We’ve talked in the past about the increase in mobile ad spending, since more and more consumers prefer to view video and other content through the convenience of their smaller devices. Now, a new report from BI Intelligence indicates that spending will continue to pick up on mobile devices with digital content, while desktop and traditional formats will see a slowing down.

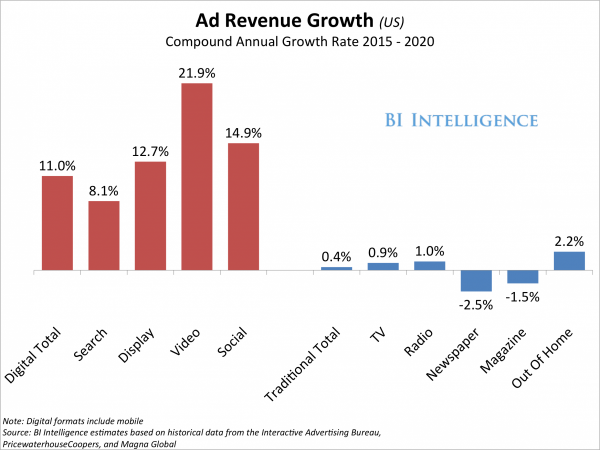

Business Insider indicates that, over the next five years, marketers will warm up to mobile spending, spread across video, search, display and social, with more dollars seeping away from traditional media, including newspapers and magazines. The chart below indicates just how much is being spent on each field.

As you can see, mobile spending will differ between 8.1 and 21.9 percent across all fields, with a digital total spending of 11 percent overall. Meanwhile, traditional media will drop anywhere between 2.2 and negative 2.5 percent, with newspaper advertising taking the most critical hit.

Other facts provided by the report are as follows:

- Mobile will be the fastest-growing advertising channel and buoy spending on each of the digital formats. US mobile ad revenue will rise by a 26.5 percent CAGR through of 2020.

- Digital video ad spending is rising faster than search and display. US digital video ad revenue will rise by a CAGR of 21.9 percent through 2020.

- Mobile search will overtake desktop search in ad revenue by 2019. Mobile search ad spend will rise by a 25.2 percent CAGR, while desktop search ad revenue will decline during the same period.

- Mobile display ads, including banners, rich media and sponsorships, will overtake desktop display-related spending even earlier, by 2017.

- Social media ads, which cut across display and video, are seeing fast adoption. US social media ad revenue, which includes video and display ads, will grow by a CAGR of 14.9 percent through 2020.

- The rapid embrace of programmatic ad-buying tools is fueling a dramatic uptick in the share of digital ad spending coming through programmatic channels. Programmatic transactions will be a majority of total US digital ad spend this year.

- Unlike digital, traditional ad revenue will remain flat overall through 2020.Total traditional ad revenue will rise by a CAGR of just 0.4 percent between 2015 and 2020.

The full report can be found here.