The mobile market (games and other apps) continues to be strong, but the latest data from research firm Sensor Tower shows some surprises are under way. There are big things ahead in mobile, and marketers need to be on top of these trends.

First, the overall picture is that combined worldwide App Store and Google Play downloads grew 8.2 percent in the first quarter of 2016 compared to the first quarter of 2015. That represents a total of 17.2 billion app downloads, with 6.1 billion in the App Store (a 13 percent growth) versus 11.1 billion in Google Play (a 6.7 percent growth). This gets even more interesting when you drill down and start looking at which apps were dominant.

Facebook is clearly a winner on mobile, as figures indicate. The top apps by download for the first quarter were WhatsApp, Facebook Messenger and Facebook itself while Instagram (also owned by Facebook) made it into fifth place. Facebook’s strategy of having multiple apps with a different focus is clearly working out well for the company, with four out of the top five apps worldwide.

As you would expect, games continue to be a powerful force among mobile apps. Eight of the top 20 apps worldwide were games, although that number drops to five when just talking about U.S. Supercell’s Clash Royale‘s enormously successful launch, appearing at the #9 position worldwide in terms of downloads. The game is on track to earn somewhere in the neighborhood of $1 billion this year, putting it near the very top of the charts for mobile game revenues. The game was the fastest game ever to reach #1 in revenues, showing that Supercell has a very deep understanding of what makes a game popular.

Speaking of extremely popular brands and developers, King Digital’s Candy Crush Jelly Saga rang in at #7 in worldwide downloads for iOS and Android combined, continuing on the success of Candy Crush Saga and Candy Crush Soda Saga.

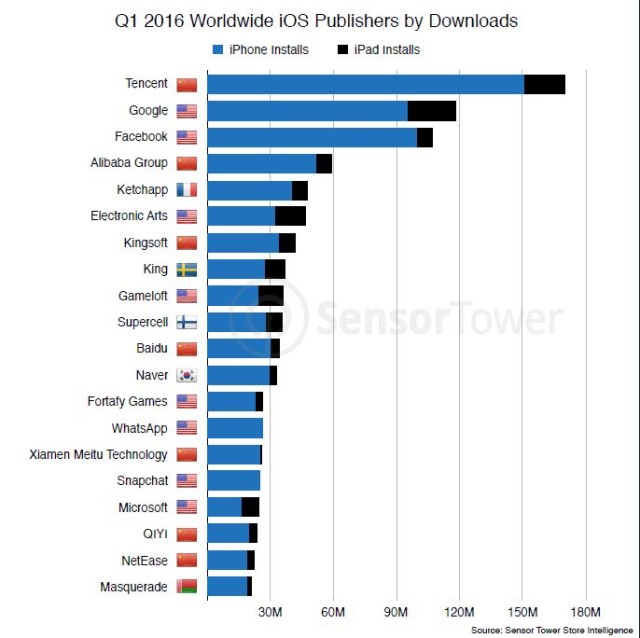

Looking at the top publishers by downloads worldwide, in iOS Tencent (the world’s largest game publisher) took the number one slot, followed by Google and Facebook—which is impressive when you consider how Google and Facebook have no presence in China. Almost half of the publishers in the top 20 by download were game publishers, notably Ketchapp at #5 and Electronic Arts at #6.

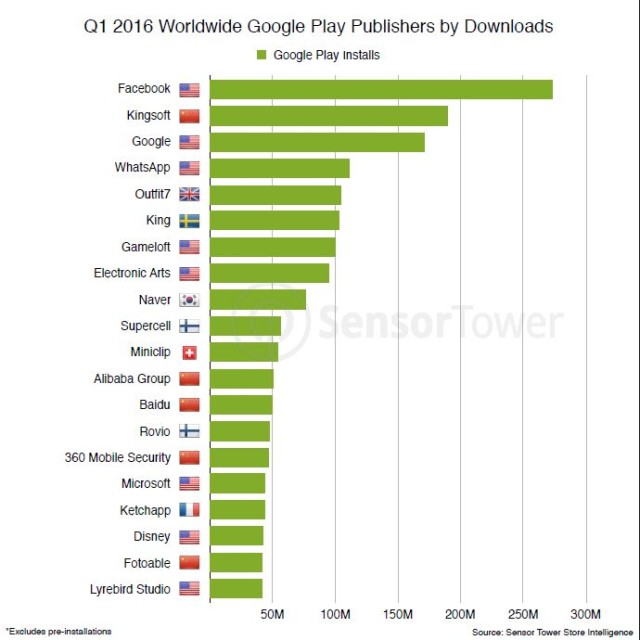

The story on Google Play is different, because there are many Android app stores in China that aren’t covered by this data, and Google Play doesn’t currently operate in China. Game publishers represent nine out of the top 20 publishers on Google Play.

What Lies Ahead For Mobile Games

Some major developments in the mobile space may be harbingers of change, especially for games. The first big thing to be aware of is Apple’s potential for slowing smartphone sales this year, and an overall cooling of the smartphone market.

According to research firm Gartner Group, global smartphone shipments will reach 1.5 billion units this year, about 7 percent above last year’s units. For mobile phones in general, Gartner expects sales to average about 1.8 percent growth through 2018. “The double-digit growth era for global smartphone markets has come to an end,” said Gartner Group’s research director Ranjit Atwal. Moreover, the situation looks worse in key markets like China and North America, where Gartner predicts even slower growth, with China up only 0.7 percent and North America up 0.4 percent. In other words, both of those two huge markets will be buying about the same number of smartphones as they did last year.

What’s going on? Several factors are coming together. For one thing, as smartphones reach an ever great percentage of the total population, you’d expect growth to slow down. The remaining percentage of the population will be harder to reach with a smartphone, often because they are unlikely buyers to begin with (too young, too old, too poor). For another, the huge innovations in smartphones are slowing down, and we’re seeing more incremental changes such as faster processors, slightly better cameras and the like. Generally speaking, smartphones are fast enough for most uses and cameras are really quite good for most purposes. Furthermore, screens have reached about the maximum reasonable size for a phone. So with the pace of upgrades slowing, it’s harder for phone makers to create the desire for a new phone.

The consequence of a slowing market is that app makers will have an even harder time generating huge audiences. Getting people to download and use a new app is hard enough, and if there are fewer new phones entering the market, it will get even harder. More pressure will be put on marketing to make that happen.

Another trend that bears watching is the increasing presence of big brands moving into mobile gaming. Nintendo has finally shipped its first mobile product, Miitomo, and it’s doing pretty good so far, generating over $40,000 per day. It’s too soon to tell how this will hold up over time, but the app is off to a good start. When Nintendo gets around to putting out mobile games using brands like Mario and Link, we should expect to see even bigger numbers. However, moves like these will make it even harder for mobile game developers that don’t have a powerful brand name or enormous marketing budget to find an audience.

Overall, the mobile game market will continue to grow this year, and we’re starting to see major brands extending their power with mobile apps. However, the business isn’t getting any easier for marketers, as slowing smartphone growth removes one of the great positive factors behind the growth of mobile games over the past few years. The easy paths to growth are becoming harder, yet the right games with the right marketing can still generate amazing amounts of money. The top slots are not all locked up by the big publishers, so new titles still have a chance to break through. There’s plenty of room to improve overall metrics of games with better game design, as the average revenue per paying user achieved in Japan are still about five times the best we usually see in North America and Europe.