The game industry’s growth continues to be linked to both the sales of game hardware and the technical capability of that hardware. Certainly its not a direct relationship, but electronic games depend on electronic devices to run — you can’t deliver any video game experience without some sort of device, after all. Tracking the past, present, and future state of game hardware is the mission of Jon Peddie Research, which follows “whatever influences a pixel” as founder Jon Peddie put it during his GDC 2015 presentation. Or, more precisely: “We monitor measure and forecast hardware and software markets that have anything to do with graphics,” said Peddie.

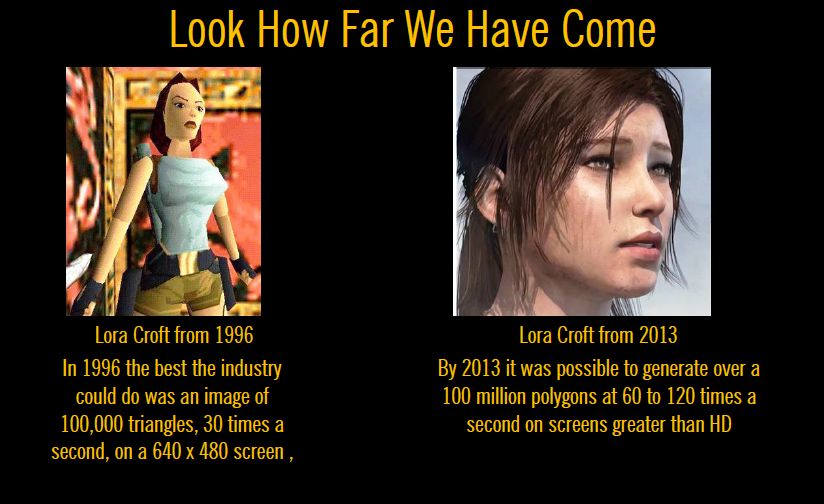

Peddie’s overview of the state of gaming hardware was chock full of numbers to chew, and salted with his opinions on the market. “The game industry is moving too slowly, and has been moving too slowly for quite some time,” Peddie said as he recapped the graphics history of the game industry. The progress was shown by an image of Lara Croft from 1996 versus 2013, and she has aged very well, thank you.

Peddie noted that recently we’ve seen some significant progress on the software side of graphics, as new drivers have been written that are much closer to the metal — with a corresponding improvement in performance. AMD’s Mantle API spurred other API development, like Apple’s Metal, Microsoft’s DirectX 12, and others. DirectX 12 in particular should reduce development time and cost for games as it stretches across Xbox One, PCs, and Windows 10 on smartphones and tablets. Developers who are addressing all of those platforms should be able to create games more speedily, although differences in the control interface still have to be taken into account.

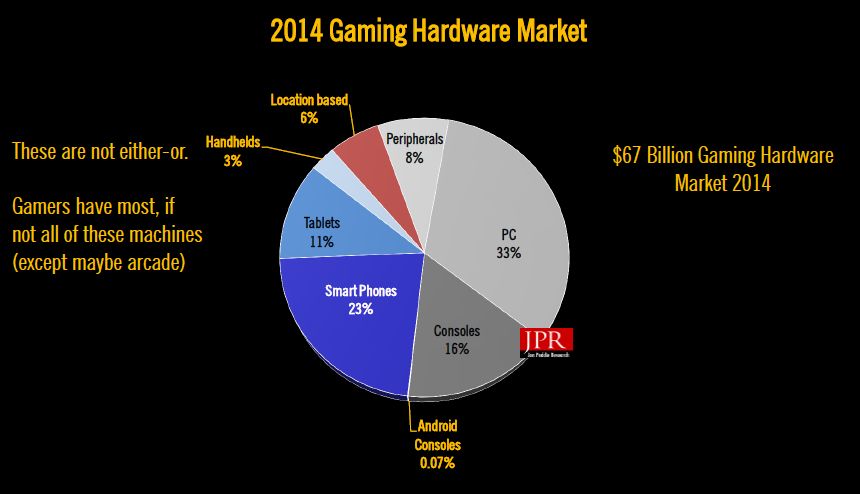

“We’re predicting robust and aggressive growth in the gaming industry, fueled by robust APIs and better graphics,” Peddie said. He provided a snapshot of the 2014 Gaming Hardware market, which he pegged at $67 billion worldwide. PC hardware accounted for the largest share at 33 percent, with smartphones at 23 percent and tablets at 11 percent (which, combined, is now even larger than the PC market); consoles clocked in at 16 percent. Handhelds like the Nintendo 3DS only account for three percent, and that’s shrinking under the relentless onslaught of smartphones and tablets. Peripherals (headsets, controllers, and the like) are 8 percent, and location-based devices (like slot machines) are six percent of the market.

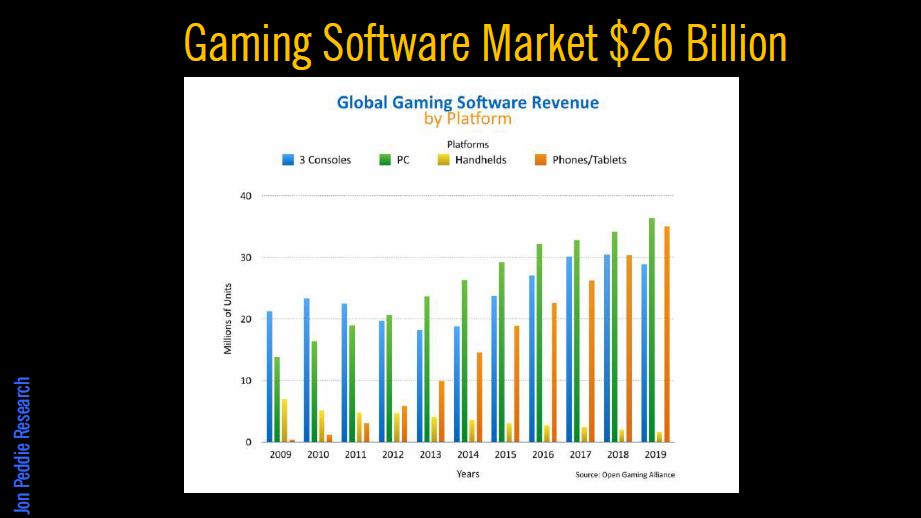

Peddie showed the current global software market at $26 billion, and projected continued strong growth for both PC games and mobile games, while console games are projected to top out by 2018. Of course, that assumes there’s no significant new console hardware coming up, or peripherals for existing consoles that might change the equation — such as VR or AR devices. Predicting numbers based on that is an exercise in educated guessing, though, since we still have no hard data on pricing, availability, or potential demand.

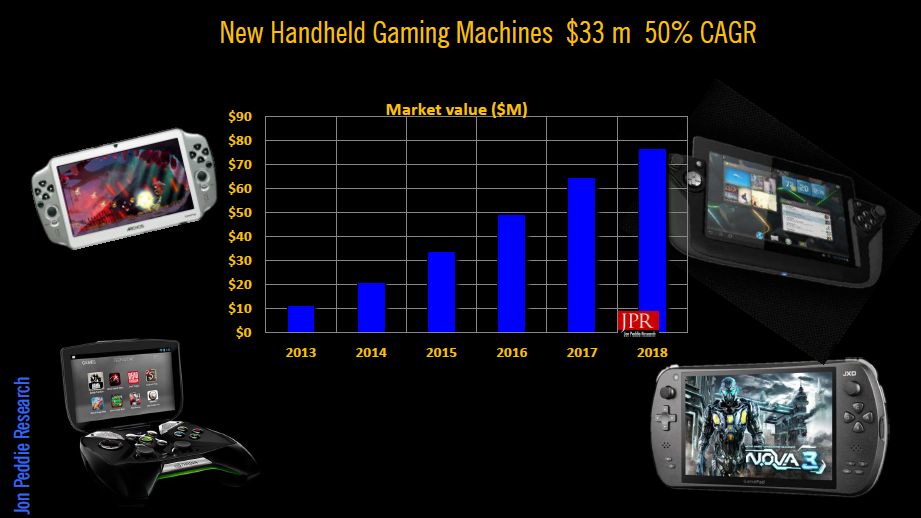

As Peddie broke down the segments of the game hardware market, it was most interesting to track what he believes will be the compound annual growth rate (CAGR) of these different segments. He feels the PC segment will have a 5 percent CAGR overall, while the peripheral segment will have a 1.5 percent CAGR. Traditional TV-based consoles (the PS4, Xbox One, and Wii U) will have a 3 percent CAGR, while handheld consoles will decline at a -2 percent CAGR in Peddie’s estimation.

The star when it comes to projected growth over the next few years is a new category: New handheld gaming machines, such as Nvidia’s Shield handheld. The market is currently small at only $33 million, but Peddie sees it growing at a 50 percent CAGR, hitting some $75 million by 2018.

Peddie’s associate Ted Pollak detailed the case for another new category, Android consoles such as Amazon Fire TV or the newly announced Nvidia Shield console: “I believe Android consoles are going to shake up the gaming space,” Pollak said. “We are on the edge of a paradigm shift.” The increasing power of these devices along with the low price and features that even the Xbox One and PS4 can’t match (such as 4K video output) will translate into sales in the coming years.

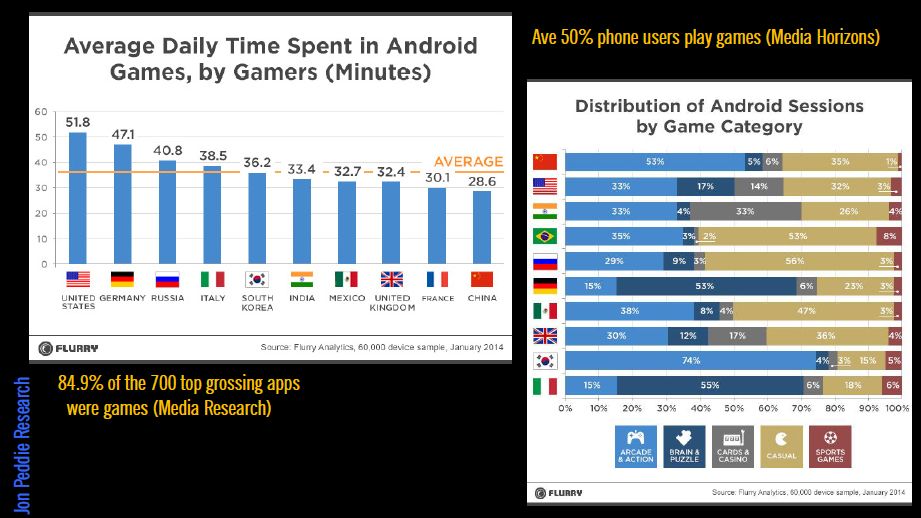

Of course, Peddie didn;’t ignore the elephant in the room — smartphones, which are the biggest segment in gaming revenues for software. He noted that the average time spent playing mobile games daily is around 40 minutes, which is quite impressive. Peddie also noted that 84.9 percent of the 700 top-grossing apps were games, so it’s pretty clear where the money is in app development.

Peddie also noted some of the social media forces driving the increasing adoption of gaming as a cultural force. Twitch is a major contributor to the spread of gaming, with more than 100 million visitors per month. As an example of just how massive Twitch has become, on the week of February 3 this year Twitch accounted for 1.8 percent of peak US Internet traffic — ranking fourth after Netflix, Google, and Apple, and ahead of Hulu, Facebook, and Amazon.

The future appears bright for most types of game hardware, and the graphics power increases will continue. The broad adoption of smartphones has transformed the potential audience for games, though, and many game developers are finding success in seeking a broad audience rather than focusing on creating the very best possible graphics. Still, the increasing power of gaming hardware is going to mean more compelling visuals, more widely distributed — and that’s nothing but good news for the games industry.