There’s a lot of hard work involved in developing a game, and then helping customers find it and enjoy it. The work’s not complete, though, until you can get players to give you some money for the game — and that’s not easily done in much of the world. While credit cards are ubiquitous in the USA, they are barely used in Southeast Asia, for instance. Some countries use prepaid cards, some use bank transfers, some use a variety of mobile payment methods. For a game developer, it’s a complicated mess.

That’s where a payment services provider like Rixty, a subsidiary of MOL AccessPortal Sdn. Bhd comes in. Rixty offers a variety of ways to let domestic and international customers spend on all types of digital content. One of these methods is letting customers exchange cash for Rixty value (which can then be used on digital content) at over 140,000 stores in the USA and Brazil, or at nearly 500,000 locations worldwide.

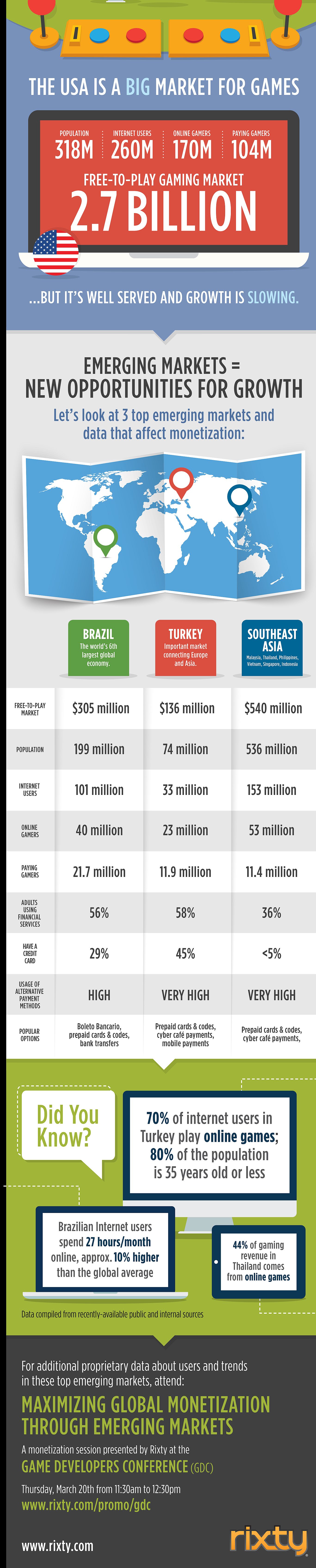

Some of the fastest-growing markets for games are in Southeast Asia, but Brazil and Turkey are also booming game markets. The Southeast Asia free-to-play game market has grown to more than $500 million dollars, and the combined market across the three regions reaches nearly $1 billion dollars. “In addition to large populations, these regions boast consumers that over-index for internet usage and are deeply engaged in online entertainment,” said Rixty in a press release. “By using the right mix of the most popular payment methods in each region, game developers can tap into the full potential of these markets.”

Those markets aren’t focusing on retail stores selling games in boxes, but rather online and mobile games that are sold digitally, as well as virtual goods for those games. Rixty’s put together an infographic showing some of the key data for these markets, and the [a]list daily spoke with Rixty’s VP of business development Julie Craft about some of this information.

Rixty believes that these emerging markets will continue to grow strongly, given how many people are still to acquire as customers. “All indicators show these emerging markets now have the infrastructure, proliferation of new devices and new alternative payment options to serve the unbanked and these trends are expected to continue,” said Craft. It’s a good market for games in the future, as long as those games appeal to that audience — and there’s a way for those customers to pay for the game content.

The situation isn’t static, either, and that makes it even more difficult to keep up. “The type and number of payment options is opening up all over the world,” Craft noted. “Since many of these markets traditional have a low penetration of credit cards or online banking, cash payment options are becoming a growing alternative for users to be able to pay for virtual goods.”

“This information comes at a critical time for game developers looking for global growth and monetization opportunities,” said Ted Sorom, CEO of Rixty. “Those focused on the North American and European markets may be surprised to learn what makes these emerging regions so attractive. We hope this infographic and the data we are releasing at GDC will help game publishers gain a better understanding of these key markets and their consumer purchasing behaviors.”

Rixty will be hosting “Maximizing Global Monetization Through Emerging Markets,” a monetization session at the Game Developers Conference (GDC), on Thursday, March 20 from 11:30am to 12:30pm. At GDC, the company plans to release proprietary company data that offers a deeper look at the profiles of online gamers in these territories, including their languages, demographics and online spending habits, with the goal of helping game developers take full advantage of these emerging markets. The audience will also have the opportunity to hear from a panel of executives from some of the world’s top online publishers, including Smilegate, Aeria Games, Wargaming.net and Gaia Online.