Industry game sales continue to grow quite well through September 2015, according to new numbers reported by SuperData. Digital sales have managed to reach $5.4 billion for the year, up 11 percent from the previous year.

Analysis from SuperData CEO, Joost van Dreunen, follows:

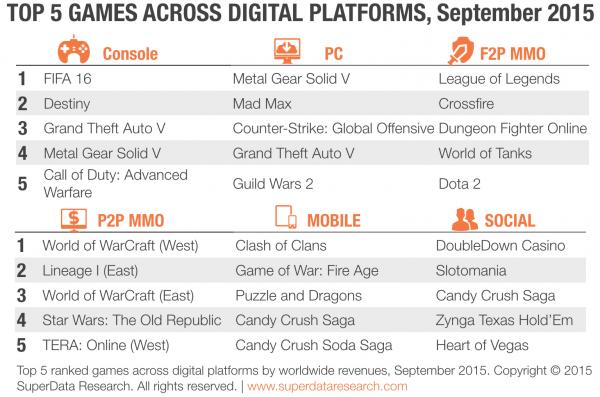

- FIFA 16 and MGS V top the charts at the start of the fall release season.

- Worldwide digital game sales reach $5.4 billion in September 2015, up 11% YoY.

- Oculus and Samsung target the mass market with the $99 Gear VR.

- FanDuel and DraftKings go after $143 million North American eSports market.

- Call of Duty and other shooter franchises eschew single-player modes.

Top selling digital titles based on revenue by category, September 2015.

Reporting period 09/01/2015-09/30/2015

Digital console

- FIFA 16

- Destiny

- Grand Theft Auto V

- Metal Gear Solid V: The Phantom Pain

- Call of Duty: Advanced Warfare

PC DLC

- Metal Gear Solid V: The Phantom Pain

- Mad Max

- Counter-Strike: Global Offensive

- Grand Theft Auto V

- Guild Wars 2

Free-to-play MMO

- League of Legends

- Crossfire

- Dungeon Fighter Online

- World of Tanks

- Dota 2

Pay-to-play MMO

- World of WarCraft (West)

- Lineage I (East)

- World of WarCraft (East)

- Star Wars: The Old Republic

- TERA: Online (West)

Mobile

- Clash of Clans

- Game of War: Fire Age

- Puzzle & Dragons

- Candy Crush Saga

- Candy Crush Soda Saga

Social

- DoubleDown Casino

- Slotomania

- Candy Crush Saga

- Zynga Texas Hold’Em Poker

- Heart of Vegas

FIFA 16 and Metal Gear Solid V top the charts at the start of the fall release season. EA’s (NASDAQ: EA) FIFA 16 was September’s highest-grossing digital console release, followed closely by Destiny (NASDAQ: ATVI). The launch of Destiny’s The Taken King expansion spurred sales of full copies of the game, which made up two thirds of its September digital revenue. The additional content persuaded new players to take the plunge, and the expansion’s complex pricing structure further incentivised existing players to re-purchase the full game bundled with all current DLC. Two of the month’s most anticipated multi-platform releases, Metal Gear Solid V: The Phantom Pain (TYO: 9766) and Mad Max (NYSE: TWX) both fared better on digital PC than digital console. Konagi’s efforts to release the PC edition of Metal Gear Solid V day-and-date with the console versions paid off in a big way as PC players flocked to the game despite the franchise’s console-focused history. We expect the digital console and PC segments to fluctuate heavily through November as major new titles impact the hit-driven segments. The top-earning MMOs and mobile games remain largely unchanged from August. In the social space, casino-style games are becoming more prominent, now accounting for four of the top five games in the segment.

Worldwide digital game sales reach $5.4 billion in September 2015, up 11% year-over-year. With the exception of pay-to-play MMOs, which fell 8% to $213 million, global digital games revenues were up across categories. The space with the biggest proportional gains was digital console, where year-over-year earnings increased 29% to $326 million despite player numbers remaining stable during this period. Most growth in the space came from existing players buying more full games digitally, as average monthly full game spending jumped 39% to $132.46. In contrast, mobile posted the biggest absolute gains, growing 9% to $2 billion, thanks to an influx of new gamers. User growth slightly outpaced revenue growth, with the total monthly active user count increasing 10% year-over-year to 2.2 billion as new, low-spending players from emerging markets continue to get access to smartphone devices.

Oculus and Samsung target the mass market with the $99 Gear VR. While the overall VR market is slated to reach 11 million users by 2016, the mobile and PC-based segments are beginning to take two very different paths. PC-based virtual reality remains focused on hardcore gamers. When it launches next year, the Oculus Rift (NASDAQ: FB) will likely cost over $350 as it strives for an uncompromising experience. Last week, SuperData had the chance to test out HTC’s (TPE: 2498) equally impressive Vive headset, which is slated for release in limited quantities this year. In contrast, the next wave of mobile VR devices will target at mainstream audiences, and non-gaming experiences are already a major component of the experience from the start. The relatively affordable Gear VR from Samsung (KRX: 005930) and Oculus will work for anyone with a 2015 Samsung Galaxy phone and will launch in time for Black Friday. To entice mainstream audiences, Oculus has added Netflix to the Gear VR, with Hulu arriving later shortly.

FanDuel and DraftKings both want in on the $143M North American eSports market. The two leading real-money fantasy sports sites have limited international appeal thanks to the availability and legally of online sports betting outside of the U.S.; as a result, both are targeting U.S. eSports fans to further their aggressive user acquisition strategies. In September, DraftKings added League of Legends (HKG: 0700) fantasy eSports to its main website while FanDuel has purchased dedicated fantasy eSports site AlphaDraft. By entering the eSports space, the sites are reaching a young, affluent audience they may otherwise miss. More than half of U.S. eSports fans are under 35 and they have an average household income of $76,000. However, younger consumers are the most likely to be cord-cutters, which until now, made them less susceptible to DraftKings’ and FanDuel’s ubiquitous TV ads.

Call of Duty and other upcoming shooters eschew single-player mode. The Xbox 360 and PS3 versions of the upcoming Call of Duty: Black Ops III will not feature a single-player story as developer Treyarch faced technical difficulties in bringing the latest campaign to older hardware. Other shooter games slated for release this fall without a single-player campaign are Ubisoft’s (EPA: UBI) Rainbow Six: Siege and EA’s Star Wars: Battlefront. As the genre becomes increasingly multiplayer-focused, competitive multiplayer gameplay lengthens player lifetime and, by extension, average spending per player. Earning higher revenues for publishers, we expect the focus on releasing additional content and maps packs to increase. Contrary to this trend, Star Wars: Battlefront is slated to launch with a $50 season pass, in a move that suggests EA is forfeiting DLC revenue. The last three entries in EA’s Battlefield franchise (on which Battlefront is based) have each seen a faster decline in post-launch revenue than the last game.