Just a few months ago, China surpassed the US as the world’s biggest market for video game revenues, particularly with mobile, thanks to its millions of users. And it has kept that lead ever since, but it’s part of a much bigger picture of the Asia Pacific market, including Japan, Taiwan, South Korea and Australia. For the past few years, Asian companies that have found success in their home countries are looking to grow internationally through investments, acquisitions, and bringing their games to a new audience.

Breaking Down Revenues

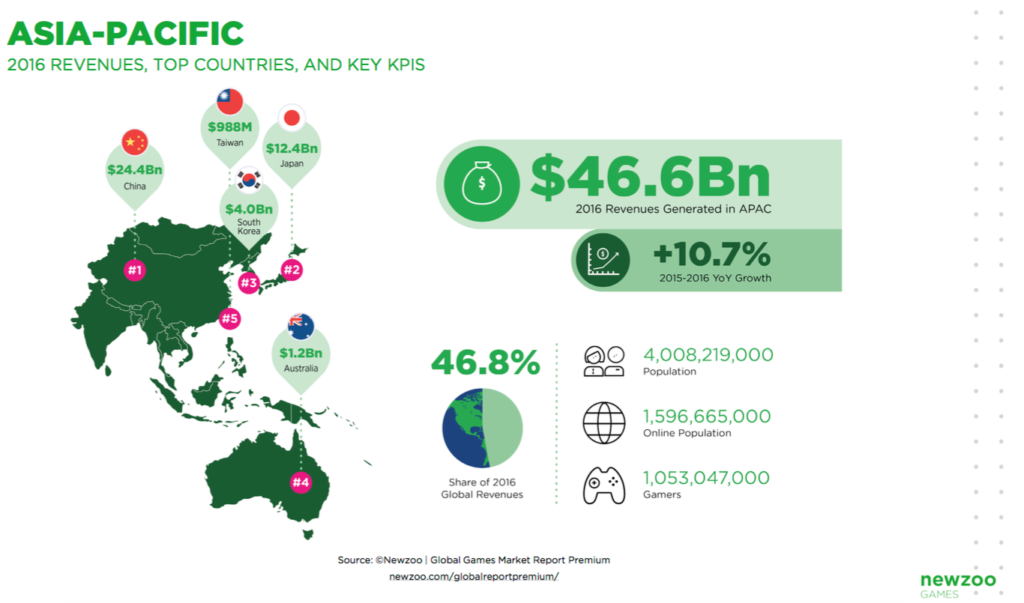

According to Newzoo’s Global Games Market Report, Asia-Pacific’s console, PC and mobile game revenues for 2016 total an estimated $46.6 billion for the year, with more than half coming from China with $24.4 billion. Close behind is Japan with $12.48 billion, and the rest split up amongst the other countries.

Out of a population of nearly four billion people, over one billion (a quarter of the population) are gamers. However, there’s still plenty of room to grow, and China is in far lead.

To help track Asia’s gaming growth Nielsen, working alongside TalkingData and its base of 650 million monthly active users, introduced a new Games IP Evaluator, with three purposes in mind: identifying audience profiles, quantifying game potential and optimizing game development and launch.

“Although 40 to 50 percent of all new mobile games involve an IP acquisition and the percentage continues to grow, most mobile game developers enter into IP partnerships based on their past experience with no support of forward-looking quantitative analysis,” said Steven Li, vice president of Nielsen’s Entertainment Vertical in China. “The Nielsen Games IP Evaluator offers developers insightful consumer research to fully understand IP potential and the right form for mobile games.”

Tencent Is Everywhere

If there is one thing that has become increasingly clear with China gaming market right now, you just can’t ignore Tencent.

Founded in 1998, Tencent has come a long way in a short time, mainly due to the popularity of online games like CrossFire and Dungeon Fighter Online, which has attracted millions of gamers. But it made a name for itself in 2011, when it purchased a majority stake in Riot Games, giving it one of the biggest properties in eSports today: League of Legends. The game continues to be a colossal hit, and Tencent completed its acquisition of Riot late last year, moving closer to eSports dominance.

Tencent also invested in a number of other companies, in an effort to expand its reach more towards Western shores. It purchased a 12 percent stake in Activision Blizzard and a small stake in Epic Games in 2012; it purchased portions popular developers such as Robot Entertainment (Orcs Must Die) and Glu Mobile (creators of Kim Kardashian: Hollywood); and it also purchased a major stake in Pocket Gems, the creators of the popular mobile game War Dragons.

But perhaps its biggest move since acquiring Riot Games took place last week, when it acquired Clash of Clans developer Supercell for $8.6 billion, giving it ownership of one of the biggest mobile companies in the US. With this purchase, Tencent now has control of 13 percent of the global $99 billion mobile market.

“China is home to more gamers than any other country,” CEO Ilkka Paananen said about the deal. “Tencent’s platforms reach around a billion users (yes, a billion!). And, they have around 300 million unique users playing games on their platforms. What this means for us is that together with Tencent, we can bring our games to so many more players. Also, their social platforms offer many new possibilities for our games, particularly for social play. All of this is very exciting!”

In short, that means more revenue and business for Tencent, adding to its already impressive mobile game sales numbers.

With the bases for social networking, eSports, mobile and web portals covered, Tencent is a big reason why the Asia’s gaming market is so immense.

South Korea Expands

While Tencent is famous for investing in developers, other companies have not only done the same, but brought their own IPs to a worldwide audience while also developing new ones.

Nexon, for example, got its start in South Korea back in 1994. It is generally credited as the company that started the free-to-play market and it rose to success with titles such as MapleStory and Dungeon & Fighter, which is one of the biggest free-to-play PC games in China.

The company has been working for years to reach a global audience. In 2015, it pushed for the Western markets with Ghost In the Shell Online, and partnered with a US developer Big Huge Games to produce the highly popular mobile game DomiNations. Shortly thereafter, it acquired the developer in a deal for an undisclosed amount, but with many dividends, thanks to DomiNations‘ 19 million downloads.

It’s also working with Respawn Entertainment on a trio of mobile games based on its hit property Titanfall, with the first expected to arrive later this year in time for the sequel’s release on consoles. Nexon will also publish Lawbreakers, the first game developed by legendary game designer Cliff Bleszinski’s new studio, Boss Key Productions.

Another major company from South Korea is NCsoft, the publisher responsible for a number of hit games over the past few years, including Lineage and WildStar. These titles have not only established an audience of Asian players into the millions, but also a great deal of interest in the US as well.

The company pushed its expansion into the West further last year with the opening of Iron Tiger Studios, a new mobile studio out of San Mateo. With it, NCsoft promised to work on a number of original IP’s for various platforms, as well as translating other established properties on the mobile front. “NCsoft West is accelerating and the launch of Iron Tiger is a key step in enabling us to develop extraordinary and innovative games more rapidly and across more platforms,” said the company’s senior VP of mobile Jesse Taylor about the opening, speaking with GamesIndustry International.

It also has a growing presence in eSports, with its owned company ArenaNet recently investing $200,000 into a Guild Wars 2 World Tournament.

While on the topic of eSports, Korean game publisher, Bluehole, has also been making waves, moving beyond its usual MMORPG territory to create a new experience called Battlegrounds in conjunction with Irish developer PLAYERUNKNOWN. It will bring another Asia Pacific-based company more into the Western market, in the hopes of following the success of its previous release, Tera, which first started in Korea and has found success in North America.

When it comes to catering more to this market, production director Dr. Chang Han Kim explained, “First and foremost, we’re focused on creating a good game, but we plan to conduct a very open development process as well. We hope to get very closely engaged with the community, share a lot of the stuff that takes place in our office, seek feedback as much as possible, and just really focus on creating a good game.”

And then there’s the South Korean eSports scene. Countless players invest hours at a time in games like League of Legends and the years-old Starcraft II. Activision Blizzard regularly holds tournaments there, with millions of fans watching both live and online broadcasts to see the best players in the world compete. According to The New York Times, it’s even considered a “national pastime.” Considering how Korea is the country where eSports first took off, it’s little wonder why companies are looking to take advantage of how eSports interest and popularity is growing around the world.