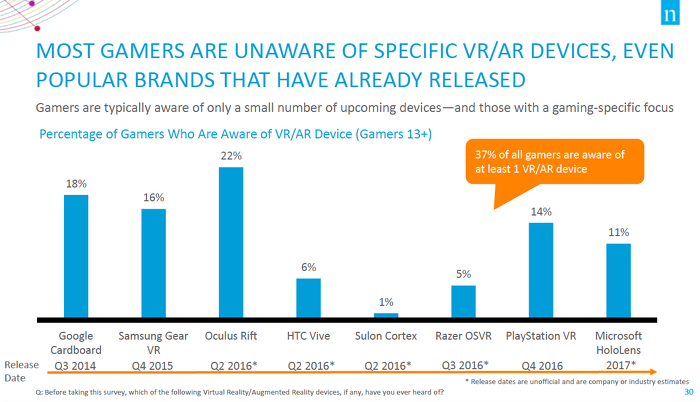

The virtual reality era has officially begun, with both the HTC Vive and Oculus Rift now shipping and PlayStation VR set to launch this October. That’s in addition to the heavy promotional pushes for mobile VR viewers like the Samsung Gear VR and Google Cardboard seen last fall. But, according to a new report from Nielsen, not all consumers may be aware of their availability.

The company’s “360 Gaming Report” indicates that 37 percent of all U.S. gamers have heard of at least one virtual reality or augmented reality device. However, that’s a rather low number, especially considering the millions of dollars that Oculus, Sony and HTC have poured into developing the technology.

Based on the numbers, the most recognizable brand is Oculus Rift, which is owned by Facebook, but even that is a low figure at 22 percent. Google Cardboard takes a close second with 18 percent, while Samsung Gear VR is third with 14 percent.

“Education will be an important factor for these companies to get the word out. However, this type of experience doesn’t really lend itself to traditional marketing driven education. A lot of the education will likely be organic through buzz/word of mouth and come from early adopters,” Nielsen Games general manager Michael Flamberg said, per GamesIndustry.biz. “This reinforces the importance of social influence in the development of these devices and content to foster a spirit of experience sharing so that early adopters can more easily advocate for VR. The early adopters, tech enthusiasts and social influencers can then cascade their influence to the masses.

“These are also devices that will require some investment from consumers and will be an immersive experience so for gaming, content available on the devices will be another key driver. [VR headsets] also have the potential to do a lot more than just gaming. Viewing other forms of content (live events, movies, TV) and engaging with a broader set of categories and functions will also help the devices in time (product development/engineering, health care, training, etc.)”

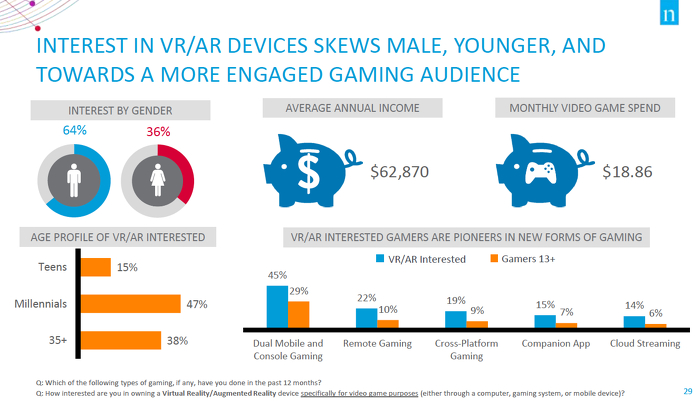

Income plays a big part, as a majority of that 37 percent showing interest in the tech are young people with an annual income of nearly $63,000 and a monthly video game spend of $20. On an interesting note, male gamers have more of an interest than female gamers, but not by much.

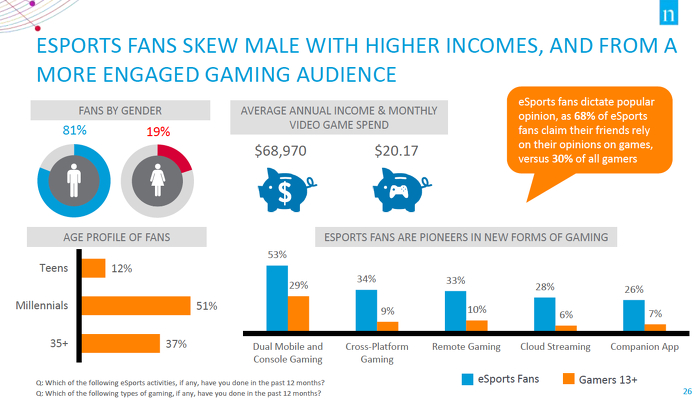

On a side note, the report also discussed eSports, explaining how 51 percent of viewers are in the millennial group, with an income of nearly $69,000.

“ESports fans are a valuable audience for the category and for brands. ESports attract fans for its entertainment value, particularly the drama of competition and the relevance of gaming to their own leisure time. To grow further, eSports will need to be easier to engage with, and both more social and interactive. More local events and increased mainstream coverage will also be key. To be successful in the space, brand fit and sponsorship execution will be important for sponsors/advertisers, who should pursue eSports as one part of a broader brand strategy,” Flamberg added.

“However, we have seen in our eSports research (released late 2015) that Twitch is definitely the destination for eSports fans as Twitch is the top destination for eSports content/programming well ahead of YouTube and other gaming sites like GameSpot and IGN. This could have implications for marketing—do you reach the majority of viewers/consumers just by being on Site A, or do you really need to get your content on all the different sites?”

Those interested in receiving a free copy of the report can send a request to peter.roithmayr@nielsen.com.