During a GDC talk, NPD games industry analyst Liam Callahan said that the U.S. and Europe is seeing a 33 percent increase in digital game and DLC revenue yearly, while China is expected to see digital sales increase 10 percent annually for the next three years. Furthermore, the Asian market is expected to lead the online and mobile games market by 2016.

The U.S., U.K., France and Germany saw $10 billion in sales for 2012, with a U.S. total of $5.9 billion followed by the U.K. at $1.7 billion, Germany with $1.4 billion and France with $1 billion. In the U.S., digital content now accounts for 40 percent of the total spend on games, which is up from 28 percent in 2010.

The annual spending on games in the U.S. for new retail games in 2012 was $7.1 billion, which represented about 48 percent of the total of $14.8 billion spent on games, down 22 percent from last year. The other revenue, according to NPD estimates, includes used games at $1.59 billion (down 17.1 percent), digital games and DLC at $2.22 billion (up 33.9 percent), subscriptions at $1.05 billion (up 12.9 percent), social network gaming at $544 million, game rentals at $198 million, and $2.11 billion in mobile game sales (up 10.4 percent).

Callahan noted different regions had different device habits. The U.K. had the highest percentage of console players, while France preferred portable consoles, Germany preferred PCs, and the U.S. was most partial to gaming on mobile and tablet platforms.

While smartphone penetration is similar in Europe and the U.S., only 27 percent of gamers paid in the U.S. while 40 percent of the players in Europe paid for mobile games (average spending in the U.K. was $16 compared to $9 in the U.S.). People in the U.K., France and Germany all spent more time playing than people in the U.S. did.

China’s growth continues, thought it’s slowed from 66 percent in 2008 to only 19.4 percent in 2012. According to Will Tao of iResearch, slow growth is expected to continue, while social games, game platforms and web games are projected to reach over 20 percent of the market in a few years and mobile game spending is projected to cross $1 billion this year, on its way to an estimated $2.8 billion in 2016.

Chinese game players are younger than in the U.S., with 37 percent of the gamers under 18 and about two-thirds of the gamers are male. A third of Chinese gamers spend between 5 and 10 hours gaming in a typical day.

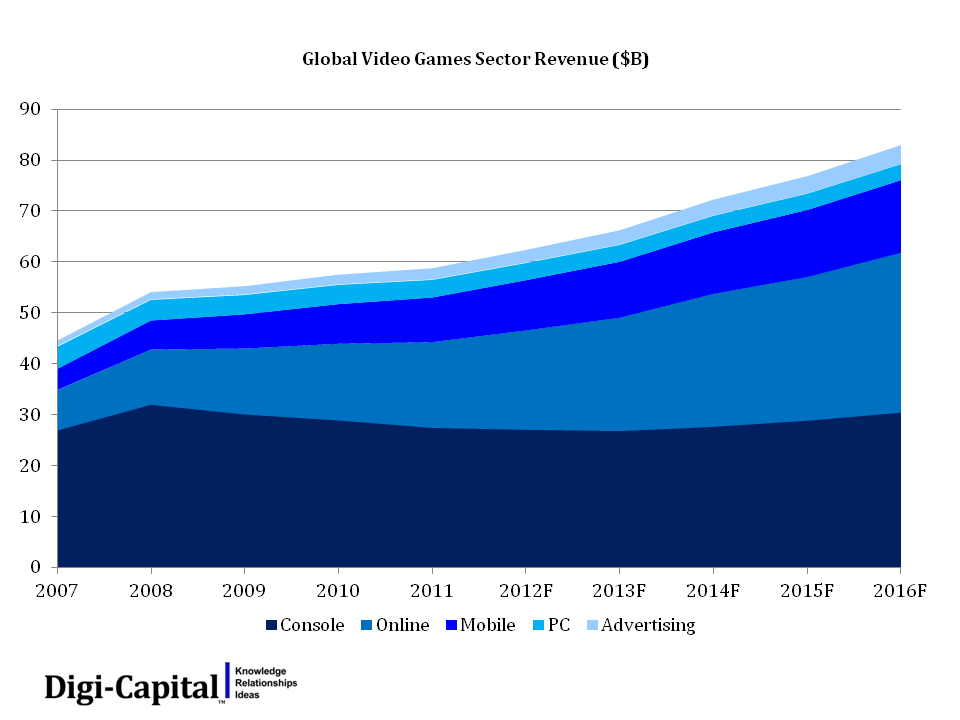

Tim Merel of Digi-Capital noted that the U.S. tended towards ‘value’ markets like console games and subscription MMOs, countries such as China and Brazil were much more likely to see ‘volume’ games like mobile, social, and free-to-play MMOs as the dominant games. Merel believes that Asian games could dominate the online and mobile games markets globally, adding that game mergers and acquisitions broke all records in 2012, and eight out of 10 of the biggest acquisitions last year were with Asian acquirers.

Merel’s suggested that developers build those contacts in China now and possibly attend the next China Joy conference. “Start building relationships in Asia now,” he said.

Source: GamesIndustry International