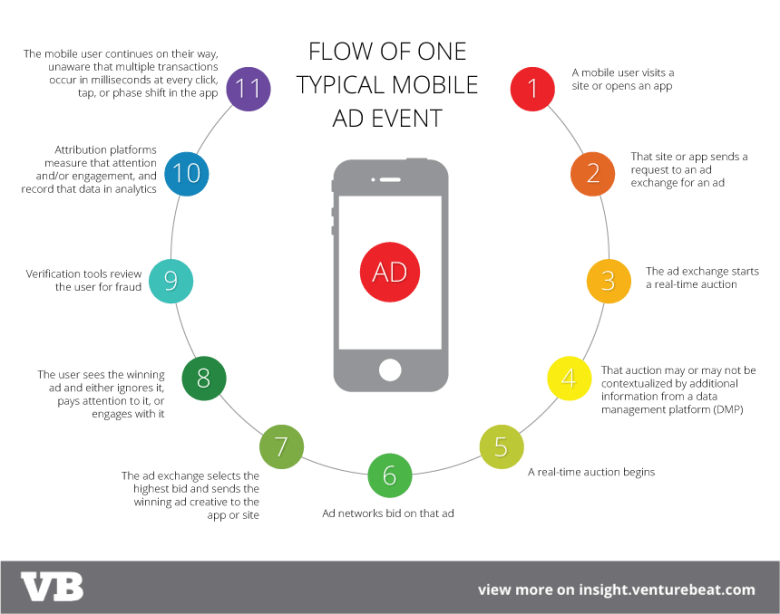

VentureBeat recently posted a report with a flow chart that breaks down how one typical mobile ad event can break down in terms of effectiveness. It starts with how a mobile user first visits a site or opens an app, then goes through a number of steps, including ad exchange, bidding for a real-time auction for ad space, user interaction, and, eventually, moving on to the next thing, although the user remains unaware in terms of just what’s going on with the deliver of said ad. According to the chart, we’re talking multiple transactions that occur within milliseconds.

According to VentureBeat, 2.1 billion mobile users downloaded over 350 billion apps over the last year, spending around 76 percent more time on their device than in previous years. That said, despite all this attention, the industry still isn’t spending enough on ads. Numbers reported by Mary Meeker indicate that they spend around $25 billion — and that just isn’t enough.

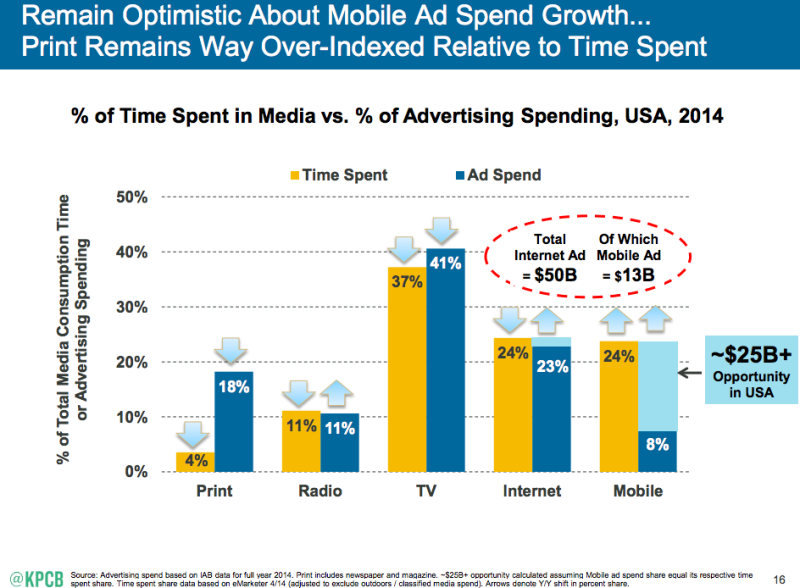

This other chart, included in the report, indicates the percent of time spent in media compared to money spent within advertising — and some of the contrast differences are worth nothing. Print has an incredible amount of difference, with only four percent time spent compared to 18 percent spending. Meanwhile, other numbers are just about even, with radio reporting 11 percent across the board, followed by TV with a small difference between 37 percent time spent and 41 percent spending, and Internet only showing a one percent difference.

The real shocker, though, is mobile. 24 percent of overall time is spent on media using mobile devices, yet companies only spend about eight percent of funding on advertisements — and they’re missing out as a result.

“The mobile ad ecosystem is like a giant Plinko game,” said John Koetsier, the author of the report and VB Insight head of research. “Advertisers toss in $100 at the top, and after going through data management platforms, ad agencies, networks, and supply-side platforms, they’re lucky if $60 actually gets spent on true placement of their ads.”

Meanwhile, the supply side of the industry is getting more support, and, as a result, brands may see more confidence with investing in ads. “There are something like 1,000 ad networks, adding to the immense complexity of this space, so the biggest opportunity for vendors is to consolidate the stack — ad network, data, supply aggregation, demand aggregation, attribution, and fraud detection — so that advertisers just have to deal with fewer vendors,” Koetsier said.

VentureBeat has a more extensive report on the project, which can be found here.