June adhered to the pattern of the last five years for domestic retail sales of video game hardware and software. NPD reported that once again retail sales of console hardware and software dropped compared to the same month in 2012, with total video game sales (hardware, software, and accessories) down 15 percent. The small crumb of comfort is that sales didn’t drop as much as they have in some of the previous months this year, where the results have plunged as much as 44 percent over last year.

Looking more closely at the numbers, the bulk of the reduction came in hardware sales, which is what you would expect with new consoles on the horizon. Video game hardware sales dropped to $142 million, down 30 percent from last year’s $201.5 million. “Nintendo’s 3DS maintained the top spot for overall hardware sales across all platforms for the second consecutive month,” said NPD’s Liam Callahan. “The Xbox 360 was the highest selling console, continuing its streak for the thirtieth month in a row.”

The odd thing here is that despite continuing sales declines, none of the Big Three have dropped prices on existing consoles. That’s the usual strategy late in a console cycle, when hardware’s not moving: Drop the price and find a whole new audience. Apparently, if that’s going to happen it will occur closer to the launch of new consoles. For a price change to have any significant impact on holiday sales, it would have to occur by October at the latest. Sony, Microsoft and Nintendo have all signaled that continuing sales of existing current-gen consoles are important. A price cut will certainly boost sales, and it’s especially important with new console competition appearing at the low end.

Speaking of which, NPD noticed the Ouya’s debut at retail, though the results weren’t impressive. “June 2012 was the first month of retail sales for Ouya (not counting direct sales through ouya.tv) and were relatively light for a new console,” said Callahan. “This may be due to the lack of a major marquee title driving consumers to seek out the console, low awareness due to Ouya being a new brand, or low inventory volume due to manufacturing constraints.” So far, the $99 console isn’t changing the world, but it’s still very early days.

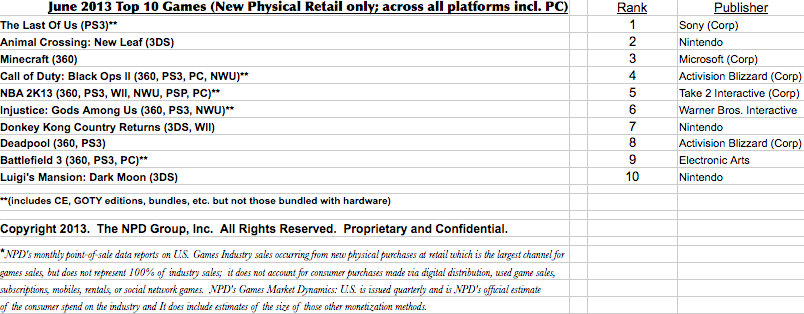

Turning to software, the picture was not quite as grim, with sales of $296.1 million, only down 10 percent from June 2012’s $328.8 million. The bright spot was the Nintendo 3DS, which had both strong hardware sales and strong software sales. “To quote Nintendo during E3, ‘software sells hardware’, which is evident in this month’s 3DS results,” Callahan noted. “Strong double-digit increases in the 3DS hardware sales were coupled with triple-digit digit increases in software for June sales. 3DS software sales momentum is building due to a steady flow of content over the past few months, leading to positive year-to-date sales results.”

In a separate note to media, Nintendo revealed further data. 3DS software sales were up 105 percent over last year, and through June, nearly 3.6 million combined physical and digital units of first-party Nintendo 3DS software have been sold, representing an increase of more than 85 percent over the same time frame last year. Animal Crossing: New Leaf sold through 505,000 copies with 20 percent of sales coming digitally. Additionally, Donkey Kong Country Returns 3D sold over 108,000 combined units in its second month and Luigi’s Mansion: Dark Moon added nearly 115,000 combined units in its fourth month on the market, bringing its lifetime total to more than 750,000 combined units.

Nintendo has certainly worked wonders with the 3DS after a slow start. Can the same thing happen with the Wii U It’s going to be a more difficult task for several reasons. First, the Wii U has more competition at both lower and higher price points (Xbox 360 and PS3 at the low end, and Xbox One and PS4 at the high end) with vastly larger and more diverse software libraries. Second, since Wii U development is significantly more expensive than 3DS development, it will be harder to rally third-party support. Nintendo will have to supply most of the compelling Wii U software with its own products, which is hard. The company has already admitted development of Wii U titles is taking longer than expected, which is why Pikmin 3 is late, for example.

Summing up, the retail picture for video games isn’t great, but at least it’s getting worse slower than it was earlier in the year. The real booster shot won’t come until September when Grand Theft Auto V hits, which will be great for retailers (though perhaps not so great for other game sales that month). We’ll start to see big holiday titles appearing in October, and then the new consoles from Sony and Microsoft will drop in November. The fourth quarter should look pretty good at retail, but the forecast for existing consoles may not improve unless we see some price cuts in the near future.