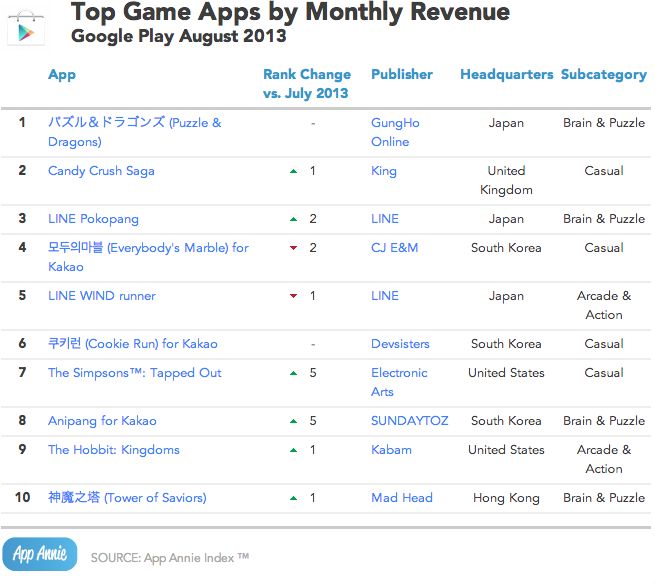

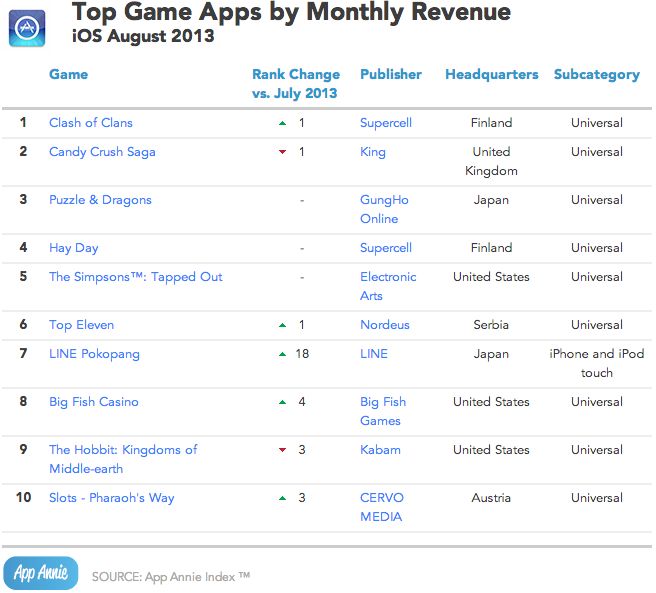

The analytics firm and market intelligence firm App Annie has pulled together numbers for August and revealed some interesting shifts in the top ten publishers and games for both iOS and Android. The top moneymakers continue to be Supercell, King, and GungHo on iOS (1, 2, and 3, respectively) and GungHo, LINE, and CJ E&M on Android (1, 2, and 3, respectively).

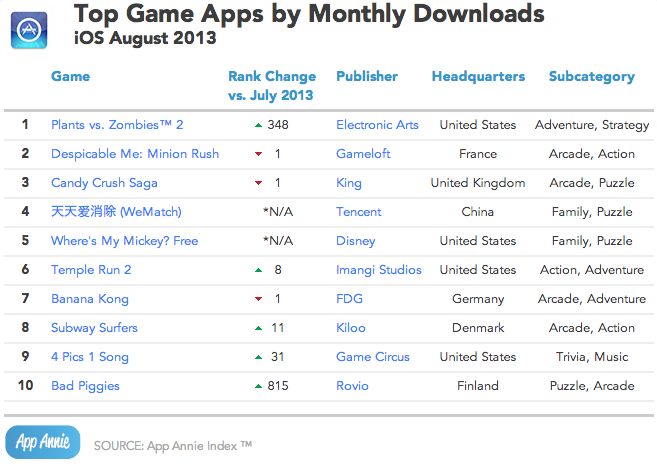

The debut of Plants Vs. Zombies 2 drove that app to the top of the iOS App Store, and since the release in mid-August Electronic Arts reported that the game has already exceeded the 25 million lifetime downloads of the first version. The Android version of the game has already been soft-launched in China with a worldwide rollout expected soon.

Meanwhile, Android games continue to be the province of publishers from Asia. “Publishers based in Japan and South Korea continued to dominate the top grossing publisher ranking for Google Play, occupying 7 of the Top 8 positions,” said App Annie’s report. “Puzzle & Dragons helped GungHo Online retain their position at the top of the ranking. The #2 publisher, LINE, had a more diverse group of apps driving its revenue generation, led by LINE Pokopang, LINE WIND runner, LINE POP, and LINE Bubble!”

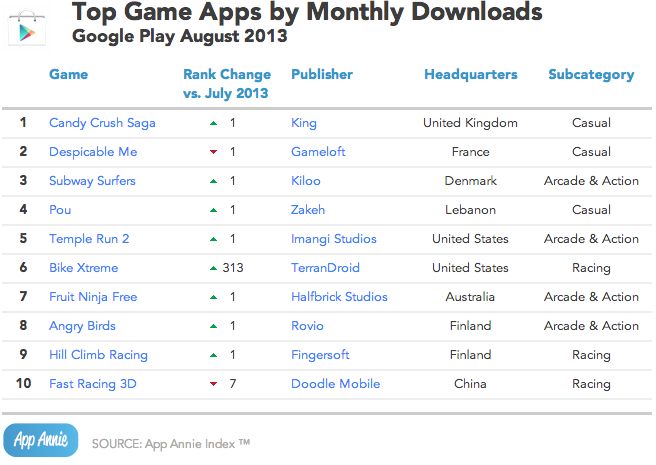

App Annie noted the prevalence of certain genres within the most-downloaded games. “Of the 16 unique games included in the Top 10 rankings by monthly downloads in the iOS App Store and Google Play, 5 are based on puzzles, 4 are endless runners, and 3 are racing games,” noted the report. “Puzzle game Candy Crush Saga and endless running games Despicable Me: Minion Rush, Temple Run 2, and Subway Surfers appear in both Top 10’s, but each app store also has a unique category driving downloads. The iOS App Store downloads are largely driven by puzzle games like Candy Crush Saga, WeMatch, Where’s My Mickey Free, 4 Pics 1 Song and Bad Piggies.”

As the app market becomes more global, publishers increasingly want their apps to succeed around the world and not just in their home country. It’s not as easy as it sounds, though, and App Annie notes that many publishers are looking for partnerships to help them extend their reach. “Some publishers like GREE have set aside money for equity investments in developers that have already achieved success on a local level and are looking to expand,” said the report. “Some publishers like GungHo Online and Supercell have developed cross-promotions with other major publishers where the publishers use each other’s characters and content to create special features and events. Other publishers like Kabam and Gameloft are partnering with smaller publishers to localize their existing apps so that they are relevant for specific markets and reaching the right distribution channels. As the global app economy evolves and publishers look to expand their audience, we can likely expect more of these partnerships to emerge.”

It’s interesting to note that the correlation between the most-downloaded games and the games that generate the most revenue is not exact by any means. Part of this is due to the newness of some games, where monetization is more likely to occur after players have been playing the game for a while. More can be attributed to the factors of the individual game’s design and the vagaries of different countries. For instance, Puzzle & Dragons generates massive revenues mostly in Japan, and doesn’t appear likely to become as significant in other regions.

The top iOS publishers list by downloads looks quite different when you examine the top publishers by revenue, and the same is true for the Google Play listings. Interestingly, it seems like it’s not so much about having a large number of games, but having just the right game. The listing shows the number of apps each publisher has, but in most cases one app is responsible for the majority of the revenue for a publisher.

Looking at the top games by downloads and by revenue reveals similar disparities. On iOS, Supercell continues to grab the #1 spot for game revenue with Clash of Clans, and its Hay Day game has the #4 slot as well. This makes them the only publisher with two games in the top ten for revenue generation. When Supercell finally releases Android versions of these games (now known to be in the works), it will be interesting to see how these games impact the Google Play top ten.