Facebook has become an advertising powerhouse over the last few years, particularly with mobile ads. The company’s second-quarter earnings showed sales up 59 percent to $6.44 billion, while profit nearly tripled to $2.06 billion. Mobile ads comprise nearly 64 percent of Facebook’s ad revenue—a truly impressive growth from a standing start a few years ago. Yet the company isn’t resting on its laurels, according to Kelly Graziadei, director of global marketing solutions at Facebook, who spoke at the recent Casual Connect conference in San Francisco.

Facebook has seen a range of games grow over time, from canvas games to mobile games, and “explosive growth over a number of categories,” said Graziadei. That led Facebook to look closely at the game market to inform its choices in building out advertising products. “What have we learned from a product perspective, and how do we think about that? What are we looking to build now and into the future that ultimately helps you grow your business?” Graziadei asked.

“With the rise in mobile games, our primary goal was app discovery and installs,” Graziadei explained. “In 2012 we built the mobile app ads product. Since product inception, we’ve driven over 2 billion installs across app and desktop lifetime. We’ve also seen over 90 percent of the top 100 grossing apps in the US log app events on Facebook. What we’ve learned, as the mobile gaming industry matures, it’s not just about scale, and it’s not just about installs. Where we are today is seeing games balance the objective of discovery and driving installs. And balancing that with re-engagement of the right gamers who will drive the most lifetime value, those gamers that are going to play more and ultimately make a purchase. Many of the partners we work with a focus solely on customer acquisition and user acquisition to get as much discovery as possible to drive low-cost installs. This strategy has worked, and it’s worked for some time. But what we’re seeing is that shift to move beyond the install. We need to find that right gamer and that right customer.”

“Where we are today is seeing games balance the objective of discovery and driving installs. And balancing that with re-engagement of the right gamers who will drive the most lifetime value; those gamers that are going to play more and ultimately make a purchase. Many of the partners we work with focus solely on customer acquisition and user acquisition to get as much discovery as possible to drive low-cost installs. This strategy has worked, and it’s worked for some time. But what we’re seeing is that shift to move beyond the install. We need to find that right gamer and that right customer.”

Finding the right customer is ever more challenging in today’s app environment. “The data is pointing to the need for this even more,” Graziadei noted. “We see over 50 percent of users who install a game don’t open a game after the first day. For those that do open the game after the first day, another 50 percent do not make it through the first week. So it’s never been more important to find the right users and drive them through that first week after they install the game.” That’s a combination of a game design challenge and a marketing challenge, because a design that keeps one player engaged and eager to keep going with a game may not work as well for another player—and that means it’s important to target your marketing efforts to the first player.

There’re some basic insights that Facebook has gleaned, which have guided how it is developing features for ad products. Graziadei summed it up this way: “Not all installs are created equal. It’s important to recognize the balance between scale versus finding valuable gamers and driving those repeat actions,” Graziadei said. “As we think about the entire customer life cycle, there are three areas to consider. First, to acquire gamers who will provide the most value. Second, to engage them with compelling creative. Third is to encourage repeat behavior that will ultimately drive lifetime value (LTV).”

Graziadei went on to provide several examples from Facebook’s partners, showing what sort of results it’s possible to get with Facebook’s new tools for analyzing app installs. “To acquire installs that will provide the most value, it’s important to know what your business objectives are beyond cost-per-install,” Graziadei said. “What are those high-value actions in your game that you ultimately want people to take? The next is understanding who is valuable—all gamers are not created equal. No one knows your game or gamers better than you. Even if you’re just tracking cost-per-install, you can dig in and understand the demographics better, and who is that high-value customer that you should reach more of.”

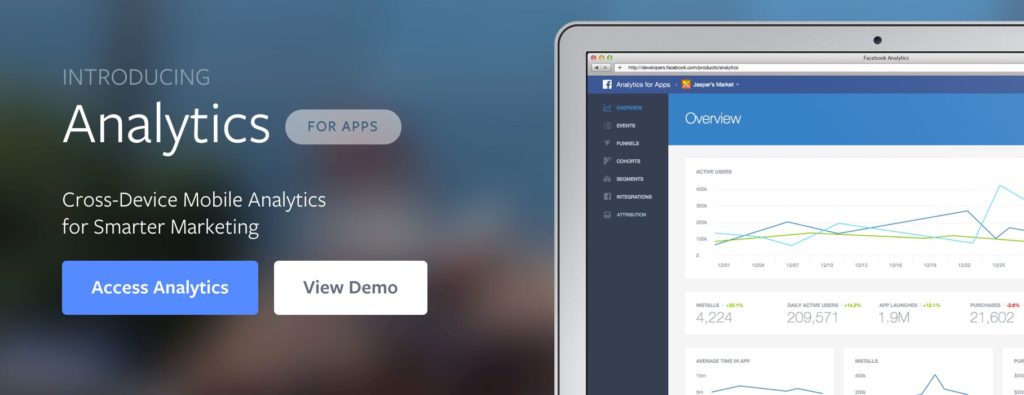

Some of the new tools Facebook has introduced are of obvious use for marketers, providing more granular detail about customers. “We’ve recently introduced Audience Insights into Facebook Analytics for Apps,” Graziadei said. “This enables you to glean even more insights, such as education, profession, income, marital status. All of this information allows you to better target your audience, and it allows you to create relevant and compelling messages for those different sub-segments of your audience.”

Facebook is continuing its development of tools for advertisers, and it announced one at the show. “To further help gaming companies find the right gamers, we’ve announced App Event Optimization,” Graziadei said. “It essentially allows you to find new gamers who are not only likely to install your games, but are also likely to take a valuable action that you designate, post-install.” This might be a game purchase or reaching a certain level. Graziadei noted that PennyPop, which participated in the beta for this new feature, saw an 80 percent decrease in cost-per-event when it optimized for that specific event, and saw a 5x growth in revenue and LTV. As another example, Smule found that when optimizing for subscriptions, it was able to improve the cost per purchase by 32 percent, and revenue figures were increased by 22 percent.

App Event Optimization provides an event-based bidding process, where advertisers can choose whether to pay less for an install or bid more for someone who is likely to use the app. Advertisers can select from 14 different user actions that might signal how likely a user is to become a valuable long-term customer. This also provides value for users, who could end up seeing more ads for apps they might actually want rather than a stream of irrelevant products.

In addition to introducing Event Optimization, Facebook now lets advertisers drive app installs and in-app purchases with Dynamic Ads. These ads are shown to users after they’ve indicated interest in a product, again producing more relevant results. Another new feature added are full-screen Canvas ads that allow a developer to give users a preview of what the full app looks like in action.