According to a new report based on a survey of leaders of the Consumer Goods Forum, a group of 400 major retailers, manufacturers and service providers across more than 70 countries, brands are facing the formidable challenges of today’s marketplace by finding creative ways of driving revenue through a transformed approach to marketing.

The New Role Of Marketers: Navigating Uncertainty, Driving Innovation, Optimizing Spend

According to the report, “Pursuit Of Harmony In Turmoil: Working Together To Make A Difference,” developed in collaboration with EY, brands face a slew of growth barriers that require leaders to adjust to constant, disruptive change.

“Companies are forced to make trade‑offs between margin versus growth, investment versus cost, and price versus purpose,” the report reads, with some of the largest producers of consumer products in the world having to “strike a balance between rising costs, price‑conscious consumers, shareholders’ needs, and their commitments to sustainable long‑term growth.”

Brands are doing this by investing in new business models and a digital infrastructure that includes creating cross-functional teams that often place the onus for digital transformation on CMOs and by enacting new mandates to drive revenue amidst economic uncertainty. In a recent EY survey, seventy percent of CMOs stated that their roles had begun to blend with that of a chief digital officer, thereby increasing their responsibilities. That tracks with the new shift among business leaders toward harnessing the power of CMOs to drive revenue-focused optimization processes across the entire organization.

Dirk Van de Put, chairman and CEO of Mondelez International Inc., a brand with over $26 billion in annual sales in 160 countries, sees the challenges that businesses face as transforming how sales and marketing teams interact and are defined and driven by digital innovation, per the report.

“Sales these days is all about Revenue Growth Management and digital tools,” Van de Put said. “It’s no longer about talking well and being in front of your client. Our next CMO could come from our digital group rather than somebody that grew up in brand management.”

Despite these shifts in duties, most CMOs in EY’s recent study reported that they had to petition for digital funding as needed, with 64 percent stating that their peers in finance “found it difficult to accept the unplanned nature of marketing expenses.”

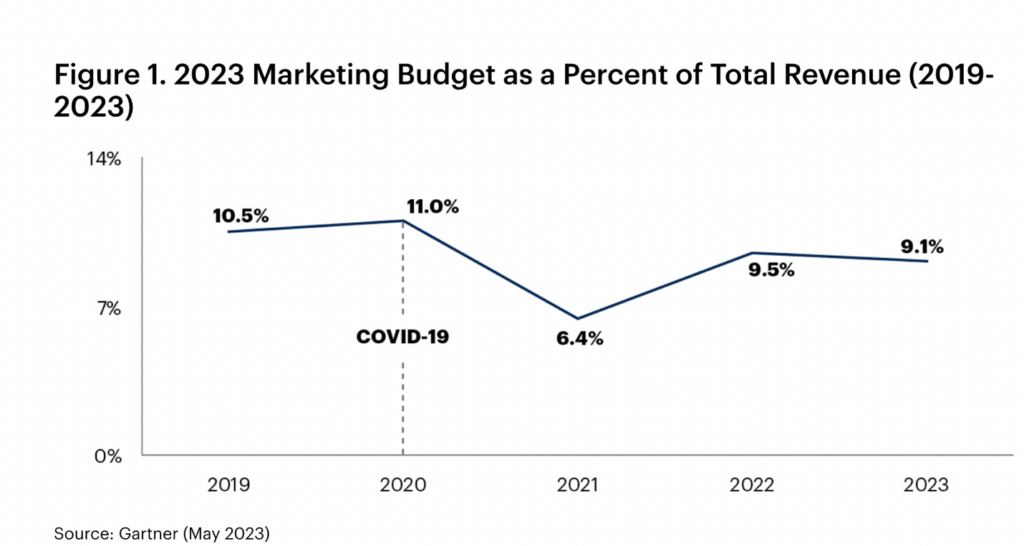

That “difficulty” may be linked to many CMOs’ experience of flat budgets, even amid inflation.

Source: Gartner

According to a May 2023 report from Gartner, CMOs must do more with less while driving digital innovation and ensuring that branding duties are maintained. At the same time, new sales pressure due to marketplace uncertainty is making long-term, customer-focused strategy management challenging.

“In 2023, CMOs need to become a new type of enterprise leader,” said Ewan McIntyre, chief of research and VP analyst in the Gartner Marketing practice. “This goes beyond serving at the helm of the brand but also assuming a more business-focused role that pivots into a period of investing for profitability versus growth. Those that carry on status-quo will face significant challenges in the near-term.”

According to a LinkedIn global survey of C-level executives and 494 CMOs from late 2022, 77 percent of CMOs report feeling pressure to “prove their campaigns are providing an enhanced short-term return on investment.” Their feelings are likely based on fact: A survey of 1,619 brand marketers by Marketing Week revealed that 37 percent saw a marked increase in ROI tracking in 2022. Another 31 percent stated they would likely have to curb their creativity while 30 percent said they would have to operate more reactively.

With 75 percent of marketers reporting that they feel pressure to cut MarTech spending, delivering on performance and engaging customers while juggling innovation means a renewed focus on the customer. But today, optimizing customer experience is not enough.

Decoding The “Disrupted” Consumer

It’s no secret that consumers are concerned about inflation, but for marketers seeking to deliver on a new ROI mandate, those concerns make performance more complicated. Per EY’s “Pursuit Of Harmony In Turmoil: Working Together To Make A Difference,” 74 percent of consumers are concerned about the rising cost of living, and 56 percent are worried about their ability to purchase household necessities. Fifty-four percent also expect rising costs to worsen in the next six months. With 67 percent of surveyed consumers reporting that they now try to repair rather than replace items and nearly one-third shifting away from brand-name products, marketers have to do more than stoke brand loyalty—they have to focus on amplifying consumers’ willingness to spend at all.

“Consumers don’t just shift based on the way they buy; they shift their opinions faster than you think,” Van de Put said. “Since we are in such a period of turmoil, we are seeing big shifts in the mindset of consumers. There’s a change in shopping habits. They want to try more things. What was true before the pandemic and this inflationary period won’t necessarily be true after.”

The Takeaway For Marketers

First-quarter sales figures for 2023 show that consumers are spending on experiences and products and services that deliver unique value. They are even willing to cut back on tried-and-true brands or go-to products to try new things or brands that align with what matters most to them now. Consumers’ willingness to splurge in the midst of inflation worries suggests that marketers’ insights into their audience’s needs and priorities can convert them back to their brands.

That means it may be back to basics for consumer engagement—allowing CMOs to leverage their expertise to bring back “disrupted” consumers with a combination of value and values—a heightened expression of what makes a brand worth its price. That could occur either by alignment with ESG principles that drive much of Gen Z purchasing, for example, or the overall emotional impact of the product or the experience of it.