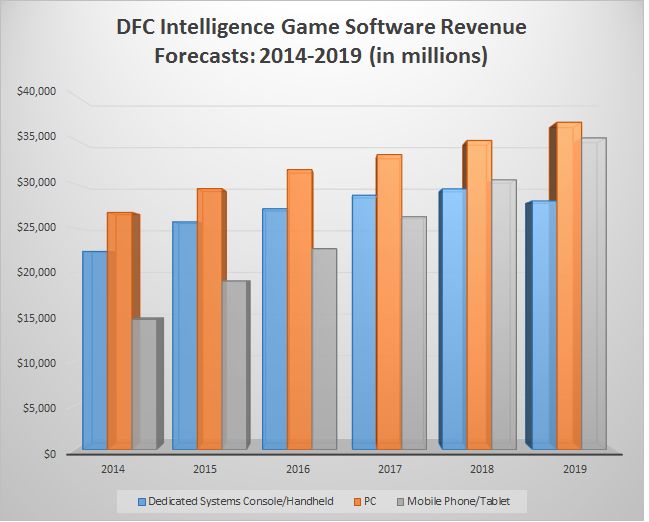

Research firm DFC Intelligence is readying a new forecast for the global games industry, and gave GamesIndustry International an advance look. The forecast has boosted its forecast for the mobile and PC game segments of the market, while lowering its forecast for consoles, to reach approximately the same $100 billion in software revenues for 2019.

DFC revealed that console forecasts are being lowered for Xbox One overall and for PlayStation 4 in North America, and DFC analyst David Cole expressed some concern about the importance of Sony and Microsoft going forward. “We have slightly lowered our forecasts for the Xbox One and Wii U. We see the PlayStation 4 remaining as the best-selling system with North America really being the only competitive market. Previously we thought the Xbox One could potentially outsell the Xbox 360 but now we don’t think that will be the case. The real issue is by 2019 whether Sony and Microsoft will still be relevant in the game space. That is a major question mark,” Cole noted.

“They really set unrealistic expectations for their systems and the issue is even as the gamer market grows they are really not growing their base in proportion. The PlayStation 2 was the best-selling console system ever and we don’t see the PlayStation 4 beating it, even as the market has grown substantially. In other words, instead of expanding the market they have focused on a core base of users that could be ripe for the picking.”

Cole sees competition increasing to deliver high-end games to televisions, from micro-console’s like Nvidia’s Shield to mobile games being sent to TV screens. Certainly the larger market for games is not as discerning when it comes to high-end graphics, and the differences will be harder and harder to spot.

DFC is also forecasting that the market will be about 85% digital by 2019, which will be largely driven by growth in the mobile and PC sectors. Retail will still be important for consoles in North America and Europe, but digital is inexorably taking over. Cole is not so bullish on VR as a source of games revenue. “When it comes to selling game software we think it will be a rounding error in the near future,” Cole said.