A recent YouGov report shows mobile gamers represent the world’s most ad-friendly audience.

Mobile Gaming Takes The Lead

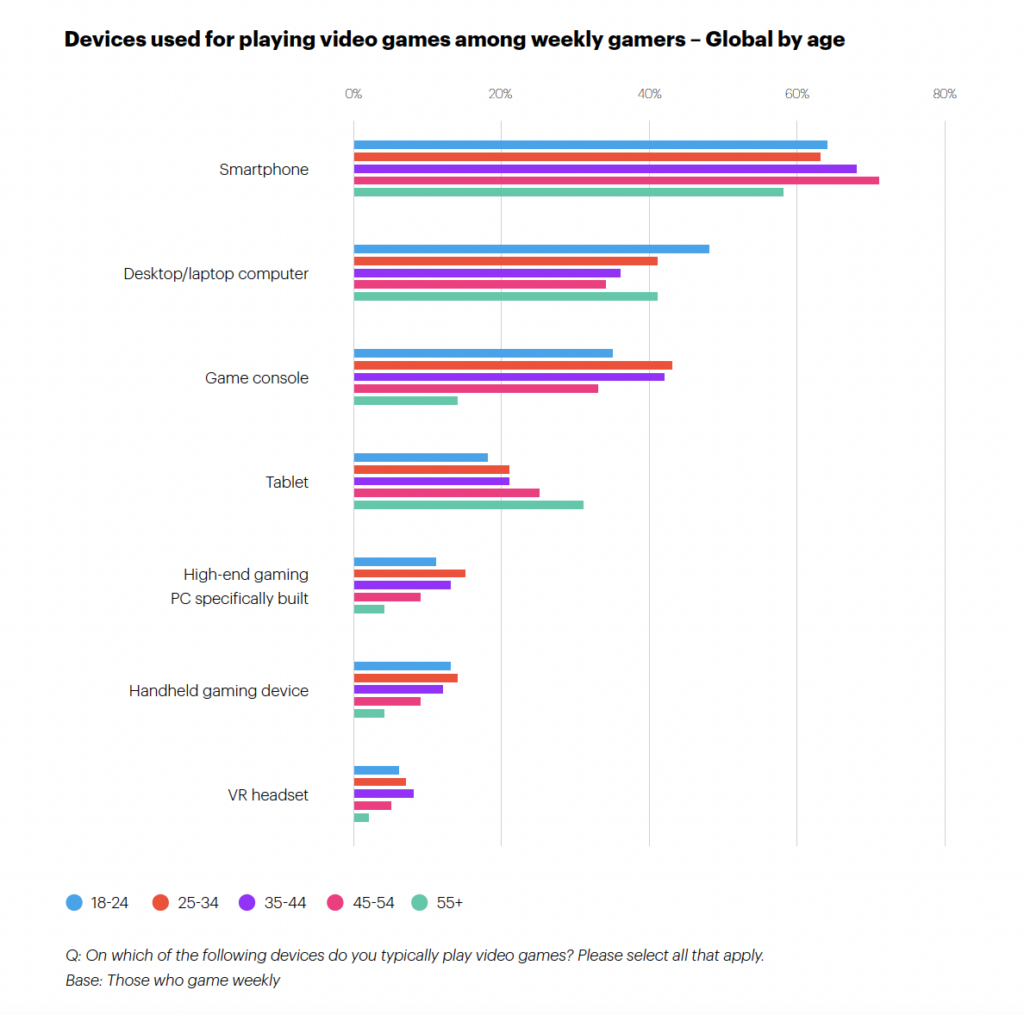

According to the YouGov report, Global Gaming & Esports 2023: Reaching Gamers – Everywhere, most gamers use their mobile devices most often when gaming weekly. At least 60 percent of gamers across every demographic surveyed use smartphones when gaming, with Gen X (45-54) showing the highest rate of mobile gaming adoption. Desktop, laptops and gaming consoles came in second and third in popularity.

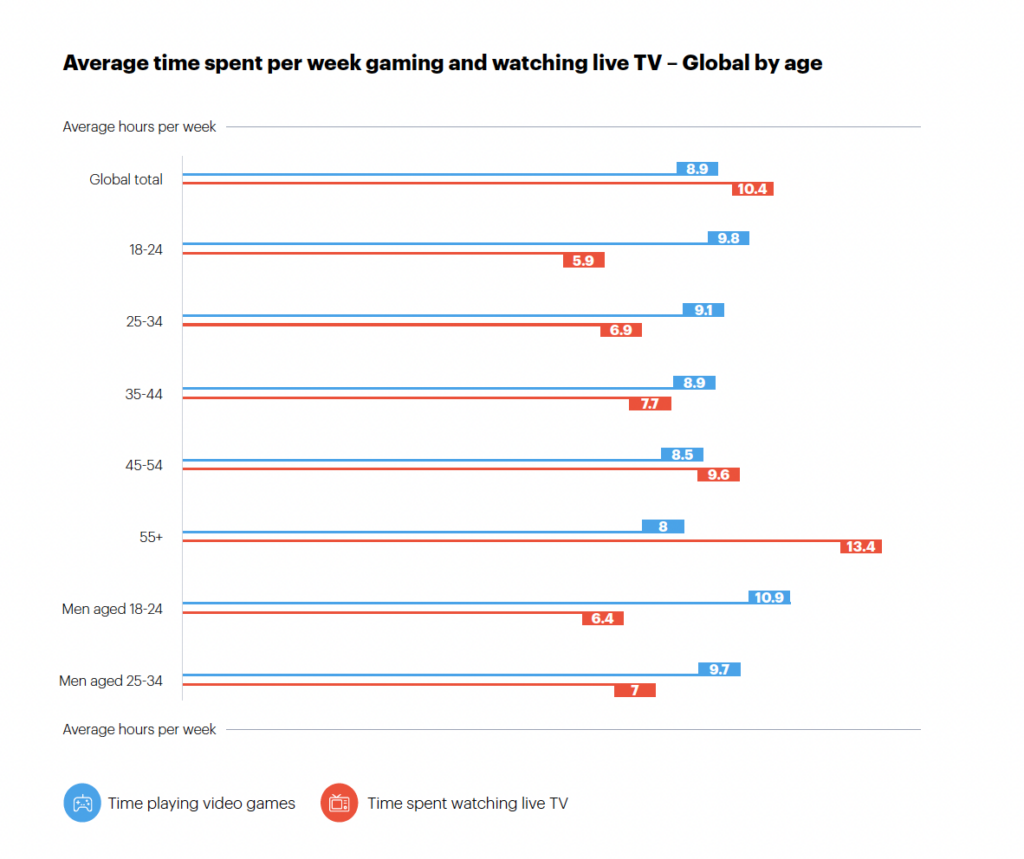

Globally, the study also found that for entertainment, gaming surpasses watching live TV for every demographic under 45, with Gen Z spending the highest average time gaming (9.8 hours).

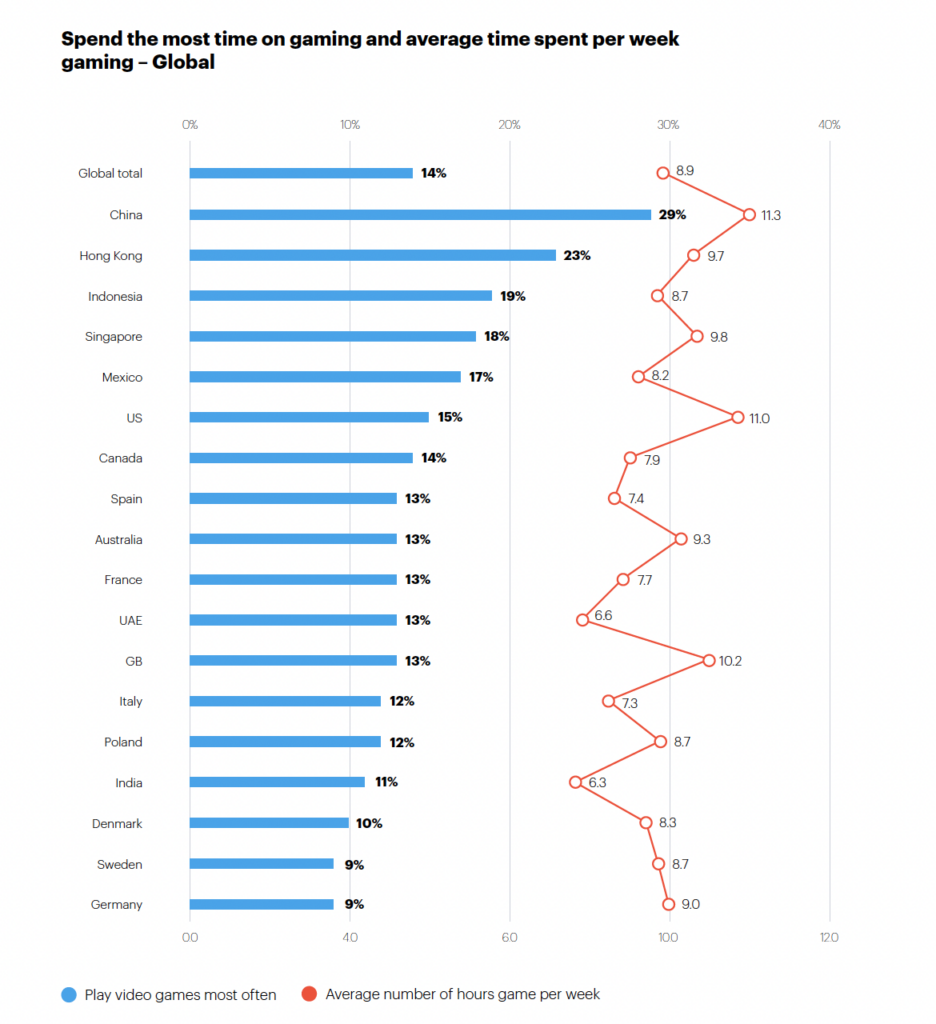

Globally, Chinese and American consumers spend the most time gaming, with consumers in both nations spending roughly the same amount of time engaged in gaming activities (11.3 and 11 hours, respectively).

For marketers, consumers’ affinity for mobile gaming presents new opportunities to connect with untapped audiences. Per the YouGov report, weekly gamers are already primed to engage.

Frequent Gamers Show Deep Brand Connections

According to the report, consumers who participate in gaming weekly are most open to receiving ads via social media, with 31 percent stating that ads on the platform inspired positive product perceptions. In addition, Gen Z (ages 18-24) weekly gamers are far more likely than others to rank in-game advertising as a preferred way to engage with brand messaging (seventh most popular versus third most popular among Gen Z).

YouGov data also reveals deep brand connections among weekly gamers. Half of the consumers who game more than an hour per week said they would like “deeper, more meaningful connections with brands” versus 45 percent of all consumers. In addition, weekly gamers show a strong preference for personalized ads. Forty-two percent of frequent gamers prefer personalized ad experiences versus 36 percent of other consumers.

Weekly gamers also have a higher tolerance for ad-supported content, with 54 percent agreeing that “It’s fair to watch ads in exchange for free content,” compared to 49 percent of consumers. In addition, consumers who game often have a higher level of trust in influencers (36 percent versus 26 percent of all consumers), are more likely to engage with ads on social media versus other websites (34 percent compared to 29 percent) and enjoy social media game experiences more than other consumers (47 percent versus 36 percent).

This data tracks with recent research from Fandom, which reveals powerful brand influences over gamers purchasing choices. Per the Fandom report:

Eighty-six percent of gamers reported being influenced to purchase a brand or product that invests significantly in gaming or on a gaming platform, with half reporting that they were “heavily influenced” to do so.

Millennials are more than 24 percent more likely to be “heavily influenced” to purchase than the average gamer.