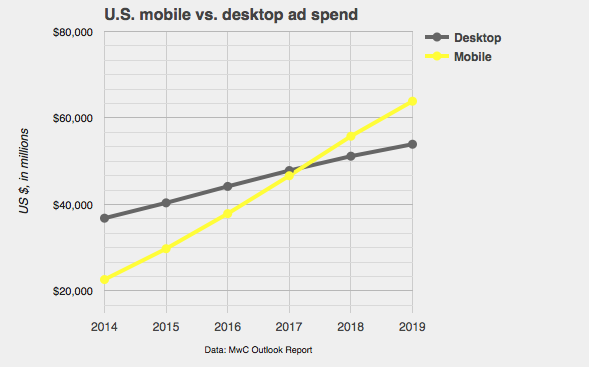

We’ve spoken in the past about what kind of growth ad spending will go through over the next few years, including mobile exceeding desktop. However, a series of new charts have broken down just what kind of increases the industry is in for over the next few years.

DigiDay has reported how the state of mobile ad spending is looking, with information provided by MwC Outlook Report, Magna Global, Mary Meeker and eMarketer. Each chart breaks down specifics when it comes to certain spending, such as how much is being spent specifically on mobile versus desktop, and so on.

First up, as you can see, there was a time that desktop was getting more spending than mobile — last year, in fact. However, as the years continue onward, mobile will be taking more of a focus, and by 2018, it’ll overlap it by a few million dollars. By 2019, however, there will be a stark difference, with no indications of slowing down.

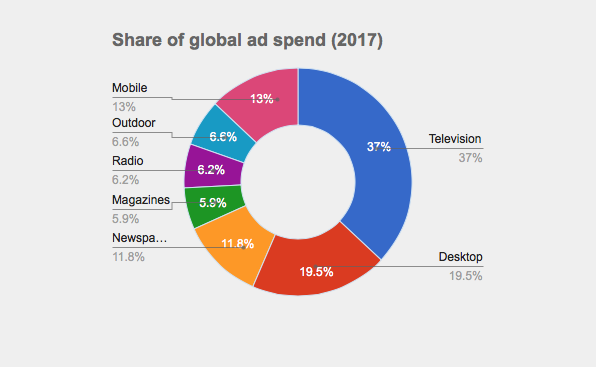

By 2017, it’s easy to see where most of global ad spending will be going. 37 percent will be devoted to television, while desktop will take 19.5 percent. Mobile will be close behind with 13 percent, although these numbers, again, could easily change in the following years. Surprising enough, newspaper still has a decent grasp with 11.8 percent, while magazines, radio and outdoor follow closely behind.

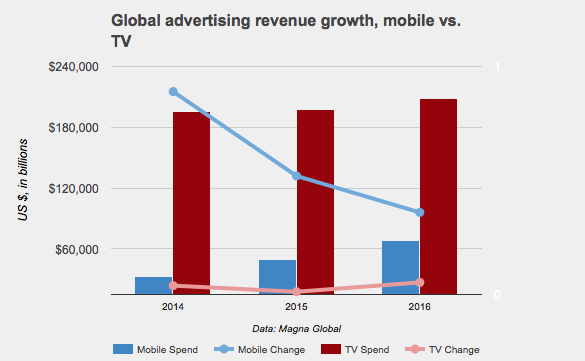

While television ad spending looks unstoppable in the previous chart, there are signs that it’s slowing down, as indicated by the above chart. Mobile will slowly increase over the next few years, while television will see a somewhat similar point, around the $180-$200 billion range.

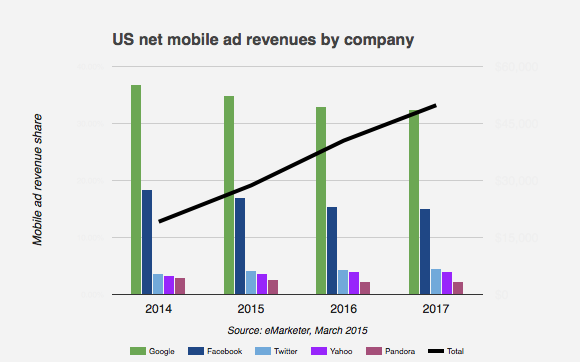

As for which companies will lead the charge on mobile ad spending, Google will continue to be unstoppable over the next few years, with a large revenue share. However, Facebook will be close behind, at about halfway of what Google is spending, followed by Twitter, Pandora and Yahoo! with much lower numbers.

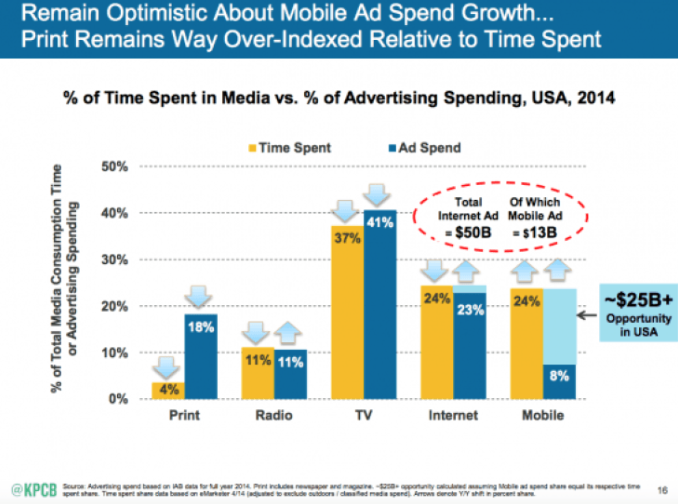

As for this somewhat complicated final chart, it shows a mobile monetization gap, with Americans spending 24 percent of their time using mobile devices, but only eight percent of ad dollars going into the format. That creates a noticeable gap of $25 billion, according to Mary Meeker’s Internet Trends Report.

More details on the report can be found here.