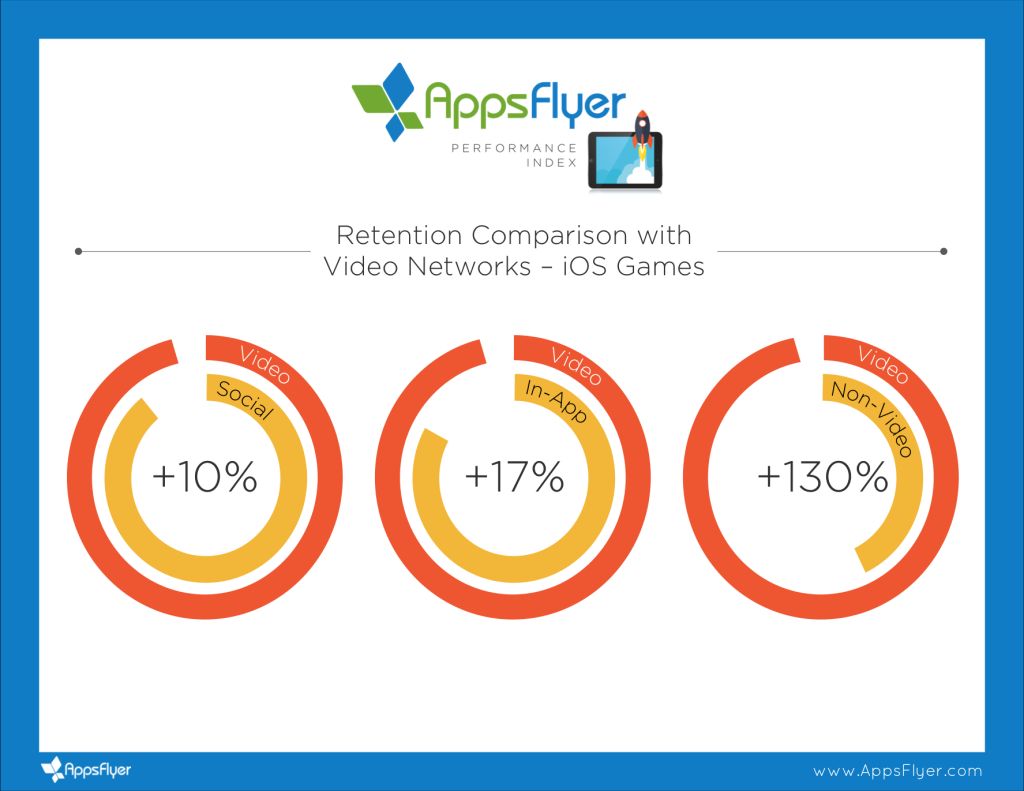

- Video proves to be the best bet when it comes to user acquisition — showing not only the highest retention rate but also the ability to drive scale. Video networks have a 130 percent higher overall retention rate compared to other networks in the index; video also has a 10 percent and 17 percent better overall retention rate compared to social network and in-app networks, respectively

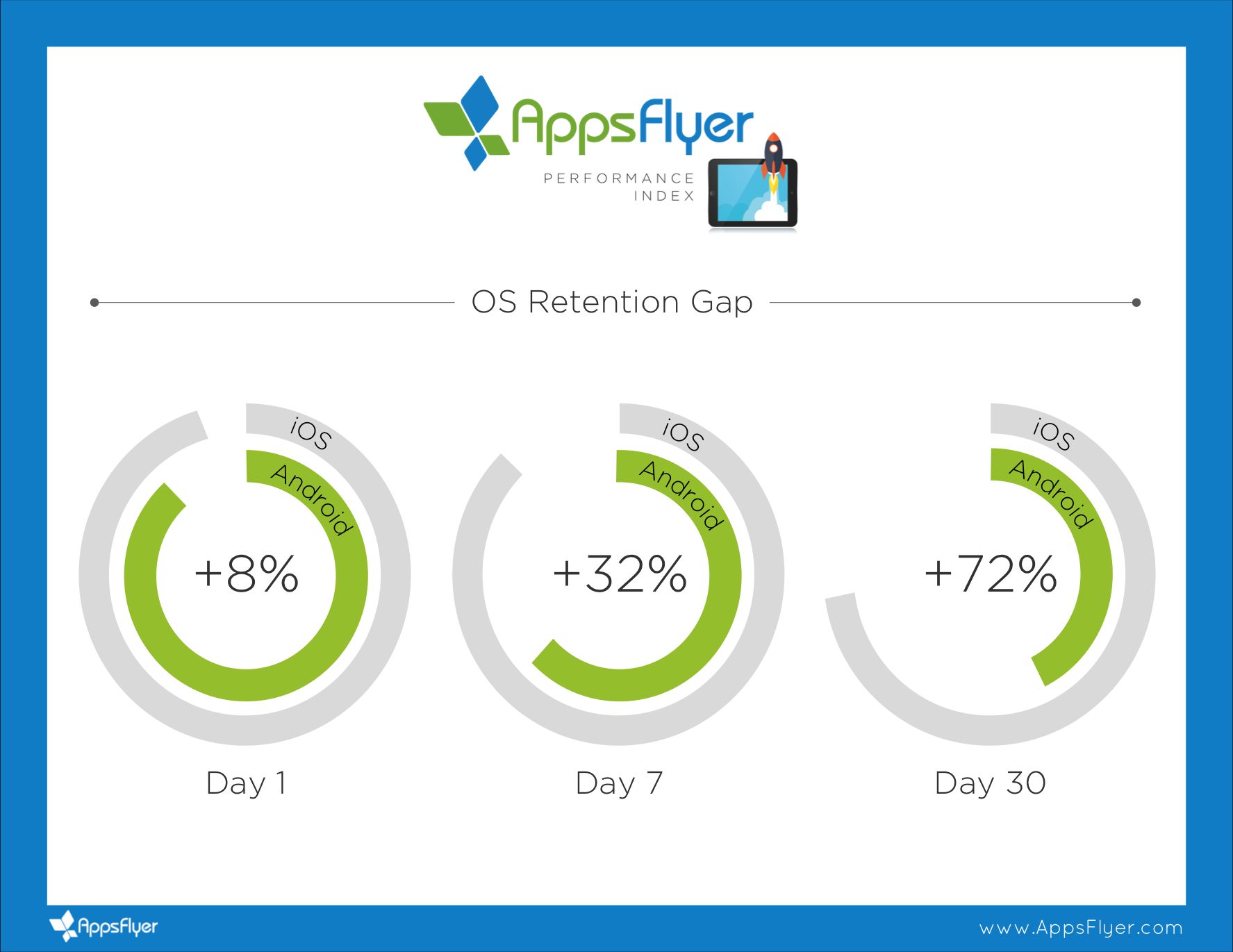

- iOS dominates app retention, widening the gap with Android over time. iOS also has a 26 percent higher retention for video networks, 28 percent higher for in-app networks, and 47 percent higher in social networks

- On average, the drop in retention across all networks between days one to seven is 56 percent, and 80 percent between days seven to 30

- Based on the quality and quantity of installs able to be generated, Facebook is number one on both iOS and Android.-Programmatic ad network AppLovin is the best ad network based on overall one-day, seven-day and 30-day retention. Vungle, AdColony, Facebook, Applifier and Chartboost are also high in rank.

AppsFlyer was careful to note that not all networks perform equally well for all clients. “Many of our clients are seeing the best ROI working with other networks from among our 1,000+ integrated partners.” The report further noted that “There’s a great deal of variance among campaigns and apps/developers. Just as companies are different, games are different as well and so are their marketing teams. Top notch marketers who put in the effort that’s required manage to beat their numbers through constant measurement, targeting, retargeting and applying deeplinking solutions such as OneLink.”

The full report can be found at AppsFlyer. The report is the first to ever analyze retention performance for all of the top mobile ad networks, and it also breaks down performance data by product type to help developers really understand which types of ad networks produce the best quality results.

AppsFlyer’s study is not a casual one. According to the report, “It is the industry’s most comprehensive study of its kind to date, covering over 50 million paid installs of hundreds of gaming apps running campaigns on hundreds of AppsFlyer’s integrated network partners.” Whenever you have such a rich source of information, there’s plenty of room to draw insightful conclusions.

Oren Kaniel, CEO of AppsFlyer, spoke with [a]listdaily to provide some more insights into how ad networks are performing for gaming apps, and ways that mobile game developers can use this information to their advantage.

Oren Kaniel

Oren KanielSome of your clients report the best ROI from networks other than the top 25. What is it about those networks, or the apps, or the companies, that leads to such high performance?

Many of the networks outside of the Top 25 are smaller networks, where a handful of top-quality publishers can significantly raise the performance of the entire network. Or in some cases they’ve got a great product but they just haven’t been able to scale it — yet. Or maybe they’ve got great targeting capabilities and the advertisers have gotten savvy about which specific audiences work best for their apps, so they’ve really dialed in their targeting and are achieving high ROI that way. In any of these cases, although the volume may be low, they’re worth paying attention to because they can grow very quickly.

It’s important to remember that this is a global report, while each app is a world of its own, with its own unique goals and target audience. So it definitely makes sense that some apps report better ROI with networks that didn’t make our top 25. That’s why the more networks a measurement partner is integrated with, the greater the chances that every marketer can eventually pinpoint and measure the optimal marketing mix from his own app’s perspective.

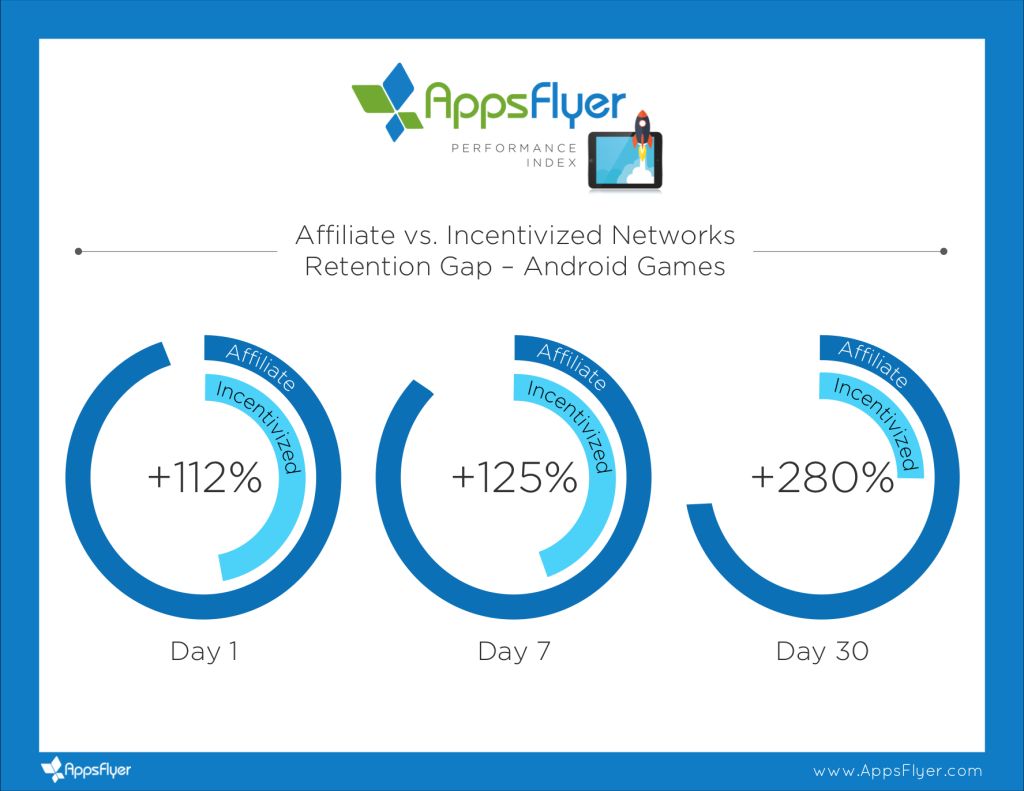

Why do affiliate networks perform so well relative to incentivized networks, and improve that performance gap over time?

Affiliate networks, by their very nature, get their inventory from a variety of sources. This includes incentivized networks, but also other, higher-quality networks, so it makes sense that retention rates of affiliate networks would be higher than incentivized networks.

Nintendo has gone on record as saying they don’t want to depend on a very small number of very high-paying players for their mobile games, but instead get a small amount of money from a very large amount of players. Is there any precedent in the mobile game market for this type of monetization?

I think a lot of gaming companies and other types of app developers are starting to embrace this strategy. More and more consumers are getting increasingly comfortable with the freemium model — a report from App Annie said that freemium apps contributed almost half of Google Play downloads — and as they do, they are coming around to the fact that a dollar or two here and there is a price worth paying for premium content in the games and apps they love. As an app developer, if you are only monetizing 5% of your userbase, your revenue potential is very limited. But with the massive audiences of some of these games, if you can monetize 20 percent or 30 percent or more — even at small levels — then your revenue potential becomes massive.

What general advice can you offer app developers to get the best ROI from ad networks?

Test, test and test some more. We encourage our clients to keep a close eye on their marketing campaigns and to continually test new networks, new products, new creative and every other variable that plays into performance. When you see that something is working, invest more heavily in those networks or campaigns, and either tweak the underperforming campaigns or cut them out altogether. This process of optimization is exactly what our product was built to enable our clients to do.