If there’s one market that’s managed to rise above expectations for 2015, it’s streaming. From Netflix and its original series (including the vastly popular Jessica Jones) to Twitch and its majority of programming, companies have capitalized on audiences with its programming.Â

With that, App Annie said that a number of channels have seen growth not only in the United States, but overseas in China as well, per Ooyala. The overall revenue growth for video streaming has reached more than three times in the U.S. That’s impressive, but it’s risen more than 10 times in China. (The United Kingdom also reports double the growth as well.)

App Annie added that U.S. revenue growth midway through the year was driven by two specific apps: HBO Now and Hulu. As far as what programming is leading the markets, the U.S. benefits highly from movies and TV episodes, while the U.K. relies more on sports leagues. In fact, almost 75 percent of the overall market comes from sports.

Ooyala believes that broadcasters may have to seek new ways to keep traditional viewers around, to prevent the “cord cutting’ that many consumers go through in an attempt to save money.

Also backing up these statistics are numbers from The NPD Group, per IPTV News. Research indicates that by 2018 we’ll see a huge upswing in installed devices that are connected to the Internet, taking advantage of streaming services; 231 million is the estimated count, up from the 127 million reported in 2014, and the 153 million reported this year. That’s an estimated growth of 82 percent in just a few years’ time.

“The two largest drivers of growth will be the increased acceptance of connected televisions in the homes of US consumers, as well as the continued adoption of streaming media players such as those offered by Google, Apple, Roku, and Amazon,†said John Buffone, executive director for The NPD Group.

Out of these devices, connected TVs will show the biggest growth by 37 percent; streaming media players are at 33 percent growth. Netflix, YouTube, Amazon, Hulu and HBO Go are expected to stay as popular channels on this front, although, a new video-distribution channel could change how people look at streaming services through TV networks in this same time frame.

MusicÂ

Video is just one part of streaming business as we see it today. Music also has a key role, as more subscribers are finding comfort in signing on to services like Pandora and Spotify instead of buying their music – and it’s a practice that isn’t likely to die down anytime soon, if at all.

IFPI reports that over the past year global digital revenues for music streaming channels rose to $6.85 billion, a 6.9 percent increase from the previous year. That includes a similar proportion of revenues from digital channels as physical (both at 46 percent). This is across four of the world’s top 10 markets overall, indicating that it’s found a strong place within the industry.

This could also change with new competitors, as Variety previously reported that Apple could be jumping into the video game with its own programming. It would make sense, considering the plethora of devices that would support it, including the new Apple TV model.

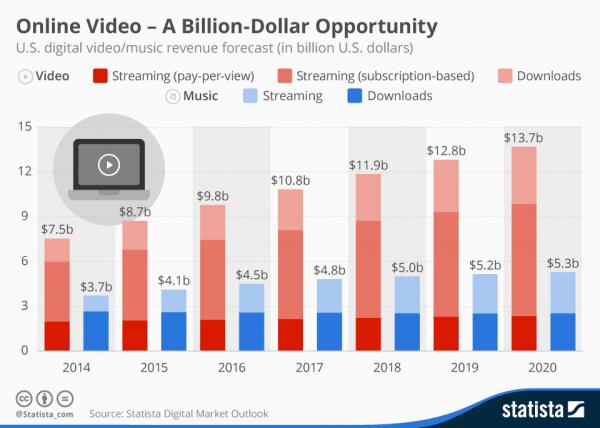

Statista’s chart below breaks down just how big a deal online video is set to become over the next few years, going from a $7.5 billion total in 2014 up to $13.7 billion. Although downloads are a little behind, they too are expected to grow, increasing from $3.7 billion to $5.3 billion.

This year has changed the landscape quite a bit, with both Apple and YouTube launching devoted music services that have attracted millions of consumers. That should push the estimates of 41 million consumers last year to new heights, as soon as end-of-year numbers are reported.

As a result, record companies have changed a bit with the times, creating a model that provides access to music more than ownership. With that, the general industry now receives around 32 percent of digital revenues from subscription and streaming services, up from 27 percent back in 2013.

Along with new companies joining the fray, older ones are making moves to adapt to the times as well. Last month, Pandora acquired the tech and talent behind Rdio, while Spotify opted to create a new data model that would make it easier to track what artists audiences listen to regularly.

This is an even trickier business with “big dogs” in the industry like Apple, Google and Amazon getting involved, as questions regarding said rights could come into play. However, Pandora is confident that its new business model, build around Rdio’s services for an estimated $9.99 a month, will bring several new options to the table for its listeners.

Tidal has also become a key factor in streaming music. Despite its lack of immediate popularity, it’s winning some listeners over with the promise of exclusive concerts and other events, adding a personable side to the service. (Granted, Apple and other services have also reached out to artists to provide special features for its channels as well.)

Regardless, with so many options available, more listeners should be turning to digital music options, streaming instead of downloads, out of sheer convenience, and the market should continue to grow. Who will profit from it in the long run, however, has yet to be seen – but it looks like companies will be doing their best to keep people from dropping the beat.

Games

Finally, there are the game streaming channels, which have their own fair share of audience members. YouTube Gaming launched earlier this year to impressive numbers, although Twitch continues to be the big breadwinner for this year, as it drew in more than 100 million viewers monthly. Twitch has also diversified its programming, airing artistic-based content and teaming with companies like Old Spice for unique promotions, creating a new flux of viewable content.

Gaming will continue to be a big focus for the company, though, and with the introduction of several new features – all introduced at its first annual TwitchCon a couple of months back – it’s likely to continue expanding into the new year and beyond.Â

Competitive eSports will play a big part in that as well, despite some programs taking to television to expand its audience. Speaking with [a]listdaily earlier in the year, Johnathan “Fatal1ty” Wendel explained, “eSports is always getting bigger every year. Five years from now, I believe that gaming will become more recreational, much like what you see with other sports. For example, I’m a tennis player and I play on a league. I believe we’ll have rec leagues for gaming. Gaming and eSports will become more recreational and competitive, event for the casual player who just wants to be a part of a team. It’s the evolution of what we do as eSports players. eSports really is the sport of the 21st century.”

Considering its popularity not only on mobile and desktop devices, but also game consoles like the PlayStation 4 and Xbox One, Twitch should continue to be a valuable asset as far as the streaming game is concerned. But what about YouTube Well, considering it’s drawing a pretty hefty audience, it’s not likely to lose ground either.

So what does this mean overall Well, there’s a substantial demand for streaming content across the board, whether it’s watching live tournaments, listening to music on the go (without needing to plug in a player or pop in a CD), or watching programming conveniently through a number of given devices. That demand will likely continue over the next few years, with companies “adapting to the times,” as it were, in an effort to get their own piece of the pie.

The answer definitely lies in the stream.