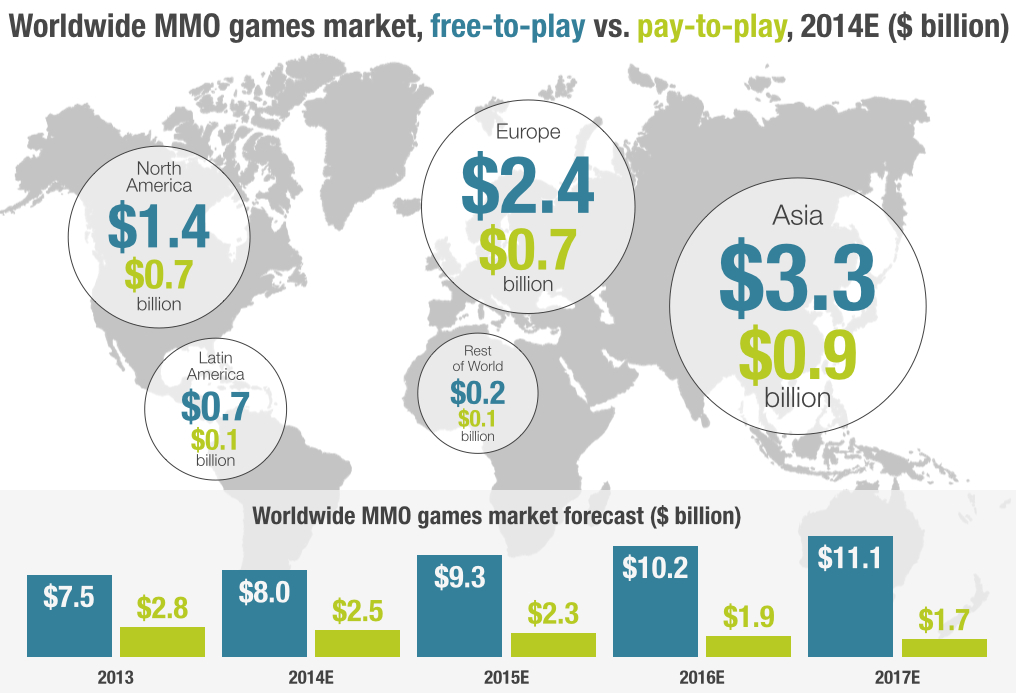

Online multi-player games have been popular for a long time. But in only a few short years, the market for MMOs has changed dramatically in terms of revenue, player preferences and addressable audience. Overall, the total category is on track to generate $11 billion in annual revenues by the end of this year, representing roughly 21 percent of the worldwide digital games market. By 2017, this number is forecast to grow to $13 billion. And so it is hardly a surprise that both small and large publishers alike are trying to claim their share of this thriving market.

Building The Dream

There’s plenty of random information on free-to-play MMOs floating around. And it is fascinating how many companies make million dollar decisions based on anecdotal evidence and things they’ve overheard at a conference. What’s been missing has been a consistent, reliable source of market data that goes beyond traffic estimates and, instead, provides insight into three key components: the monthly active user base, the percentage of players that convert to spending and, finally, the average spend per paying player.

For example, if you compare a title like League of Legends with World of Tanks, you immediately notice that the former has a much, much larger audience. However, the latter monetizes as higher rate and has a higher overall lifetime value. (This was the topic of an article we published earlier this year.) Each in their own way, these titles evolve and develop based on the unique characteristics of their user base and content strategy.

By building a data partner network consisting of developers, publishers and payment providers, we’ve managed to accumulate a dataset that contains the actual spending of over 37 million digital gamers, going back well over a decade. Consider for a moment that in the digital games market only a few percent of players actually converts to spending. This allows us to map out historical performance, read early signs of market saturation, build detailed life cycle curves, and establish title-level performance. Combined with in-depth qualitative consumer insight, we know exactly what drives the market, and it puts our publisher clients in a position to assess marketing budgets, identify major inflection points and benchmark overall performance.

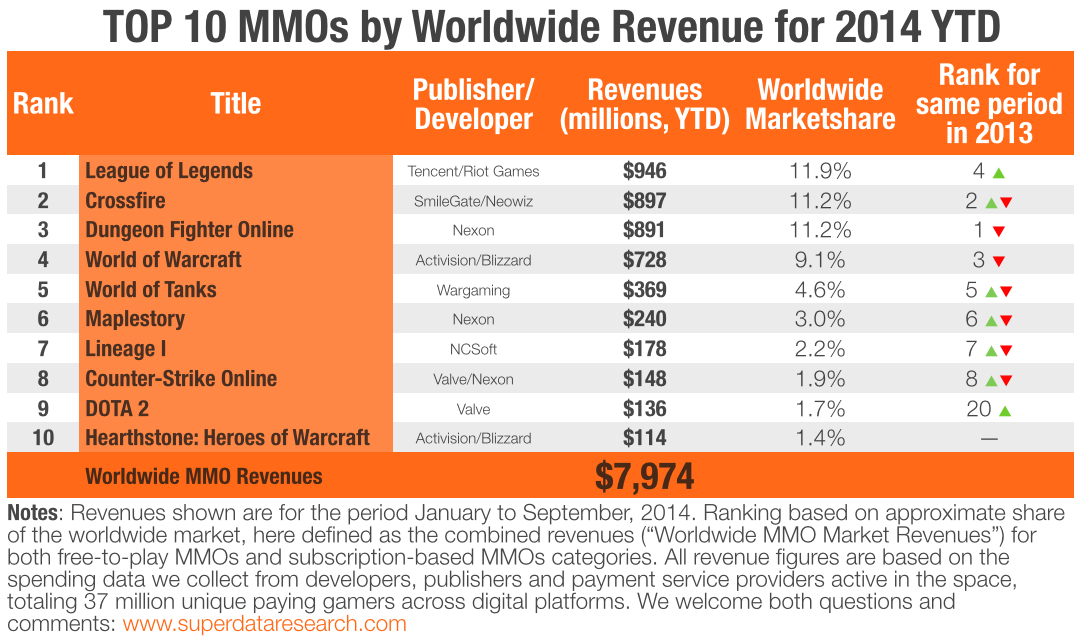

Comparing Top MMOs

Looking at the current top ten MMOs we notice that League of Legends is now the number one MMO with $946 million in revenues so far in 2014. Riot Games’ emphasis on providing a unique player experience, rather than focusing on revenues, has paid off. Remarkably, incumbent titles like Crossfire ($897 million) and Dungeon Fighter ($891 million) managed to maintain their leadership positions, providing evidence to the notion that free-to-play gamers are much more loyal than is generally assumed. What’s really exciting is DOTA 2’s rise in the charts, reaching $136 million in revenues, now claiming the number nine spot, up from number 20 previously. And, finally, ahead of its earnings call Activision is brimming with good news: after announcing an increase in its subscriber base for World of Warcraft earlier, its new title Hearthstone managed to come in at number ten, ahead of titles like Elder Scrolls Online ($111 million) and Star Wars: The Old Republic ($106 million). Of course, there is no way of knowing whether Valve intends to announce Half-Life 3 now that Team Fortress 2 is losing its position and dropping from 11 to 14 with $92 million in year-to-date revenues, but one can dream.

Changing Consumer Preferences

The success of MOBA titles indicates a subtle but important shift in the way people like to play online. Offering the same fast paced action as first-person shooter games, MOBAs have quickly become one of the most popular game genres worldwide, growing their share of the overall MMO category from 16 percent to 24 percent in just the last year. On a title-level, we observe the ascendance of League of Legends and DOTA 2. Certainly, both companies’ eSports strategy played a major role in popularizing the MOBA genre, and it is paying them dividends.

But the popularity of the free-to-play model among consumers does not mean that traditional ways of publishing are on a decline. In fact, whenever there’s a major release on console, either via traditional retail or digital channels, we observe a dip in free-to-play spending. Gamers, the data tells us, play on multiple platforms at once and regularly shift their focus between them, expressed in both time played and money spent. Innovative game mechanics and monetization strategies, it suggests, do not exist in a vacuum, but rather expand and add to the gaming ecosystem. How publishers differentiate themselves in such a volatile market has become a key strategic component.

Changing Revenue Models

The recent news that World of Warcraft saw a 600,000 increase in its subscriber base in the lead-up to its new expansion, Warlords of Draenor, silenced critics of the subscription-based MMO revenue model. Generating well over one billion in annual revenues, the game is on track to tally 8.2 million subscribers by the end of the year. Its underlying mechanics have changed, however, as World of Warcraft now also features microtransactions and a partial free-to-play component. It is a sign that things are changing, especially for the major publishers, when a company like Activision retires Titan and, instead, doubles down on Heroes of the Storm.

A key reason why free-to-play is so popular among publishers is its ability to distribute and monetize new markets. In the absence of an installed console base and in countries where people generally play at Internet cafés rather than at home, free-to-play games offer high-quality game play that is also accessible. Consequently, we’ve seen a spectacular adoption by gamer audiences in markets like Brazil, Russia and Turkey. But Asia remains the biggest market for free-to-play MMOs: with $4.2 billion in revenues, it looms over North America ($3.1 billion) and Europe ($2.1 billion), two markets traditionally central to any successful publishing strategy. The popularity of this model, combined with the protectionist policies of a country like China, has allowed a company like Tencent to quickly become a dominating force in the industry. It has also, however, raised the bar for future growth, as big Asian publishers now ask themselves how to replicate their success in Western markets. Tencent’s answer so far has been to acquire and invest in companies that offer high quality game play that is also culturally relevant, like Riot Games and Epic. We expect to see more of this in the years to come.

So that’s where we are on the MMO market today. We still have a way to go, but by working together as an industry, we have managed to establish a necessary degree of market transparency. Because, let’s face it, game development and publishing isn’t getting any cheaper.