When Starbucks announced the launch of its first cashless location, it didn’t just make headlines on the merit of its innovation. The rise of cashless payments has also created a data gold rush for marketers.

“Data is clearly the biggest upside to all these trackable transactions,” said Debby Ruth, senior vice president of global media and entertainment at Magid. “Going cashless really provides the opportunity to get a better understanding of your customers and build relationships, especially if it makes sense with an app.”

Kicking off the program at one of its Seattle locations, Starbucks’ cashless pilot store won’t accept cash for purchases for an unspecified period of time—except for tips.

This tech is coming at the right time. Consumers may still break out the plastic when they want to pay, but swiping is going out of style. PwC predicts that by 2019, there will be over a billion global mobile proximity payment users and that 85 percent of transactions will be near field communication (NFC)-based.

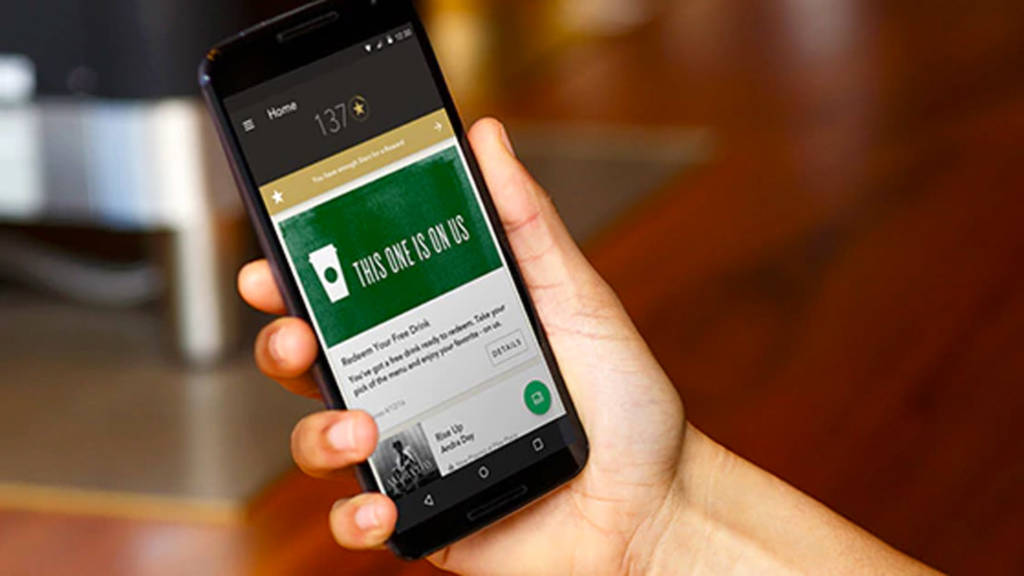

With an app ready to take on the transactions, Starbucks is a good test case scenario for a transition to cashless: Mobile payments comprised 36 percent of the brand’s total US transactions in the third quarter of 2017. Making high-traffic locations cash-free would allow the Seattle-based company to increase this figure.

“It’s a pretty seamless experience from a user perspective,” Ruth said. “[Starbucks is] smart by using all the gaming techniques like setting goals and getting points. Those sorts of advantages really would increase purchase amounts and frequency of purchases.”

Offering cashless transactions through a mobile app also cuts out the middleman, allowing brands direct access to valuable marketing data.

“They don’t have to rely on the credit card companies or banks because they’re in between,” said Ruth, adding that apps may not be for everyone. “Even if you’re reliant on the credit card companies, I think it’s more important than ever when you’re negotiating to use their services to include data in that.”

Total card payments in the US grew from $5.65 trillion in 2015 to $5.98 trillion in 2016, according to the 2017 Federal Reserve Payments Study. The annual report found that US consumers are not only using cards more but are making larger purchases when they buy. Total card payments increased at an annual rate of 7.4 percent by number and 5.8 percent by value from 2015 to 2016.

Cashless payments offer convenience to consumers and safety for businesses against would-be robbers, but digital transactions are not without risk. Identity theft and fraud affected over 15 million US consumers in 2016, who lost over $16 billion—even with the transition to EMV chip readers.

Still, Ruth notes the risk is a worthwhile one for those marketing the brand.

“As long as marketers are in the data chain, I think it’s a real boon.” she said.